Four busted over fraud linked to $1.8 billion DGCX XinKangJia case

Hong Kong police have arrested four individuals in connection with an alleged cryptocurrency investment ring that defrauded victims of over 3 million Hong Kong dollars. The operation was linked to a bogus platform posing as affiliated with the Dubai Gold and Commodities Exchange (DGCX). However the alleged ringleader escaped and publicly mocked victims for their supposed lack of intelligence in falling for the scam.

The arrests are part of a wider fallout from the collapse of the so-called “DGCX XinKangJia” platform in mainland China. On June 25, the platform abruptly froze withdrawals for its 2 million users. By the next day, it had gone completely offline.

Marketed as the Chinese branch of the Dubai organization, XinKangJia promised investors 1% fixed daily returns on USDT-denominated investments in gold and oil. Before shutting down, the platform allegedly transferred around 1.8 billion USDT (roughly 13 billion yuan) through Tornado Cash to offshore wallets, according to blockchain security firm SlowMist.

The scheme employed a paramilitary-style pyramid structure, dividing members into nine ranks from “squad leader” to “commander.” Users were encouraged to recruit new investors to climb ranks and earn USDT bonuses.

On July 7, authorities in Taojiang County, Hunan Province, officially classified the platform as a suspected case of fundraising fraud and illegal network-based pyramid selling. The real Dubai Gold and Commodities Exchange publicly disavowed any affiliation with the Chinese platform on April 8, 2025, warning that any platforms, apps or promotional material using its name were unauthorized and likely fraudulent.

All XinKangJia’s deposits, returns and withdrawals were conducted in USDT, placing the operation outside the scope of China’s traditional financial oversight.

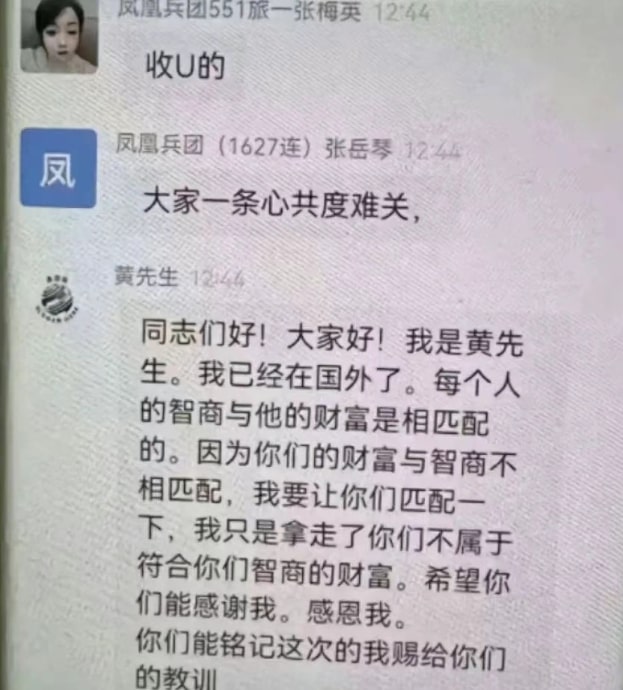

Public outrage intensified after XinKangJia’s founder reportedly fled abroad and mocked victims in group chats.

“Everyone’s wealth should match their intelligence. Since your wealth didn’t match your intelligence, I helped balance it out for you. I only took what didn’t belong to your level of intelligence. I hope you can be grateful,” reads a machine translation of a message from the founder, as shown in a screenshot shared by local media.

Anime fans can buy NFTs to become Japan’s digital citizens

Once known mainly to knife collectors and factory insiders, the quiet Japanese city of Sanjo is now running a blockchain-powered experiment in civic identity.

On Tuesday, Sanjo launched the Digital Sanjo Citizen ID, an NFT that allows anyone in the world to become a digital resident of the city. Holders gain access to a private community and perks like hot spring stays, virtual town hall meetings and even voting rights in December’s digital mayoral election. They can also propose initiatives for Sanjo’s digital future.

