In a significant crypto market twist, decentralized exchange Uniswap has surged past Coinbase in daily trading volume, spurred by the recent buzz surrounding Pepecoin’s booming market cap.

In the latest crypto trading development, Uniswap has been making waves as it outpaced Coinbase in daily trading volume. This event comes on the heels of the excitement surrounding pepecoin, which recently soared past a market capitalization of $1 billion.

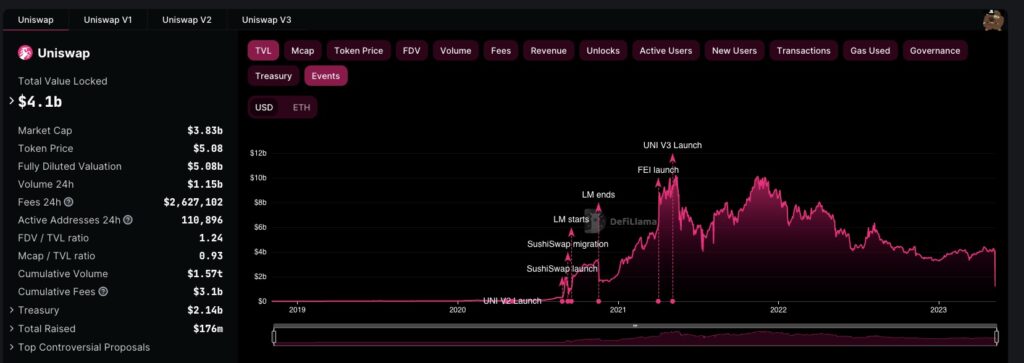

On May 4th, Uniswap squared off with Coinbase, with each platform recording a trading volume of roughly $1.2 billion, as reported by DeFi Llama and CoinGecko. Uniswap then took the lead on May 5th, registering a trading volume of $2.2 billion, significantly outdoing Coinbase’s $1.3 billion.

As it stands now, Uniswap continues to maintain a slight edge, recording a daily volume of $1.2 billion, against Coinbase’s $948 million.

Uniswap’s successful run can be attributed to its flexibility. The protocol operates across three versions on six different blockchains, including ethereum, arbitrum, and optimism. On the other hand, Coinbase provides support to ethereum and all EVM-compatible networks.

While the recent trading volume surge seems linked to the meme coin mania, it’s important to remember that the rivalry between Uniswap and Coinbase for the second spot in trading volume is not new, and has been ongoing since last year.

Uniswap has outshined Coinbase multiple times in 2022, more notably after the fall of FTX in November, which prompted traders to shift away from centralized exchanges. The year 2023 also started positively for Uniswap, as it outperformed Coinbase in trading volume for two successive months – February and March.

When it comes to trading volume, Coinbase is the runner-up among centralized cryptocurrency exchanges, while Uniswap is the top dog in the decentralized trading arena. In fact, Uniswap’s trading volume over the past week is four times that of its closest DEX competitor, PancakeSwap, as revealed by Dune data.

In March alone, Uniswap handled almost $73 billion in trades, contributing to 61% of all DeFi trading in the past week. However, Binance still reigns supreme, with a trading volume nearly seven times that of both Uniswap and Coinbase, according to CoinGecko’s latest figures.