TRON’s daily revenue reached a new all-time high while its price witnessed a quick correction after touching its 40-month-high.

On Aug. 21, TRON (TRX) reached $0.165, a level not seen since April 2021. The rally was majorly triggered by the SunPump meme coin hype as investors jumped on the Pump.fun competitor.

However, TRX quickly faced increased selling pressure as both long-term and short-term holders aimed at profit-taking. TRON declined 5% in the past 24 hours and is trading at $0.151 at the time of writing.

The TRX market cap is currently sitting at $13.16 billion, losing the 10th spot to Cardano (ADA). Notably, the global crypto market cap increased by 0.7% over the past day, reaching $2.23 trillion. While TRX witnessed a bearish correction, Bitcoin (BTC) surpassed the $60,000 mark.

According to an X post by TRON founder Justin Sun, the daily revenue on the network reached $5.33 million on Aug. 21, marking a new all-time high. Sun claims that TRON’s revenue surpassed all other blockchains with the latest rise.

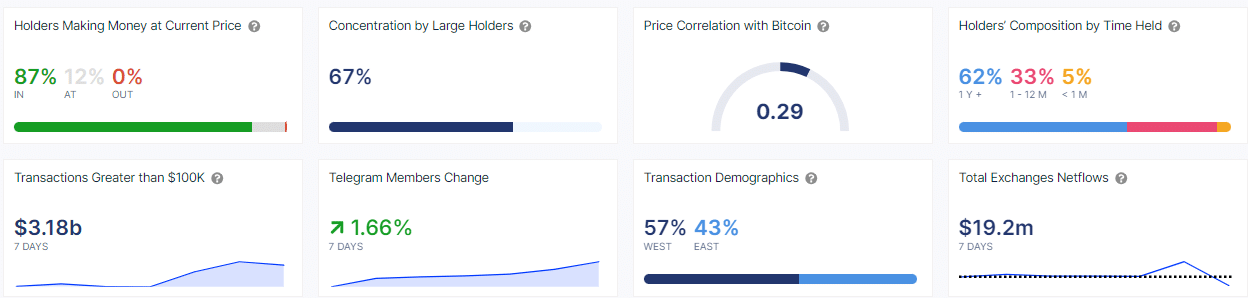

Despite the pullback, only 0.48% of TRX holders are currently at a loss, according to data from IntoTheBlock. Roughly 12% of the TRX holders are close to their investment — either at a minor loss or little gains. The remaining holders enjoy major profits on their TRX holdings, per ITB.

Data shows that the majority of TRX addresses, around 62%, have been holding on to their investments for over a year. 33% of them have accumulated the tokens between one and 12 months. The remaining 5% are traders as their assets are younger than a month.

Per data from crypto.news price page, the TRX Relative Strength Index cooled down from 85 to 38 over the past 24 hours. The indicator shows that the token is oversold at this price point. If the selling pressure continues its decline, a price surge would be expected for TRX.