DeFi protocol Ondo Finance has completed the acquisition of Oasis Pro, an infrastructure provider for real-world assets (RWAs), in a move the company said would strengthen its tokenized security offerings in the United States.

Oasis Pro is a broker-dealer, Alternative Trading System (ATS) and Transfer Agent (TA) registered with the US Securities and Exchange Commission (SEC). The acquisition gives Ondo Finance a key foothold in the regulated tokenized securities market, the company said in a statement on Friday.

Ondo Finance declined to disclose the financial terms of the deal but confirmed that Oasis Pro CEO Pat LaVecchia will join Ondo as part of the acquisition.

Oasis Pro has been a member of the Financial Industry Regulatory Authority (FINRA) since 2020 and has served on the self-regulatory organization’s Crypto Working Group.

Tokenized securities are an emerging focus within the crypto industry, with early efforts largely aimed at offering tokenized US stocks and exchange-traded funds (ETFs) to investors outside the US.

As Cointelegraph recently reported, Kraken and Robinhood offer tokenized securities to non-US residents.

By acquiring Oasis Pro, Ondo Finance aims to expand these offerings to US investors as well, the company said.

Related: Chainlink, JPMorgan, Ondo Finance complete crosschain treasury settlement

Ondo’s RWA tokenization “arms race”

The Oasis Pro acquisition was announced shortly after Ondo Finance launched the Ondo Catalyst fund, a joint venture with Pantera Capital aimed at investing $250 million in RWA projects.

Ondo Chief Strategy Officer Ian De Bode said the investment is part of the company’s effort to stay ahead in the tokenization “arms race” unfolding across the market.

Tokenization is gaining traction among major industry players such as BlackRock, Franklin Templeton, Multibank and Libre, which are already active in the market.

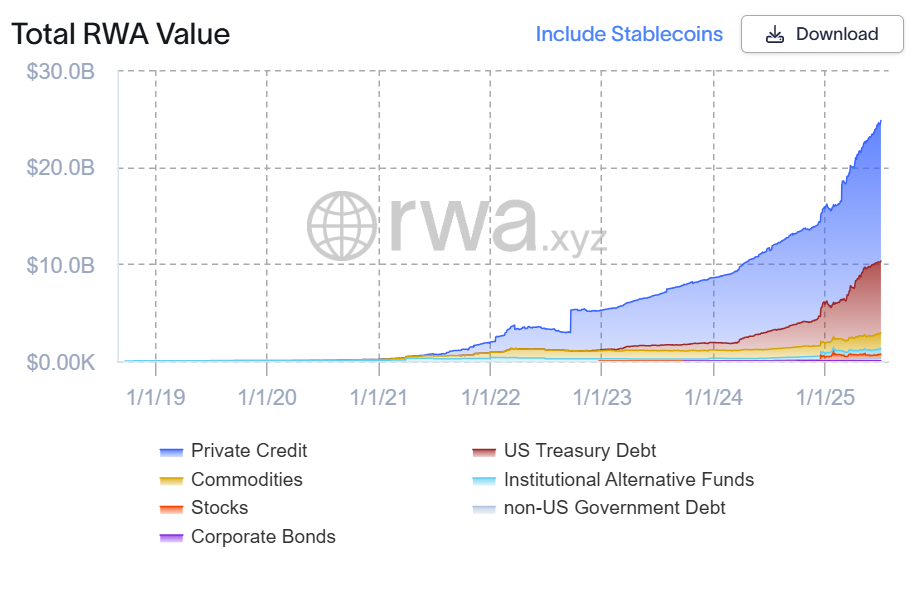

Together, these and other firms have fueled the rapid growth of tokenized RWAs, with onchain financial assets now nearing $25 billion in cumulative value.

Industry adoption is occurring in lockstep with an eagerness among regulators to adopt crypto-friendly policies in a second-term administration of US President Donald Trump.

This was one of the main takeaways from a recent CNBC interview with SEC Chair Paul Atkins, who called tokenization an “innovation” and vowed to end the agency’s “regulation through enforcement,” referring to SEC policies under former Chair Gary Gensler.

Related: Private credit powers $24B tokenization market, Ethereum still dominates — RedStone