Coinspeaker

Uniswap (UNI) Plummets 15% after SEC’s Wells Notice

The decentralized (DEX) crypto exchange Uniswap vows to “fight” after receiving an enforcement notice from the US SEC (Securities and Exchange Commission).

Reacting to the SEC’s Wells notice on X, Uniswap CEO Hayden Adams noted:

“I’m not surprised. Just annoyed, disappointed, and ready to fight.”

The DEX’s native token UNI slumped immediately after the news and dropped below $10. Let us mention that a Wells notice informs persons or firms of likely enforcement actions. Even Coinbase received a Wells notice before its ongoing lawsuit began.

Crypto Industry Supports Uniswap to Defend DeFi

Reacting to the notice, Uniwap Chief Legal Officer, Marvin Ammori, stated:

“The Uniswap Protocol, web app, and wallet don’t meet the legal definitions of securities exchange or broker.”

“Just weeks ago, the judge in SEC v. Coinbase dismissed the claim that crypto wallets were brokers – *even if* the tokens at issue were securities,” added he.

Several industry figures support Uniswap to fight and defend the DeFi space. In particular, Coinbase’s legal chief Paul Grewal poured cold water on SEC’s move on Uniswap. Referencing the recent dismissal of the SEC claim against the Coinbase Wallet, Grewal reiterated that the SEC can’t claim Uniswap is a broker.

Sometimes you have to laugh or else you'll cry. Question: how can you square the @SECGov's claim that @Uniswap acts as a broker with the Court's ruling against the @SECGov just a handful of days ago? Answer: you can't. https://t.co/K42aKw5YZc pic.twitter.com/OcegMnDWVu

— paulgrewal.eth (@iampaulgrewal) April 10, 2024

Even so, Mary Lader, Uniwap COO (Chief Operating Officer), emphasized that “Uniswap is an upgrade to the financial system, whether the SEC recognizes it or not”.

Marc Boiron, Polygon’s CEO, also welcomed Uniswap’s unwillingness to give up. “I look forward to Uniswap Labs taking it to the SEC, and I’m happy to see the team ready to fight,” said he.

Uniswap is a leading DEX that started on Ethereum but has expanded into several other chains, including BNB Chain.

According to DefiLlama data, Uniswap boasted $6.2B in TVL (Total Locked Value), underscoring users’ confidence and trust in the protocol. However, the enforcement notice spooked some users.

UNI Dumps over 15% as Bearish Bets Increase

According to CoinMarketCap, UNI was down 16% and dropped from $11 to below $10 within hours after the notice. It traded at $9.33 as of the time of writing.

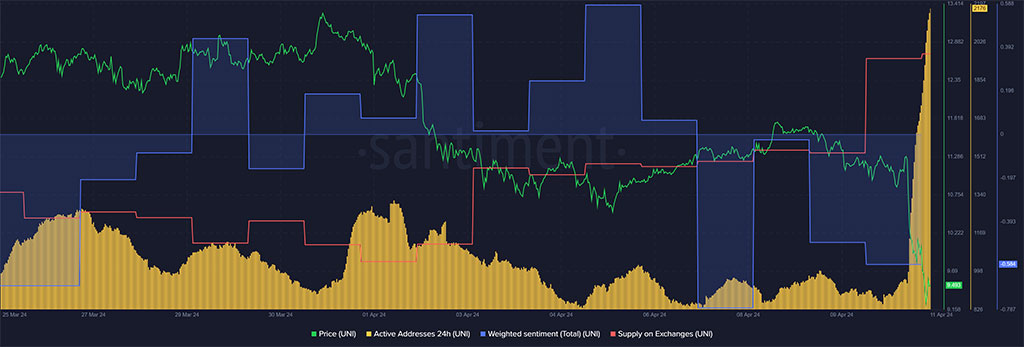

Photo: Santiment

Additionally, the intelligence data platform Santiment showed that the overall weighted sentiment turned negative (blue line), meaning social networks were bearish on the token. Besides, active addresses spiked (yellow) alongside supply on exchanges (red), indicating more users moved UNI holdings to exchanges for sell-offs.

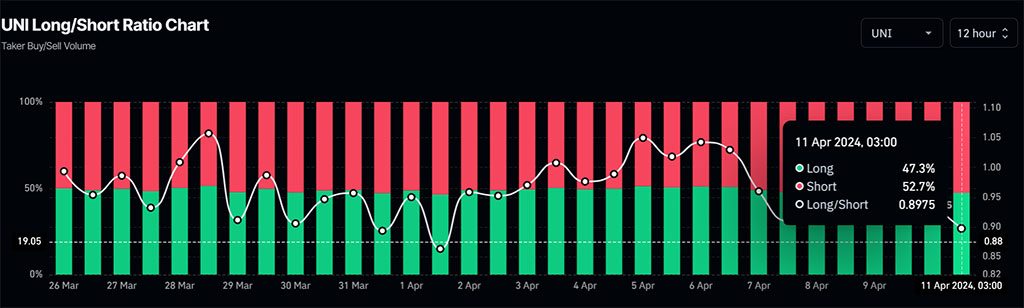

Photo: CoinGlass

The bearish sentiment was also evident in the derivatives market. Per CoinGlass, bearish bets against UNI spiked as users shorting the asset dominated at 52% on the 12-hour timeframe.