Solana (SOL) price slid to a 30-day low of $82 on Jan. 22 as crypto investors scaled back on mega-cap altcoin acquisitions, here’s what could happen next.

Solana emerged one of the best performing mega cap altcoins, as the crypto market rallied in the build up to the spot Bitcoin ETF verdict. But, since SOL hit a 2-year peak of $126.1 on Dec. 25, the price has headed south.

On-chain data trends unveil key factors driving the current Solana decline and what price action to anticipate in the week ahead.

Volatile macro conditions behind Solana price downtrend

Since the turn of the year, Solana network has maintained strong performance in its underlying growth metrics, with network usage and daily active users on a steady rise. However, Solana price fell to $82 on Jan. 22, bringing its weekly time frame losses to the 20% mark.

The Solana price decline has been attributed to bearish sentiment surrounding the broader altcoin markets. TradingView’s TOTAL3 chart sums up the market capitalization of all listed crypto assets excluding Bitcoin (BTC) and Ethereum (ETH).

As depicted below while SOL price has dropped 20% between Jan 14 and Jan 22, the TOTAL3 chart also shows an 8% downtrend.

The TOTAL.3 chart (total crypto market cap excluding BTC & ETH) shows that the global altcoin market has shrunk by $32 billion over the past week. This signals that investor confidence in the sector as a whole has been on a downtrend. As the 8th largest cryptocurrency, it’s not surprising that SOL price has been disproportionately impacted.

Without a significant improvement in market sentiment, SOL could experience more downside.

Investors are bracing up for more downside

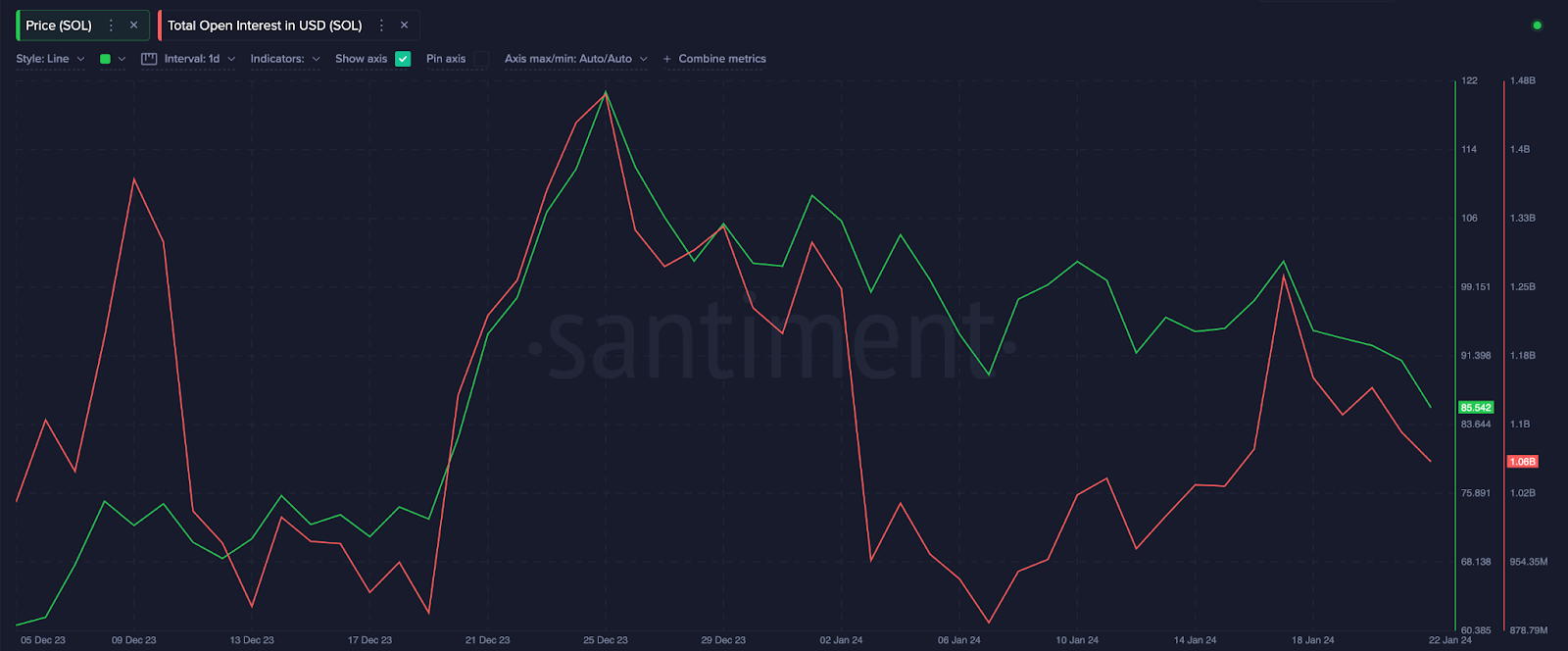

In the derivatives market, Solana investors appear to be closing out their positions in anticipation of further price downswings. Santiment’s open interest data tracks the real-time value of all active derivatives contracts for a particular cryptocurrency. According to the chart below, SOL open interest is down $226 million since Jan. 17.

A closer look at the chart shows that Solana open interest slid $1.3 billion on Jan 17 to $1.06 billion at press time on Jan 22, representing a 20% price decline.

A decline in open interest means that more investors are exiting their positions than those bringing in new capital. This further affirms the growing disinterest among crypto investors.

In summary, volatility in the altcoin markets and negative trading activity among derivatives speculators are two major factors behind the ongoing Solana price downtrend.

Solana (SOL) price forecast: Bears could target $75

Drawing insights from the derivatives and market data trends analyzed above, SOL price is likely to experience more downside toward the $75 area the coming days.

The Bollinger bands technical indicators also emphasize this bearish outlook. It shows that, with SOL price currently trading as $82, it has now wobbled below the 20-day Simple Moving Average price of $93.

Concisely put, this means that investors are willing to pay less for Solana price than they were 20 days ago.

However, the bulls could regroup around the lower-Bollinger band at $85, in attempts to trigger an early rebound. But if the bears can scale that buy-wall SOL price could slide towards $75, as predicted.

On the upside, the bulls could regain control if they successfully force an upswing above $95. However, as highlighted above, the 20-day SMA at $95, could pose a major resistance, as investors holding unrealized losses over the last 20-days could begin to exit once price approach their break-even point.