In a post on X (formerly Twitter), acclaimed crypto trader Gert van Lagen has pinpointed Cardano (ADA) as the potential frontrunner of the ongoing bull market. His analysis leans heavily on Cardano’s foundational strengths compared to its rivals, Ethereum (ETH) and Solana (SOL).

Why Cardano Is Van Lagen’s Top Pick

Central to van Lagen’s argument is the concept of decentralization, where he posits Cardano as a model of “fundamental superiority.” He articulates, “Cardano stands out for its fundamental superiority over Ethereum and Solana, boasting greater decentralization and the notable absence of support from centralized entities like Gemini.”

This statement not only underscores Cardano’s commitment to decentralization but also implicitly critiques the reliance of other blockchains on centralized support, suggesting a purer adherence to blockchain’s original ethos by Cardano.

Highlighting the critical importance of network reliability, van Lagen points to Solana’s vulnerability, marked by its “sporadic inexplicable network outages of a few hours.” He contrasts this with the inherent stability of the Cardano network, which he notes is “mathematically embedded in the Cardano ecosystem,” suggesting a foundation built on rigorous scientific principles and peer-reviewed research that underpins Cardano’s operations, enhancing its reliability and user trust.

Van Lagen’s enthusiasm extends to Cardano’s Extended Unspent Transaction Output (EUTXO) model, which he believes is a game-changer for blockchain scalability and efficiency. He explains, “In this bullish market, my top bet is on Cardano, leveraging its EUTXO model to dramatically scale network capacity through TPT, not just TPS.”

This approach, focusing on Transactions Per Transaction (TPT) rather than just Transactions Per Second (TPS), allows for a more nuanced and complex handling of transactions, enabling a multitude of operations within a single transaction.

Roy M. Avila’s article, referenced by van Lagen, delves deeper into the TPT concept, illustrating how it differentiates from the traditional account model by allowing for a diverse array of transactions to be processed simultaneously within a single transaction. This significantly reduces the need for sequential transaction processing, enabling greater throughput and efficiency.

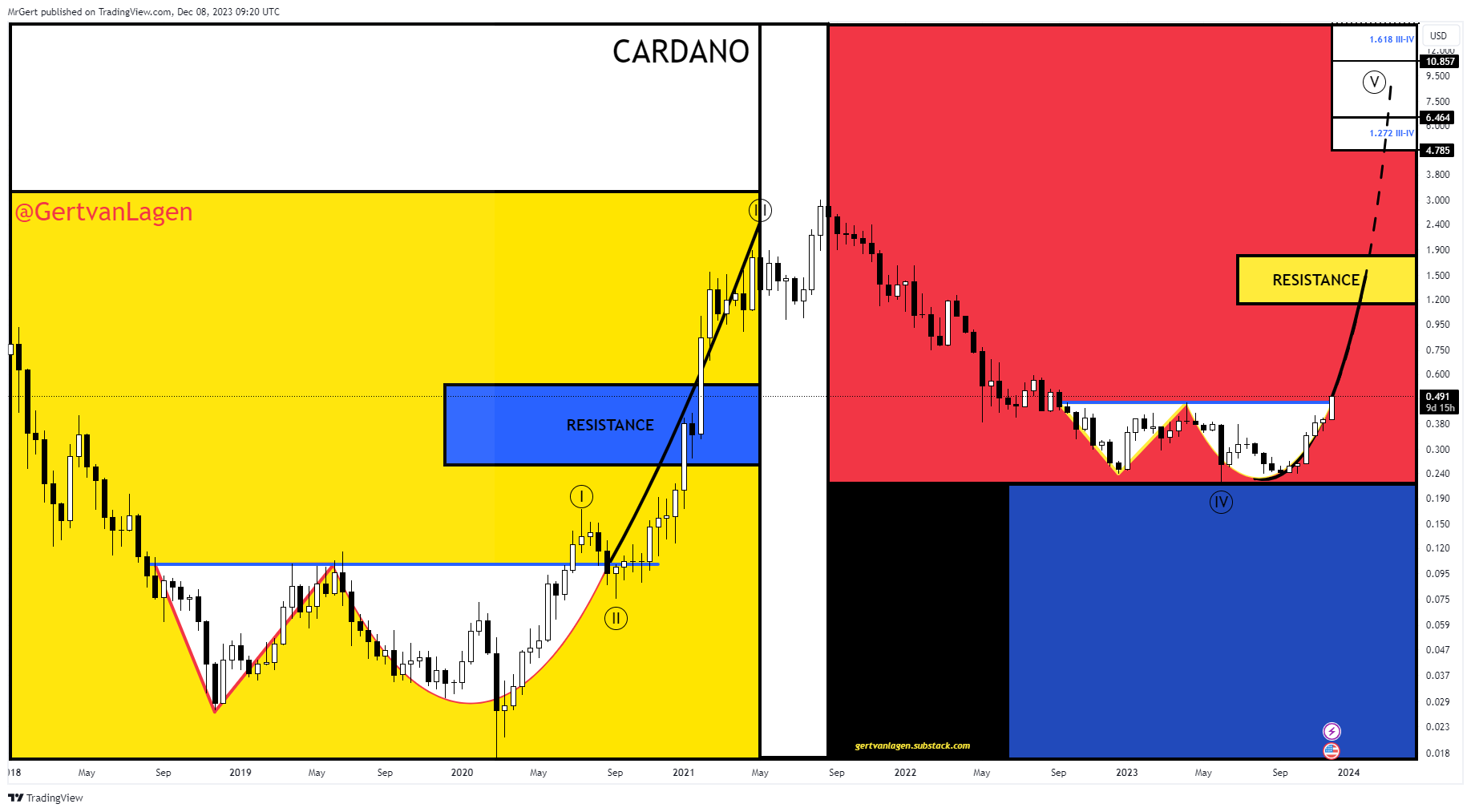

Technical Analysis For ADA

Van Lagen shares his technical analysis of Cardano, identifying key patterns and indicators that bolster his bullish stance. At the end of January, noted in a post on X, “Looks very much like ADA, broken black downtrend through weekly closes. Clear double bottom setup below red horizontal –> broken out, currently retesting.” This pattern suggests a strong reversal and potential for significant upward movement.

He further elaborates on ADA’s price action, observing, “ADA [2W] – Compare Adam and Eve bottoms within 🟨 & 🟥. Price has broken through the blue neckline and is on its way to the key resistance zone before ATH: $1.2-1.8. Conservative extension targets: $5-15. Invalidation EW-count: $0.17.”

These insights provide a detailed roadmap for ADA’s potential price trajectory, highlighting both the bullish outlook and critical thresholds for invalidation.

At press time, ADA traded at $0.5325.

Featured image from Shutterstock, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.