Despite the availability of over 15 platforms facilitating euro-denominated trading with crypto, only a few attract substantial trading volume, Kaiko says.

Cryptocurrency exchanges Bitvavo, Kraken, Coinbase, Bitstamp, and Binance collectively dominate the landscape of euro-denominated trading volume, accounting for over 98% of the total trades.

According to a recent research from Kaiko co-made with Bitvavo, crypto exchange Kraken saw €25 billion in cumulative volume in 2023, followed by Binance, which once held a significant market share. Crypto exchange Bitvavo, according to the report, witnessed cumulative euro volumes exceeding €34 billion, accounting for over 50% in December 2023.

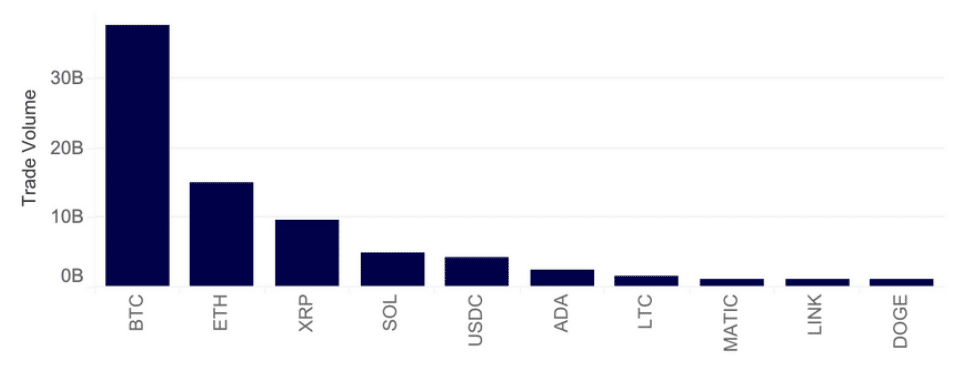

Euro traders in 2023 demonstrated a strong preference for Bitcoin (BTC), which experienced substantial gains in Q4 2023. According to analysts, Bitcoin transactions in Europe surpassed €37 billion in trading volume, overshadowing Ethereum (ETH) (€15 billion) and XRP (€9.5 billion). The top 10 assets traded in Europe aligned closely with global and U.S. trends in trading activity, Kaiko says.

The correlation between the quantity of euro volume and the number of euro-denominated trading pairs listed by each exchange is evident, analysts at Kaiko say, noting that both Kraken and Bitvavo boast over 200 euro pairs, solidifying their positions with the highest euro-denominated volume. Conversely, global exchanges like Bitflyer and Bybit focus on regions such as APAC, contributing to the diverse landscape of euro-denominated trading.

Even though historically Europe has been trailing behind the U.S. and APAC in crypto trading and investment, the trend is “primed for reversal” in 2024 as the region is witnessing a surge in exchanges establishing headquarters, buoyed by a well-defined regulatory regime, Kaiko concludes.