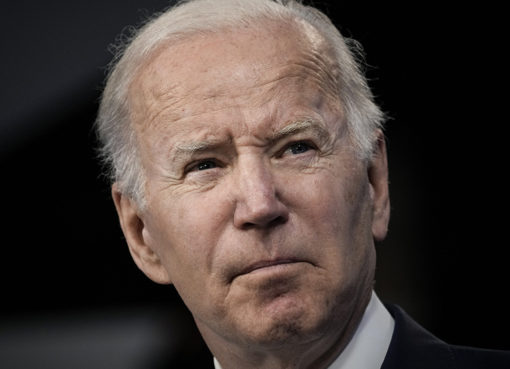

While SEC Chair Gary Gensler acknowledged constructive dialogue in Bitcoin ETF applications, he also warned of persisting non-compliance issues in the crypto space.

On Thursday, December 14, SEC Chair Gary Gensler revealed that the agency’s reevaluation of applications for a spot bitcoin exchange-traded fund (ETF) incorporates insights from recent court decisions. This marks a notable shift in the SEC’s stance, which has historically rejected several Bitcoin ETF applications.

The turning point came with a panel of judges instructing the SEC to reassess a previously unsuccessful bid from Grayscale Investments, signaling a potential shift in the regulatory landscape. Currently, the SEC is reviewing more than a dozen Bitcoin ETF applications submitted by major asset managers, including industry giants like BlackRock and Fidelity.

The SEC’s “new look” at spot bitcoin ETF applications reflects a changing perspective, influenced by legal developments and court rulings. The ongoing deliberations and potential approval of such ETFs could significantly impact the cryptocurrency market and open new avenues for institutional investors to participate in the Bitcoin market.

Investors are closely monitoring these developments as the SEC navigates the complex regulatory terrain surrounding cryptocurrency investment products. Speaking to CNBC during his interview on Thursday, Gensler said:

“We had in the past denied a number of these applications, but the courts here in the District of Columbia weighed in on that. So we’re taking a new look at this based upon those court rulings.”

In August, a trio of judges from the US Court of Appeals for the D.C. Circuit mandated that the SEC undertake a reassessment of Grayscale’s application for a Bitcoin ETF position. This directive came after the asset management company initiated legal action against the agency last year, contesting the rejection of its proposal for transforming its flagship GBTC fund. The court specifically scrutinized the SEC’s disparate treatment of spot Bitcoin ETFs versus similar funds centered on futures contracts, which the regulatory body had previously sanctioned.

In September, Gary Gensler informed legislators that he was scrutinizing both the aforementioned court ruling and “numerous submissions related to Bitcoin exchange-traded products”.

Non-Compliance in Crypto

Gensler restated his belief that the cryptocurrency industry exhibits considerable noncompliance with current securities laws. Speaking to CNBC, the SEC chair:

“There’s been far too much fraud and bad actors in the crypto field. There’s a lot of noncompliance, not only with the securities laws, but other laws around anti-money laundering and protecting the public against bad actors there.”

The industry’s attention has turned to Anti-Money Laundering (AML) due to congressional appeals and directives from the Treasury Department. Recently, the Treasury presented suggestions to legislators, urging them to grant increased authority and sanctions tools to effectively pursue illicit actors within the cryptocurrency sector.