Coinspeaker

Spot Bitcoin ETFs See 7th Consecutive Days of Inflow Streak, Reaching $300M Yesterday

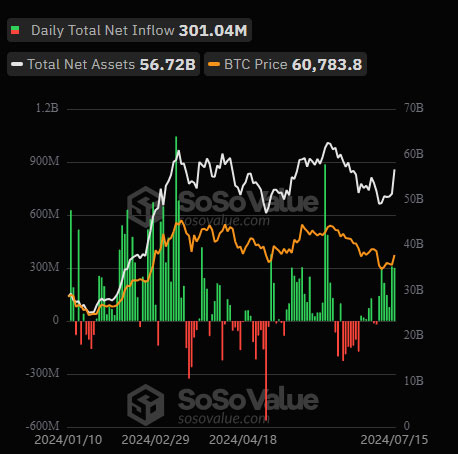

Investors are showing a dramatic shift in sentiment towards Bitcoin, piling into spot Bitcoin exchange-traded funds (ETFs) for a record seventh day in a row. The surge in interest coincides with the rising price of the world’s leading cryptocurrency, which recently surpassed $63,000.

Photo: SoSoValue

Data from SoSoValues shows all 11 spot Bitcoin ETFs in the US raked in a combined net inflow of $301 million on Monday, July 15th, 2024. This extends their winning streak to an impressive seven days, reflecting a clear resurgence of confidence in Bitcoin as a digital asset.

BlackRock’s IBIT Leads the Charge

Amongst the influx, BlackRock’s iShares Bitcoin Trust (IBIT) emerged as the frontrunner, attracting a net inflow of a staggering $117.25 million. This dominance extends to trading volume as well, with IBIT recording $1.24 billion worth of trades on Monday, making it the most actively traded Bitcoin ETF that day.

Ark Invest and 21Shares’ ARKB followed closely behind with net inflows of $117.19 million, indicating a strong appetite for the product from institutional investors.

Other notable contributors to the positive inflows included Fidelity’s FBTC ($36.15 million) and Bitwise’s BITB ($15.24 million). Additionally, funds from VanEck, Invesco, Galaxy Digital, and Franklin Templeton also witnessed net inflows, painting a picture of broad-based investor participation.

Grayscale’s Bitcoin Investment Trust (GBTC), the world’s largest Bitcoin fund by assets under management, did not record any net inflows on Monday. This stands in contrast to the overall market trend. Similarly, ETFs from Valkyrie, WisdomTree, and Hashdex also saw zero net flows.

While the positive sentiment is undeniable, it’s worth noting that the trading volume in spot Bitcoin ETFs remained lower compared to March 2024, when several days saw volumes exceeding $8 billion. Despite this, the total net inflow for these funds since their launch in January has reached a significant $16.11 billion.

Bitcoin Price Surpasses $63,000 Mark

Coinciding with the ETF inflows, Bitcoin price has displayed a remarkable recovery, surpassing the $63,000 mark at the time of writing. This bullish trend further strengthens the case for Bitcoin as a viable investment option.

Adding fuel to the fire, BlackRock co-founder and CEO Larry Fink, who previously held skeptical views on cryptocurrency, recently acknowledged Bitcoin’s growing legitimacy as a “financial instrument” during a CNBC interview. This public endorsement from a prominent figure in traditional finance is a significant development for the cryptocurrency space.

The positive outlook for the crypto market is further bolstered by the anticipated launch of spot Ether ETFs on July 23rd, 2024. This development is expected to attract even greater investor interest in the digital asset ecosystem.

Spot Bitcoin ETFs See 7th Consecutive Days of Inflow Streak, Reaching $300M Yesterday