On-chain data confirms that old Bitcoin (BTC) whales have been divesting their BTC tokens to traditional institutional investors, as the firstborn cryptocurrency continues to command growing interest in Wall Street.

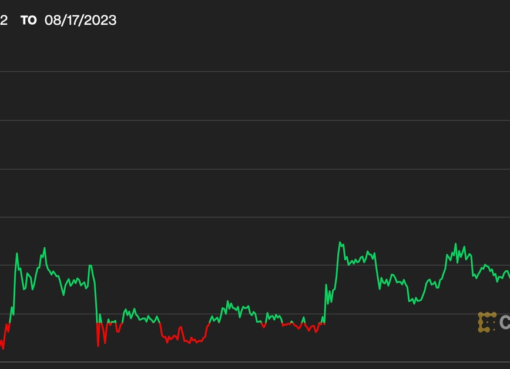

Ki Young Ju, the founder and CEO of CryptoQuant, highlighted this phenomenon in a recent analysis, drawing attention to a comparative analysis of Bitcoin’s demand and supply across old and new whale addresses.

The data suggests that the Bitcoin network is experiencing a surge in demand from emerging whale entities, coinciding with heightened selling activity among established whale addresses.

This observed pattern may indicate older addresses seeking to capitalize on profits from their Bitcoin holdings, particularly amid the current price discovery phase, which has seen BTC surge above $73,000.

The metric reveals that the present pattern was observed in the market in the last two cycles. Remarkably, this trend emerged in early 2017, coinciding with the onset of the 2017 bull cycle. Subsequently, Bitcoin surged from $966 in January 2017 to its peak of $19,666 in December 2017.

During the bull market at that time, the significant change in ownership endured for 332 days. Participants in the market, particularly bullish investors who entered in 2017, resumed this pattern in the 2021 bull run, divesting their BTC to new whale entities over a period of 136 days.

Data indicates the emergence of a cohort of new whale entities during the current bull market. However, an intriguing deviation from the pattern this time is that these new whales predominantly consist of traditional institutional investors who are exhibiting heightened interest in BTC.

This is primarily due to the approval and success of the spot Bitcoin ETFs. These investment products have introduced BTC to Wall Street. Following a period of sustained outflows, spot Bitcoin ETFs have recorded two consecutive daily inflows this week, indicating a resurgence of interest.

Bitcoin shows more room for growth

Meanwhile, the ongoing shift in ownership has historically aligned with periods of market peaks. As a result, the metric indicates that Bitcoin might still have room for more substantial growth, as the emerging accumulation trend remains minimal at the reporting time.

Moreover, despite Bitcoin’s current position above the $70,000 mark, its daily relative strength index (RSI) stands at 45, indicating that the cryptocurrency remains well below overbought levels. This reaffirms the notion that the asset has ample potential for further ascent.

According to data provided by Santiment, the number of whale transactions consisting of at least $100,000 worth of BTC has been consolidating around the 13,100 mark over the past two days.

The number of transactions consisting of at least $1 million worth of BTC increased by 3.8% — rising from 2,691 to 2,789 unique transactions per day.

The high amount of whale activity at this point could potentially put Bitcoin in a slightly volatile zone.

Bitcoin is currently trading at $70,759, up 1.61% over the past 24 hours. The crypto asset has gained by more than 4% in the last week, as it looks to recover the losses of the past few days.