Coinspeaker

Over 90% of Stablecoin Transactions Are Non-Organic

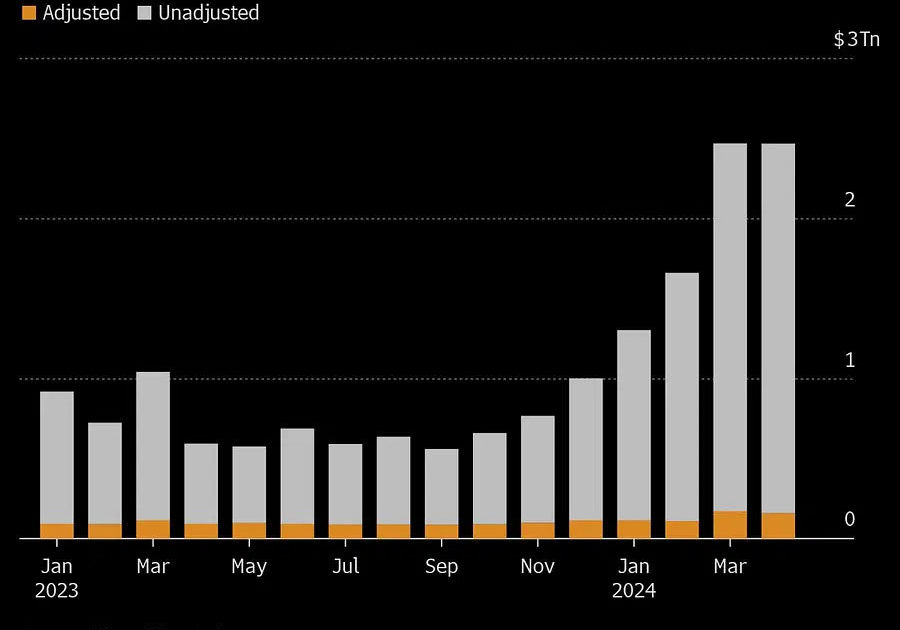

In a surprising report from Bloomberg, Visa and Allium Labs’ recent study challenges the notion that stablecoins are poised to transform the global payments landscape. The report suggests that a startling 90% of stablecoin transactions in April 2024 did not originate from regular consumers, casting doubt on their potential as a mainstream payment method.

Photo: Visa, Allium Labs

Visa’s metric seeks to isolate “organic payments activity” by filtering out transactions driven by bots and high-volume traders. This revealed that only $149 billion out of a total of $2.2 trillion in stablecoin transactions stemmed from genuine user activity.

Stablecoins’ Slow Adoption as Payment Tool

“It says that stablecoins are still in a very nascent moment in their evolution as a payment instrument, […] That’s not to say that they don’t have long-term potential, because I think they do. But the short-term and the mid-term focus needs to be on making sure that existing rails work much better,” said Pranav Sood, executive general manager for EMEA at payments platform Airwallex.

The lack of real-world use isn’t shocking. Tracking the actual worth of crypto transactions via blockchain data has always been challenging. Data firm Glassnode estimates the record $3 trillion market cap for digital tokens in the 2021 bull run was likely closer to $875 billion.

Double-counting of transactions further complicates the matter. Swapping funds between different stablecoins on decentralized exchanges like Uniswap can inflate the total volume. For instance, exchanging $100 of USDC (from Circle) for PYUSD (offered by PayPal) on Uniswap would register as $200 in total stablecoin activity, according to Cuy Sheffield, Visa’s head of crypto.

Stablecoins’ Disruptive Potential

Established payment giants like Visa, which handled over $12 trillion in transactions last year, have a stake in preserving the current state. However, Bernstein analysts believe the total value of all stablecoins could surge to a remarkable $2.8 trillion by 2028, a staggering 18-fold increase.

Proponents argue that stablecoins’ near-instant and virtually cost-free transactions make them perfect for disrupting the payments industry. This reasoning has encouraged companies like PayPal (with its PYUSD) and Stripe (it accepts stablecoins) to embrace the technology.

However, Airwallex’s Sood emphasizes the complexity as a major obstacle. Many consumers still find the technology overly complex, he notes. Importantly, checks remain widely used for business transactions in the US, highlighting the gradual adoption of technology in the payments industry.

The future of stablecoins as a common payment option is uncertain. While their disruptive potential is evident, overcoming hurdles like user acceptance and insufficient transparency in transaction data are vital before they can become a true game-changer.