Falling cryptocurrencies like Bitcoin, Jasmy, and Avalanche could face further downsides after the U.S. published strong gross domestic product and jobless claims data.

Bitcoin (BTC) ‘s price retreated by almost 4% on Thursday and was trading at $63,950. Other altcoins, like JasmyCoin (JASMY) and Avalanche (AVAX), performed worse, falling by over 10%. The two have slipped for four consecutive days and are hovering at their lowest swings since July 14.

Most of this decline is likely because of the ongoing liquidation of Bitcoin from Mt.Gox wallets. Kraken has already distributed its coins, while Bitstamp will move coins worth $3 billion on Thursday.

US GDP and jobless claims data

The other risk facing Bitcoin, altcoins, and stocks is that the U.S. economy is doing better than expected. In a report, the Bureau of Economic Analysis said that the economy expanded by 2.8% in the second quarter, beating the median estimate of 2.0%. It was also better than Q1’s growth of 1.4%.

Another report revealed that the initial jobless claims dropped from 245,000 to 235,000 last week. That number was also better than the median estimate of 237,000.

These numbers mean that the Federal Reserve may decide to hold rates higher for longer than expected.

In previous statements, Jerome Powell and other officials have expressed concerns that the economy was slowing. In particular, the Fed is more concerned about the labor market as the unemployment rate rose to 4.1% in June, its highest point since 2021.

Still, economists expect the Fed will leave interest rates unchanged in its meeting next week. The CME Fed Watch tool estimates that the bank will cut rates in September.

Looking ahead, the next crucial economic data to watch will come out on Friday, when the US will publish the personal consumption expenditure (PCE) data. PCE is the Fed’s favorite inflation gauge.

Implication on Bitcoin, Jasmy, Avalanche and altcoins

A hawkish Fed would be negative for Bitcoin and other altcoins because these assets do well in a low-interest rate environment. For example, Bitcoin jumped to a record high of $68,000 in 2021 as the Fed brought interest rates to zero.

Steeper rate cuts would incentivize investors to move to riskier assets. Some of these investors would move from money market funds, which have over $6.1 trillion in assets, to other assets like stocks and cryptocurrencies.

Bitcoin and Ethereum will likely see more inflows from institutional investors now that the SEC has approved spot BTC and Ether ETFs.

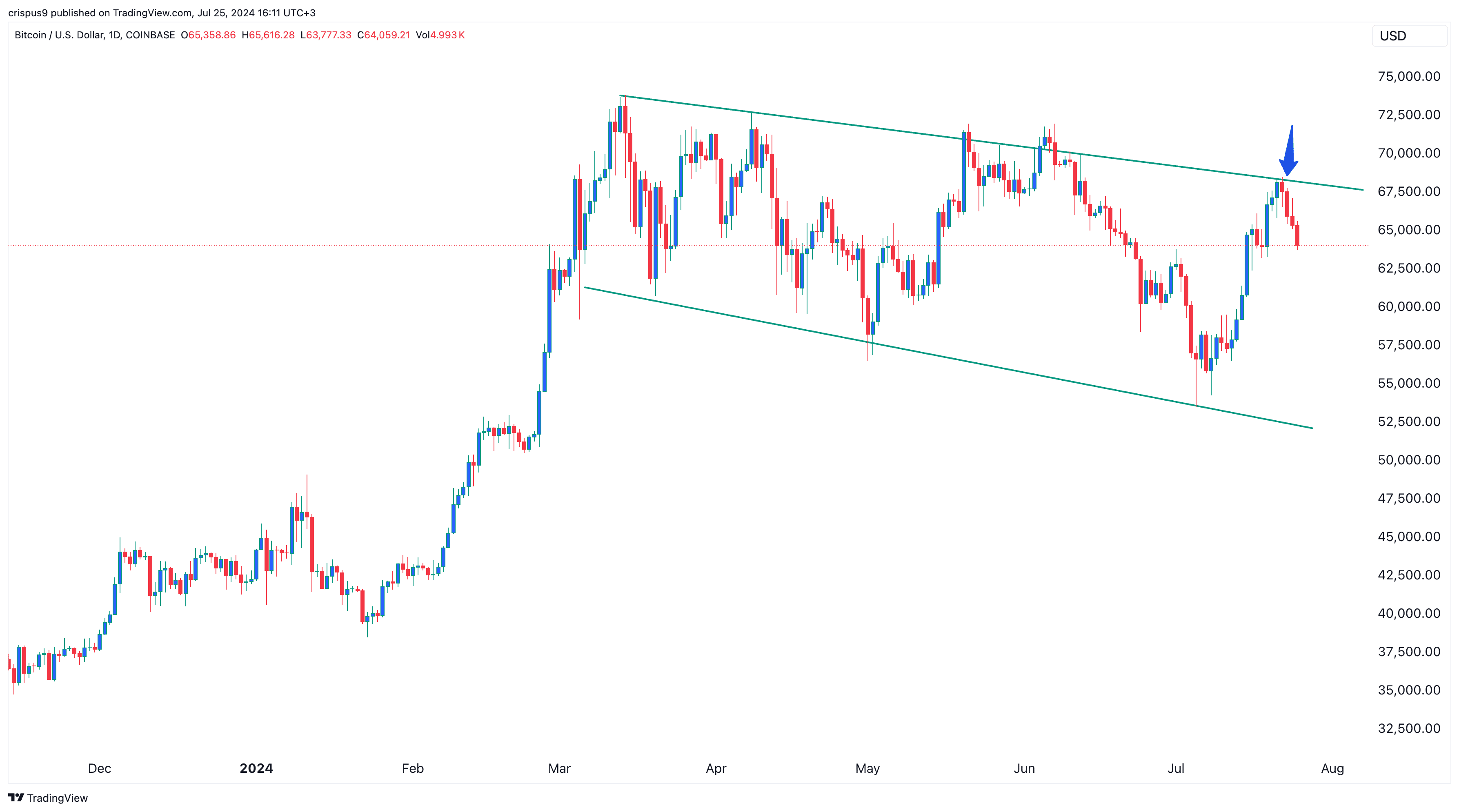

Bitcoin rejected at a key level

The other risk that altcoins face is based on technical issues. As shown above, Bitcoin’s retreat happened after failing to pierce the descending trendline that connects the highest swings since March. That indicates that the coin could see more downside as sellers target the key support at $60,000.

On the positive side, Bitcoin has formed a falling broadening wedge pattern, a popular sign of a bullish continuation. This means that the coin may have some upside, but only if it crosses the descending trendline.