Bitcoin, the enigmatic digital currency, is back in the spotlight as the US banking system grapples with mounting stress. While some predict a stratospheric rise to $1 million per coin, fueled by economic woes, others remain skeptical.

Related Reading

Banking On Bitcoin’s Rise?

Bitcoin advocates see it as a beacon of stability in a storm. Unlike traditional assets tied to the health of institutions, Bitcoin boasts a finite supply and decentralized nature. This, they argue, positions it perfectly to benefit from a “flight to safety” scenario, where investors seek refuge from a potentially collapsing banking system.

The recent history seems to support this narrative. In March 2023, the failures of prominent institutions like Silicon Valley Bank coincided with a 40% surge in Bitcoin’s price within a week. Industry figures point to this as evidence of Bitcoin’s role as an “uncorrelated asset class” – a hedge against traditional financial turmoil.

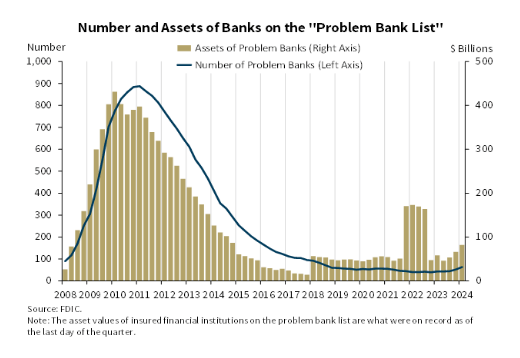

Further bolstering this argument is the latest report by the Federal Deposit Insurance Corporation (FDIC). The report paints a concerning picture, highlighting a worrying trend of unrealized losses on securities held by US banks.

These losses, driven by rising interest rates, have ballooned to over $500 billion. Additionally, the number of banks on the FDIC’s “Problem Bank List” has grown from 52 to 63 in just one quarter, raising fears about the overall health of the sector.

Million-Dollar Dream Or Flight Of Fancy?

While the potential for Bitcoin to gain value seems undeniable, the ambitious price target of $1 million faces strong headwinds. Experts warn that such a dramatic surge might come at the cost of a full-blown economic meltdown, a scenario that wouldn’t necessarily benefit Bitcoin in the long run.

Furthermore, Bitcoin’s historical correlation with other assets is not static. While periods of weak correlation exist, there have also been instances of strong correlation, particularly during broader market downturns. This casts doubt on Bitcoin’s ability to completely decouple itself from a struggling traditional financial system.

Related Reading

Another factor to consider is the recent uptick in the M2 money supply, a metric representing the total money circulating in the economy. Historically, periods of M2 expansion have coincided with Bitcoin price increases. However, the interplay between money supply and Bitcoin in an environment with a potentially shaky banking system remains an open question.

The Road Ahead For Bitcoin

Bitcoin’s future is a bit of a guessing game right now. Banks in the US are having some problems, and that could make Bitcoin more valuable. But if the whole economy goes downhill, even Bitcoin might suffer. So, it all depends on how bad things get with the banks and the economy in general.

Featured image from Pngtree, chart from TradingView