USDT issuer Tether set a new record after making $4.5 billion in net profits during the first quarter of 2024.

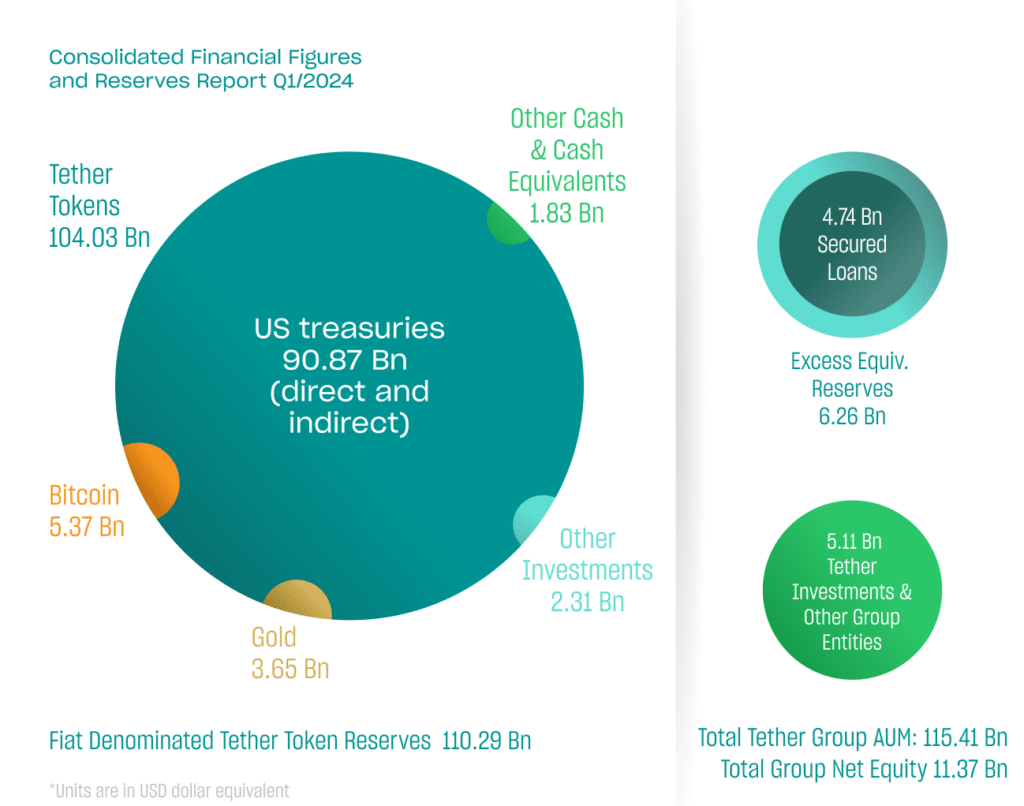

A BDO assurance opinion released on May 1 also showed that Tether’s Treasury bills stockpile reached a new high of over $90 billion, and the digital asset firm’s total net equity crossed $11.3 billion due to diversified operations.

According to the attestation, since last year’s fourth quarter, USDT provider ownership of U.S. Treasuries and net equity have grown from around $80 billion and $7 billion, respectively.

The latest report revealed that $1 billion of its record-setting profits was generated from stablecoin issuing entities and reserve managing strategies. In other words, most profits were made from holding U.S. Treasuries, while the rest were derived from Bitcoin (BTC) and Gold holdings.

Furthermore, this is the first time the firm’s fiat-pegged stablecoins have been backed up to 90% by cash and cash equivalents. Tether CEO Paolo Ardoino said the stats underscore dedication to responsible risk management as a crypto and stablecoin market leader.

Per CoinGecko, USDT is currently the largest U.S. dollar-pegged stablecoin with a market cap of over $110 billion and is the third-biggest cryptocurrency behind Bitcoin and Ethereum (ETH).

“Tether is again raising the bar in the cryptocurrency industry in the realms of transparency and trust.”

Paolo Ardoino, Tether CEO