XRP issuer Ripple is advancing on stablecoin plans after CEO Brad Garlinghouse teased the idea during Consensus 2024.

Ripple (XRP) has begun work on a fiat-pegged token called the Ripple USD, or RLUSD, as the company eyes a $160 billion stablecoin market currently dominated by Tether (USDT). The digital payment titan said private beta testing started on XRP’s ledger and the Ethereum mainnet, crypto’s second-largest blockchain by market cap.

At Consensus 2024, Garlinghouse told attendees that the stablecoin market had a high ceiling and could become a $3 trillion industry before 2030. Ripple president Monica Long also indicated that XRP would likely launch its stablecoin token this year.

An Aug. 9 announcement said RLUSD will operate as a U.S. dollar-backed token in a 1:1 ratio. The firm plans to use cash deposits, treasuries, and cash equivalents as reserves. Ripple also pledged to release monthly attestations and use a third-party accounting firm for audits. The official statement suggests a move toward regulatory compliance and approval.

Ripple to enter stablecoin industry

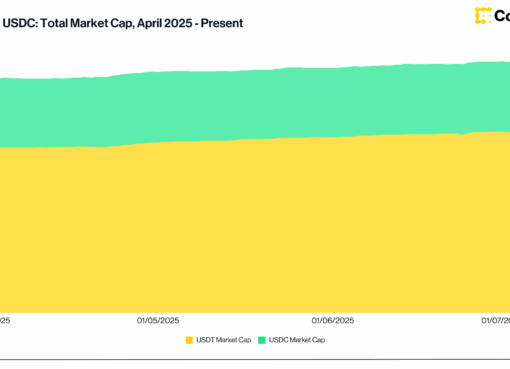

Entering the stablecoin market means competing directly with incumbents like Tether and Circle’s USD Coin (USDC), even if Ripple’s CEO stressed that there is ample room for all players to grow.

Specifically, Circle has demonstrated the ability to comply with comprehensive stablecoin regulations in Europe. Circle is also poised for an initial public offering in America and could become the first stablecoin company to list shares.

U.S. policymakers are mulling stablecoin regulations that could greenlight bank participation in the space. Legislators like Patrick McHenry and Maxine Waters have reportedly made progress toward such a bill.