There’s something about major psychological price levels, like bitcoin’s (BTC) $100,000 mark. As prices near these thresholds, anything tied to the asset gets an extra spark of energy.

The Nasdaq-listed ProShares UltraShort Bitcoin ETF (SBIT) is a case in point, posting record trading volume of over 8 million shares on Nov. 13 as bitcoin topped $90,000 for the first time and strengthening the case for a rally into six figures by year-end, data tracked by TradingView show.

Since then, BTC has held between $90,000 and $100,000, and the ETF’s daily trading volume has averaged just over 5 million shares. That’s significantly greater than the sub-2 million readings over the preceding months.

The ETF seeks to deliver twice the inverse daily price performance of bitcoin, so that if BTC falls by 1%, the ETF rises by 2%, offering a leveraged bearish bet on the cryptocurrency.

The spike in volume could be associated with the capitulation of investors who bought the ETF early this year anticipating a slide in BTC. Or it could be bulls protecting their long positions in spot/futures markets from possible BTC price pullbacks as the key $100,000 level approaches.

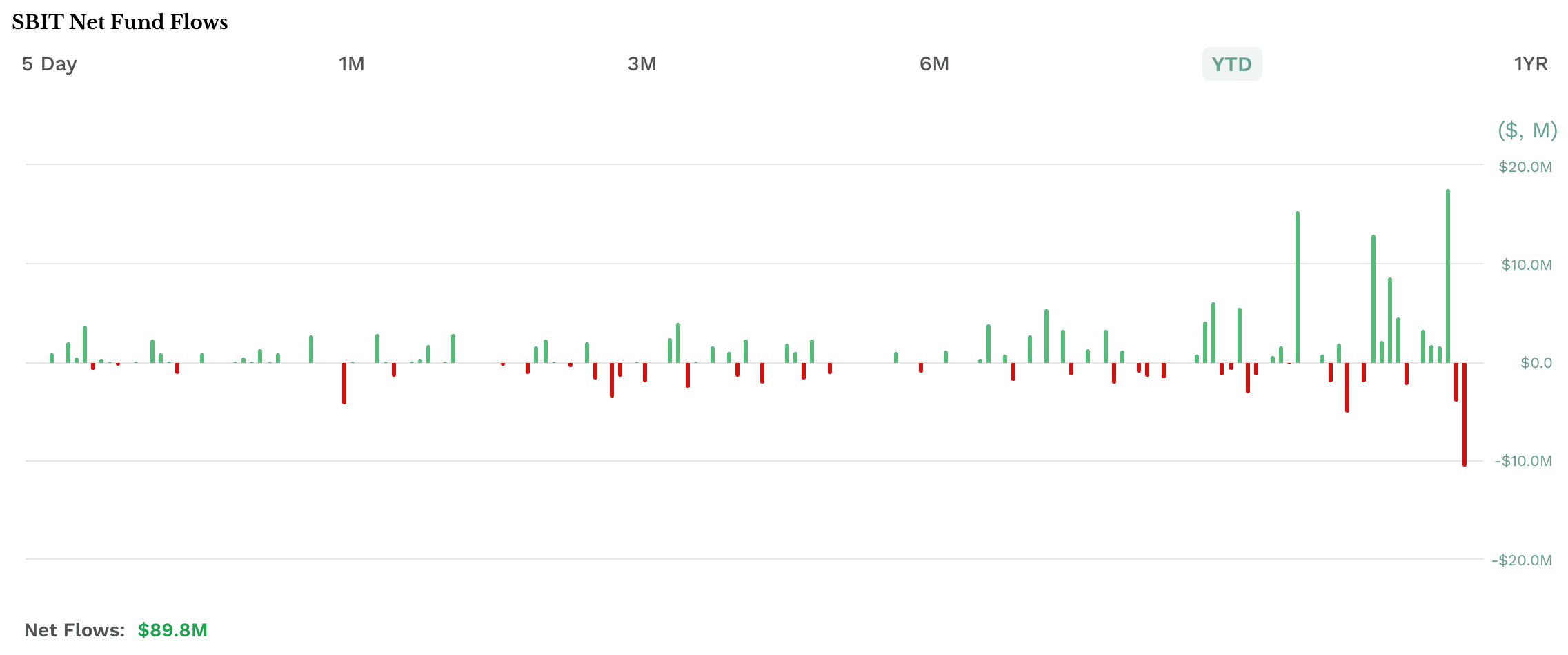

The latter seems to be the case, because inflows into the ETF have picked up. The fund registered a net inflow of $17.7 million on Friday, the most since its debut in April, according to data source ETF.com.

Those bulls, however, may be feeling demoralized as the 11 spot bitcoin ETFs have accumulated over $2.5 billion in net inflows since Nov. 13, according to data tracked by Farside Investors.