The NFTs, recognized by the local government, are designed by students at a nearby anime college. Each token features a “Guardian of the Artisans” that represents a real-world manufacturer from the Tsubame-Sanjo industrial cluster, famous for its knives, pliers and stainless steel tools.

Like many rural regions in Japan, Sanjo is grappling with population decline and youth migration to bigger cities. In response, officials are turning to the concept of kankeijinko — a “related population” of outsiders who engage meaningfully with the community without living there.

Last year, Cointelegraph reported that Yamakoshi, a village in the Niigata mountains, attracted 1,700 digital citizens through a similar NFT initiative. Japan’s government has also been exploring metaverse applications to address broader social issues, including “hikikomori,” or socially withdrawn individuals.

Read also

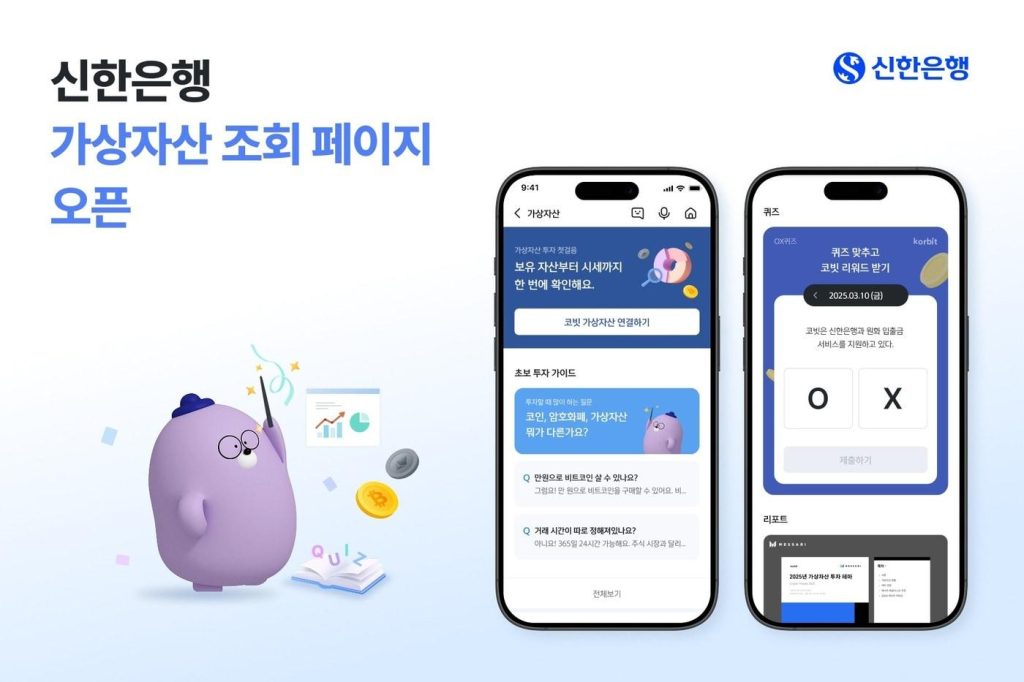

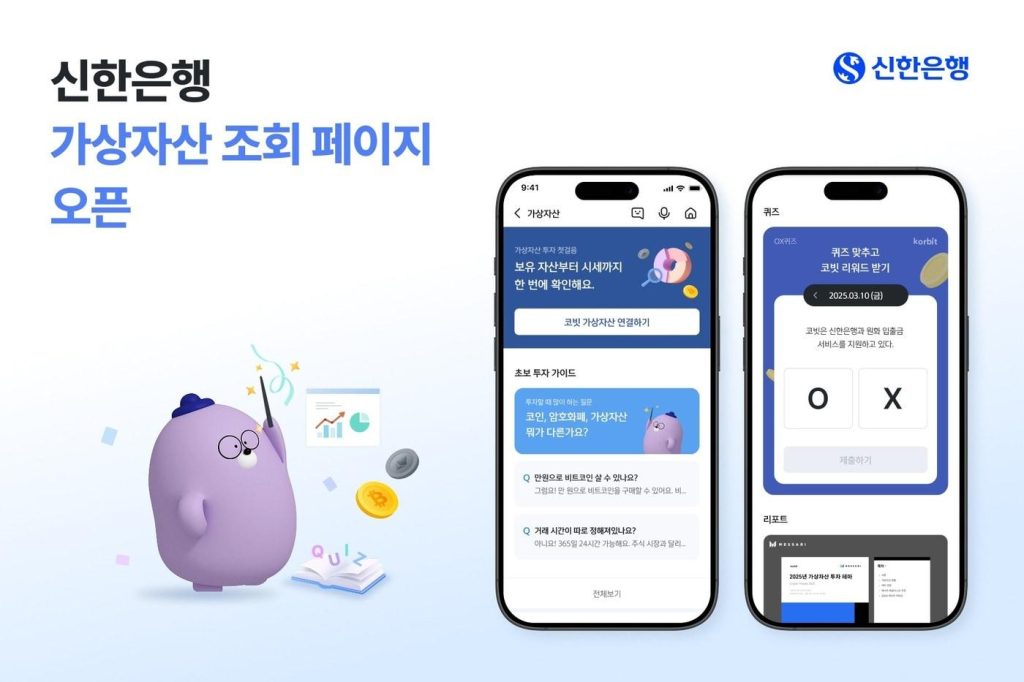

First major South Korean bank opens crypto page

Shinhan Bank, one of South Korea’s largest commercial banks, has become the first mainstream financial institution in the country to launch a dedicated cryptocurrency section within its mobile app.

The new feature allows users to track real-time crypto prices, explore beginner-friendly educational content, and access professional research reports. It’s part of Shinhan’s broader effort to make digital assets more approachable and transparent for the general public.

The app integrates with local exchange Korbit, enabling customers to link real-name verified accounts, view crypto holdings and request higher transaction limits.

Shinhan is one of five South Korean banks that have partnered with licensed exchanges, offering customers compliant pathways to trade crypto through their bank accounts. The bank has long positioned itself at the forefront of the country’s digital asset adoption.

The launch comes as South Korea accelerates efforts to regulate the crypto sector under President Lee Jae Myung’s administration. His campaign included proposals for a won-pegged stablecoin. In late June, eight major banks — including Shinhan — announced a joint initiative to issue a fiat-backed digital currency.

