Coinspeaker

Spot Bitcoin ETFs See 4th Consecutive Days of Inflow Streak, Reaching $147M Yesterday

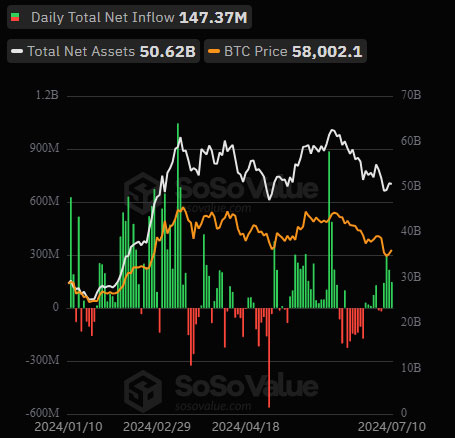

US spot Bitcoin exchange-traded funds (ETFs) are experiencing a surge in investor interest, evidenced by a streak of net inflows. SoSo Value data shows that on Wednesday, July 10, 2024, these ETFs raked in a combined $147.37 million, marking the fourth consecutive day of positive fund flow.

Photo: SoSoValue

Fidelity Digital Assets’ FBTC fund emerged as the top performer, attracting a significant $57.79 million in net inflows. This surge suggests a major boost in investor confidence for the fund. Franklin Templeton’s spot Bitcoin ETF followed closely with its highest daily inflow since early May, pulling in $31.66 million.

BlackRock’s IBIT, the spot Bitcoin ETF with the largest net asset value, also reported positive inflows of $22.24 million. Valkyrie’s BRRR contributed $20.68 million, further solidifying the positive sentiment as established players in the ETF space are retaining investor interest.

Invesco and Galaxy Digital’s BTCO also saw inflows of approximately $9.5 million, showing participation from a broader range of investment firms. Even smaller players like Ark Invest, 21Shares, Bitwise, and VanEck contributed to the overall positive sentiment surrounding spot Bitcoin ETFs.

Grayscale’s GBTC Struggles Despite ETF Success

Grayscale’s Bitcoin Trust (GBTC), the second-largest player in Bitcoin investment, stood out from the crowd. Unlike other funds, GBTC experienced net outflows of $8.15 million. This could be due to several reasons, one being its structure as a security, not a true ETF.

Spot Bitcoin ETFs saw positive inflows, but overall trading volume remains low compared to the peak in March and April 2024, when daily volumes soared above $12 billion.

However, the year-to-date net inflows are impressive. Since January 2024, spot Bitcoin ETFs have raked in a total of $15.42 billion, highlighting the growing popularity of this asset class.

The influx of capital into spot Bitcoin ETFs is a positive sign, but the price of Bitcoin itself faces headwinds. In the past 24 hours, its value has plunged 0.88% to $57,280. While it has seen some recovery from last week’s decline, it’s still significantly lower than the $70,000 range observed in early June.

Mt. Gox’s Shadow Looms Over Bitcoin

Crypto investors continue to face uncertainties around the Mt. Gox payout distribution and the possible selling pressure from the German government’s bitcoin sales. These factors might negatively impact Bitcoin price in the short term.

Despite current challenges, some experts remain hopeful about Bitcoin’s long-term future. Matt Hougan, CIO at Bitwise, thinks Bitcoin could hit $100,000 by the end of 2024. He mentions changing political views on Bitcoin and potential interest rate cuts by the US Federal Reserve as possible reasons for a price rise.

Recent investments in spot Bitcoin ETFs show positive trends for the cryptocurrency market. However, regaining investor trust remains a challenge. Resolving existing uncertainties and leveraging potential advantages will be essential for Bitcoin price to climb to new heights.

Spot Bitcoin ETFs See 4th Consecutive Days of Inflow Streak, Reaching $147M Yesterday