Coinspeaker

US Bitcoin ETFs See Five-Day Inflow Streak as BlackRock Leads with $184M

The present situation with the US spot Bitcoin exchange-traded funds (ETFs) is one that reflects the popular ‘tough times don’t last’ saying. This follows after the spot Bitcoin

BTC

$63 824

24h volatility:

0.1%

Market cap:

$1.26 T

Vol. 24h:

$23.42 B

ETFs registered another day of cumulative inflow on Wednesday, making it five days in a row.

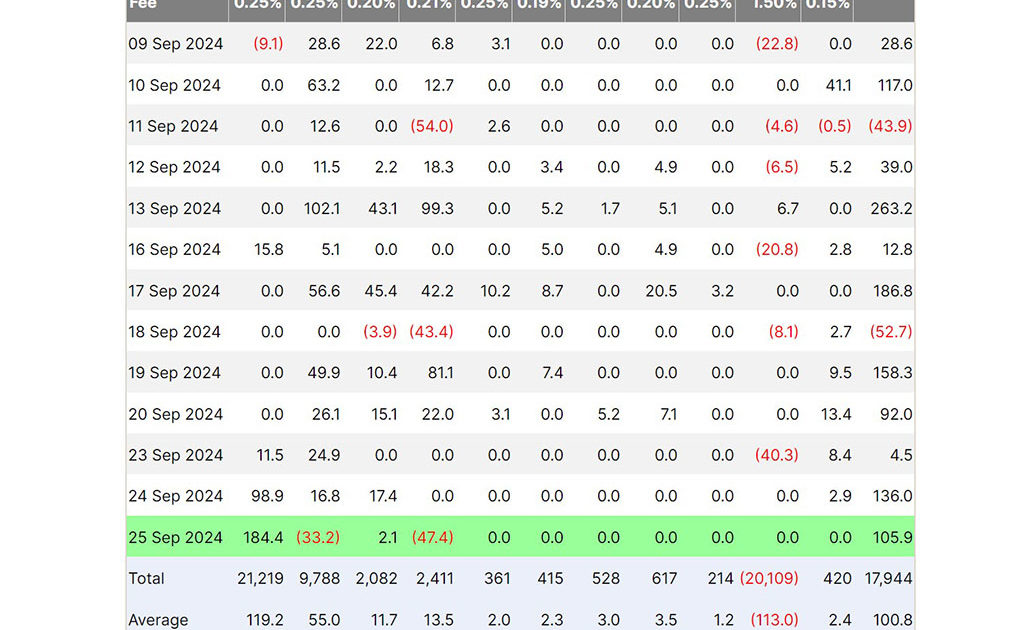

According to data from Farside Investors, the funds pulled in an impressive $106 million on the day, with BlackRock’s iShares Bitcoin Trust (IBIT) clearly in charge of the movement.

Source: Farside Investors

As seen in the image above, the IBIT fund saw net inflows of over $184 million on the day, reflecting what appears to be an investor preference for BlackRock’s product.

Generally, though, and considering the solid momentum being displayed, it might be safe to say that investor confidence in Bitcoin ETFs has grown remarkably in recent times. That is, despite the unstable market conditions and regulatory issues all around.

BlackRock Dominates, Other Bitcoin ETFs Show Mixed Results

There is no gainsaying that BlackRock has a chokehold on this sector, at least, for the time being. However, while its IBIT fund continues to see maximum activity and enjoys surging investor interest, the same cannot be said of other Bitcoin ETFs.

For instance, on Wednesday, Bitwise’s Bitcoin ETF (BITB) attracted just over $2 million in new capital, a far cry from IBIT’s larger gains. However, though BITB recorded a relatively smaller level of success than BlackRock’s IBIT, it still performed better than every other fund.

Fidelity’s Bitcoin Fund (FBTC) and ARK Invest/21Shares’s Bitcoin ETF (ARKB) are examples of such other funds that experienced massive outflows on the day. While $33 million in capital left Fidelity, ARK Invest/21Shares saw an even bigger outflow of about $47 million.

Every other Bitcoin ETF that is listed in the US experienced zero net flows on Wednesday. However, the most notable fund in that category was the Grayscale Bitcoin Trust (GBTC).

GBTC used to be a leading force in the ETF market before losing its steam. Since converting from a trust to an ETF, investors have pulled out over $20 billion from the fund.

On a more positive note, though, the massive outflows observed from GBTC earlier have begun to slow down in recent weeks.

Overall, it appears that investors are beginning to shift their preferences. This would explain the contrasting experiences of the funds. While BlackRock’s IBIT continues to capture the majority of new capital, other ETFs are struggling to keep up with the pace of a market that is increasingly moving toward larger and more established funds.

In total, US spot Bitcoin ETFs saw $246 million in net inflows this week. So, it might be safe to say that digital asset investments are still a thing regardless of recent market volatility.

US Bitcoin ETFs See Five-Day Inflow Streak as BlackRock Leads with $184M