Read also

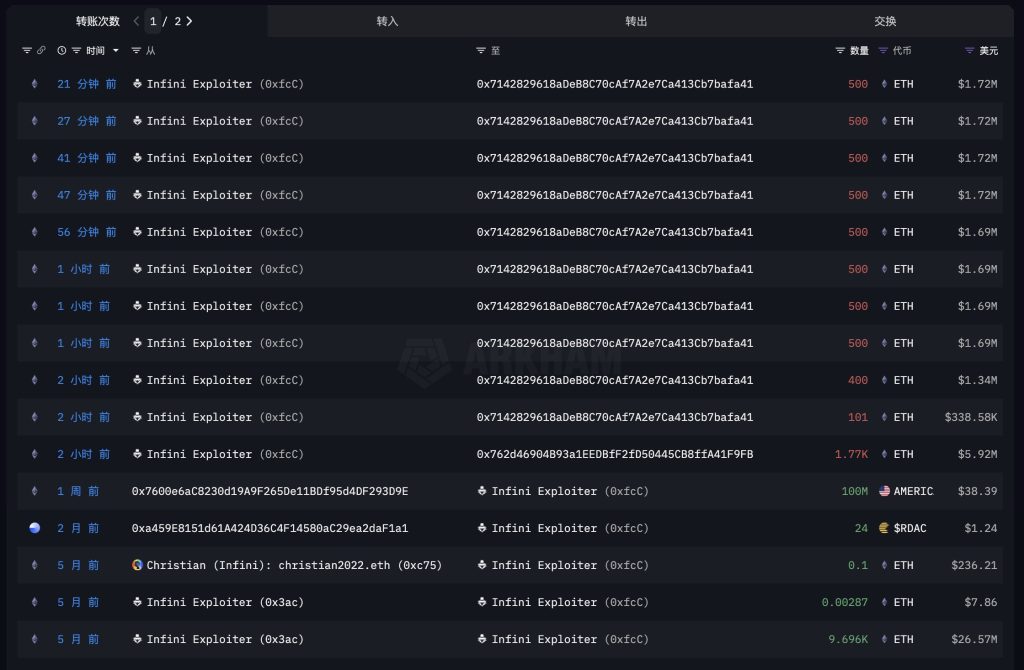

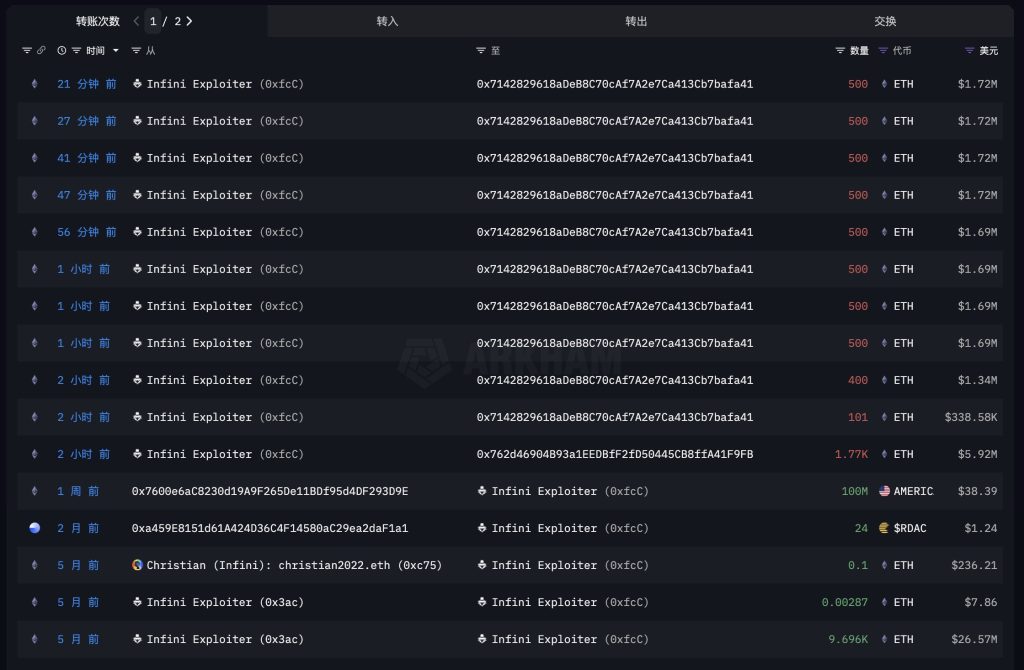

Infini Hacker Moves ETH amid price surge

The attacker behind the $50 million exploit of crypto card company Infini has begun laundering stolen funds, capitalizing on Ethereum’s recent price rally to secure multimillion-dollar gains.

On February 24, the attacker drained $50 million in USDC from Infini’s vaults and quickly converted the funds into 17,696 ETH. With Ethereum now trading above $3,400, the stash has grown to roughly $61 million — an $11 million unrealized profit.

On-chain data analyzed by blockchain sleuth EmberCN shows the hacker has started to offload a portion of the holdings. So far, 1,770 ETH has been swapped for $5.88 million in DAI and 5,001 ETH has been funneled into Tornado Cash, a privacy tool frequently used to obscure fund movements.

Infini had previously offered a bounty for the return of the funds and initiated legal proceedings. In June, the company announced it would shut down its stablecoin card business.

The attacker still controls around 10,925 ETH in their wallet.

Subscribe

The most engaging reads in blockchain. Delivered once a

week.

Yohan Yun

Yohan Yun is a multimedia journalist covering blockchain since 2017. He has contributed to crypto media outlet Forkast as an editor and has covered Asian tech stories as an assistant reporter for Bloomberg BNA and Forbes. He spends his free time cooking, and experimenting with new recipes.