Coinspeaker

Spot Bitcoin ETFs Draw $31M Net Inflows, Reversing Seven-Day Outflow Trend

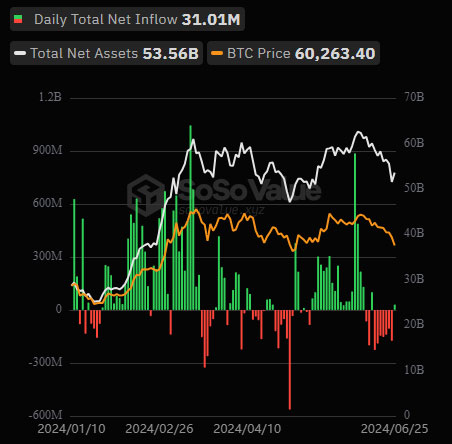

US spot Bitcoin exchange-traded funds (ETFs) finally reversed course on Tuesday, June 25th, 2024, attracting a net inflow of $31 million, according to data from SoSoValue. The trend reversal comes after a week-long stretch of net outflows that had some questioning the short-term viability of these recently launched financial products.

Photo: SoSoValue

Fidelity and Bitwise Leads the Charge

Fidelity‘s FBTC led the inflow movement with $49 million, showing strong institutional interest in gaining exposure to Bitcoin through a regulated vehicle. Bitwise’s BITB followed closely, attracting $15 million, further confirming the presence of established players in the industry. VanEck’s HODL also contributed $4 million in net inflows.

However, not all funds maintained a positive trend. Grayscale‘s long-standing GBTC trust continued to see outflows, this time losing $30.3 million. Ark Invest and 21Shares’ ARKB also faced a net outflow of $6 million, suggesting a more cautious stance from some investors.

Meanwhile, BlackRock‘s IBIT, currently the largest spot Bitcoin ETF by net asset value, stayed neutral on Tuesday, June 25. Despite a daily trading volume of $1.1 billion, the fund recorded zero net inflows. Similar inactivity was seen with offerings from Invesco, Galaxy Digital, Valkyrie, and Franklin Templeton.

Despite the mixed performance of spot Bitcoin ETFs, the overall outlook remains positive. As of Tuesday, June 25, the combined net inflows for these 11 funds since their January launch reached $14.42 billion, showing significant investor appetite for regulated Bitcoin exposure.

Spot Ether ETFs Gaining Momentum

As Bitcoin ETFs begin their journey, attention is quickly moving to spot ether ETFs. In May, the Securities and Exchange Commission (SEC) gave a cautious approval, prompting US issuers to hurry in finalizing their offerings. Last week, amended S-1 registration statements were filed. Industry experts like Eric Balchunas, a senior Bloomberg ETF analyst, expect a launch as soon as next week.

Matt Hougan, the Chief Information Officer at Bitwise, predicts a phenomenal reception for spot ether ETFs. He foresees a potential net inflow of $15 billion in the first 18 months after their US debut, indicating strong investor interest in Ethereum, the world’s second-largest cryptocurrency.

The recent inflow for Bitcoin ETFs has been modest but hints at a potential revival of investor confidence. The real challenge, however, might be the launch of spot ether ETFs. Analysts are forecasting significant growth, suggesting that the upcoming weeks could be crucial for the cryptocurrency ETF market in the US.

Spot Bitcoin ETFs Draw $31M Net Inflows, Reversing Seven-Day Outflow Trend