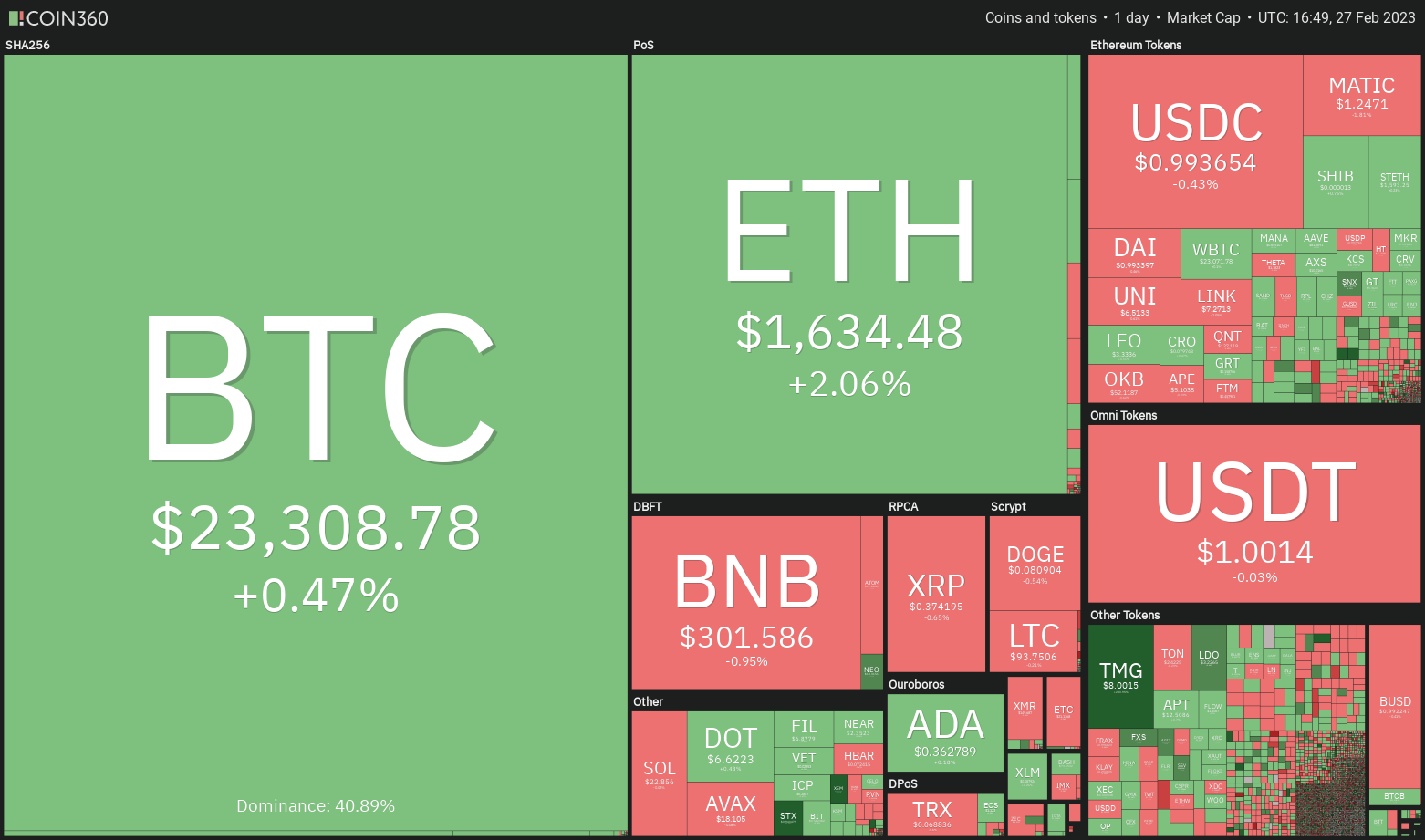

Bitcoin and U.S. equities markets are attempting to recover, but selling at overhead resistance could continue to weigh on the bullish momentum.

Bitcoin (BTC) and the United States equities markets are trying to start the week on a positive note but some analysts are skeptical about the short-term prospects of the markets. According to Bloomberg Intelligence senior macro strategist Mike McGlone, Bitcoin will face significant resistance at $25,000. McGlone believes that it “may be a while before buy-and-hold types gain the upper hand.”

It also looks like Bitcoin whales, unique entities owning 1,000 Bitcoin or more, are also not convinced of the recovery in the crypto markets. According to Glassnode, Bitcoin whale numbers have fallen to 1,663, which is well below the peak of 2,161 hit in February 2021.

It is difficult to catch the bottom in any market. Hence, traders should try to build a portfolio when they believe that the downtrend has ended and a basing pattern has begun.

Instead of buying the entire quantity at one go, they could gradually build a portfolio and aim to finish the purchases before the asset picks up momentum and shoots higher.

Could the strength in the equities markets pull Bitcoin and altcoins higher? Let’s study the charts to find out.

SPX

The S&P 500 index (SPX) plunged below the 20-day exponential moving average (4,046) on Feb. 17, which intensified selling and pulled the price to the uptrend line. Although the bears pulled the price below the uptrend line on Feb. 24, the lower levels attracted buying as seen from the long tail on the day’s candlestick. That helped the index close near the uptrend line.

The bulls may face an uphill task as the bears are likely to sell on any relief rallies near the 20-day EMA, as seen from the long wick on the Feb. 27 candlestick. If the price turns down from the 20-day EMA, it will suggest that the sentiment is negative and traders are selling on minor rallies. A close below the uptrend line may open the doors for a possible drop to 3,764.

If bulls want to salvage the situation, they will have to push the price back above the 20-day EMA. If they do that, it will indicate that the break below the uptrend line may have been a bear trap. The index could then attempt a rally to the overhead resistance of 4,200.

DXY

The bulls successfully defended the retest of the breakout level from the wedge pattern on Feb. 20, which started a stronger relief rally in the U.S. dollar index (DXY).

The index has reached the 38.2% Fibonacci retracement level of 105.52. This level may see an attempt by the bears to stall the recovery. If sellers want to maintain their hold, they will have to sink the price below the moving averages.

On the other hand, if bulls want to strengthen their position, they will have to push the price above 105.52. If they manage to do that, the index could extend its recovery to the 50% retracement level of 106.98 and then to the 61.8% retracement level of 108.43.

BTC/USDT

Bitcoin rebounded off the $22,800 support on Feb. 25 and rose above the 20-day EMA ($23,417) on Feb. 26. This suggests that lower levels are attracting buyers.

However, the bears may not give up easily. They will try to pull the price back below the 20-day EMA and challenge the 50-day simple moving average ($22,433). If this level gives way, the BTC/USDT pair may plummet to the next major support at $21,480.

Alternatively, if the price once again bounces off $22,800, it will signal that buyers are fiercely defending this level. That may indicate a range-bound action between $22,800 and $25,250 for a few days.

ETH/USDT

Ether (ETH) rebounded off the 50-day SMA ($1,587) on Feb. 25, indicating that the bulls are fiercely defending this level. The 20-day EMA ($1,626) has flattened out and the RSI is just above the midpoint, indicating a balance between supply and demand.

This balance will tilt in favor of the bulls if they thrust and close the price above $1,680. The ETH/USDT pair will then attempt to rise above the $1,800 resistance and start its journey toward the psychological level of $2,000.

Alternatively, if the price once again turns down from the overhead resistance, it will indicate that bears are not willing to give up. That may increase the possibility of a break below the 50-day SMA. The pair could then drop to $1,460 and later to $1,352.

BNB/USDT

BNB (BNB) broke and closed below the 50-day SMA ($307) on Feb. 24 but the bulls purchased the dip and pushed the price to the 20-day EMA ($309) on Feb. 26. This level is attracting selling by the bears.

If the price turns down and breaks below $295, it will indicate that sellers have flipped the 20-day EMA into resistance. The BNB/USDT pair could then tumble toward the critical support at $280. This is an important level to watch out for because a bounce off it may point to a range formation between $280 and $318 for some time.

The next trending move in the short term could begin if buyers drive the price above $318 or bears sink the price below $280.

XRP/USDT

XRP’s (XRP) price has been swinging inside a large range between $0.30 and $0.43 for the past several weeks. The price broke below the 50-day SMA ($0.39) on Feb. 23 and has been gradually falling toward the solid support at $0.36.

The 20-day EMA ($0.38) has started to turn down and the RSI is in the negative territory, indicating that bears have a slight edge in the near term. If the price breaks below $0.36, the XRP/USDT pair may slide to the support line of the descending channel.

This negative view could invalidate in the near term if the price turns up and rises above the channel. The pair could then attempt a rally to the overhead resistance at $0.42 where the bears are expected to mount a strong defense.

ADA/USDT

Cardano (ADA) bounced off $0.35 on Feb. 25 but the recovery is facing selling at the 50-day SMA ($0.37). This indicates that the bears are trying to flip the level into resistance.

The moving averages are on the verge of a bearish crossover, with the 20-day EMA ($0.38) dropping below the 50-day SMA. Such a move will suggest that the bears have the edge in the near term. A break and close below the strong support zone between $0.34 and $0.32 could start a decline to $0.26.

If bulls want to prevent the downtrend, they will have to propel the price back above the 20-day EMA. The ADA/USDT pair may then climb to the $0.42 to $0.44 resistance zone.

Related: Bitcoin price eyes $24K retest as US dollar dives into monthly close

MATIC/USDT

Polygon (MATIC) plunged below the 20-day EMA ($1.30) on Feb. 24 and the bears successfully held its retest on Feb. 26. This indicates that the 20-day EMA is acting as the new roof.

The bears will next attempt to sink the price below the 50-day SMA ($1.16). If they succeed in this endeavor, the selling could intensify and the MATIC/USDT pair may tumble to the next strong support at $1.05.

If buyers want to regain the upper hand, they will have to thrust the price above the 20-day EMA. That will indicate solid buying on dips. The pair may first climb to $1.42 and thereafter rally to the $1.50 to $1.57 resistance zone.

DOGE/USDT

Dogecoin (DOGE) bounced off the strong support near $0.08 on Feb. 25 but the recovery is facing selling pressure from the bears on Feb. 27.

The moving averages have completed a bearish crossover and the RSI is in the negative territory, indicating that bears have the upper hand. A break and close below the $0.08 support will complete a head and shoulders pattern in the near term. The DOGE/USDT pair could then plummet to $0.07.

Contrary to this assumption, if the price turns up from the current level or $0.08, it will indicate that lower levels are being viewed as a buying opportunity. The relief rally may face selling near the downtrend line but if bulls overcome this barrier, the pair could attempt a rally to $0.10.

SOL/USDT

Solana (SOL) is witnessing a tough battle between the bulls and the bears near the 50-day SMA ($22.75). This indicates that bulls are attempting to protect the level while the bears are trying to break it and come out on top.

If the price slips below $21.41, the SOL/USDT pair could drop to the important support at $19.68. This is an important level for the bulls to defend because a close below it may increase the selling pressure and sink the pair to $15.

Conversely, if the price turns up and rises above the 20-day EMA ($23.23), the bulls will push the pair to the resistance line. The bears are likely to defend this level with all their might but if buyers overcome this obstacle, an up-move to $39 is possible.

The views, thoughts and opinions expressed here are the authors’ alone and do not necessarily reflect or represent the views and opinions of Cryptox.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.