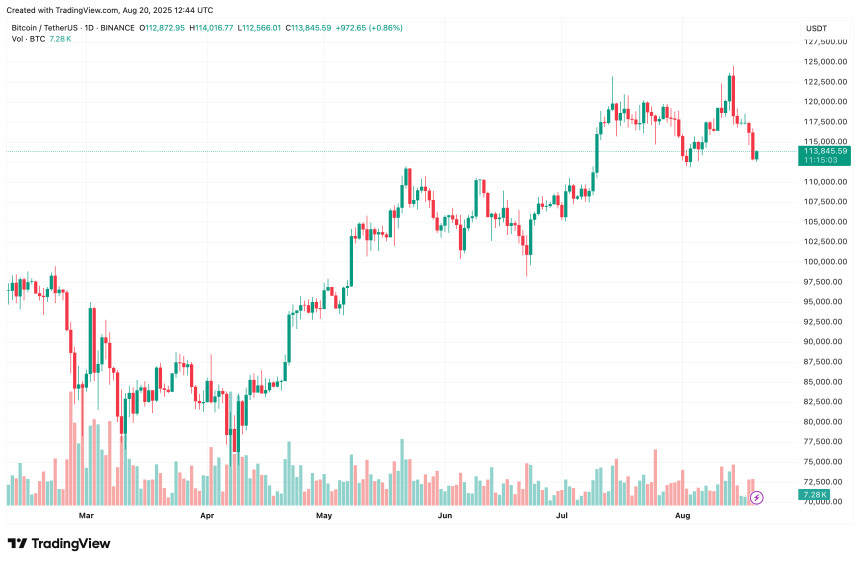

After hitting a new all-time high (ATH) of $124,474 on Binance on August 13, Bitcoin (BTC) has tumbled toward $113,000, with the next major support zone around $110,000. Analysts warn that more downside could still be ahead for the top cryptocurrency.

Bitcoin To Fall More? Crowded Long Trade Gives Hint

According to a CryptoQuant Quicktake post by contributor XWIN Research Japan, Bitcoin open interest across all exchanges has surged past $40 billion, nearing ATH territory. This rise shows both whales and short-term traders are piling into leveraged positions.

Related Reading

The chart below highlights the recent spike in BTC open interest, now hovering at $40.6 billion. Compared to August 2024 levels of $15 billion, open interest has grown by more than 150%.

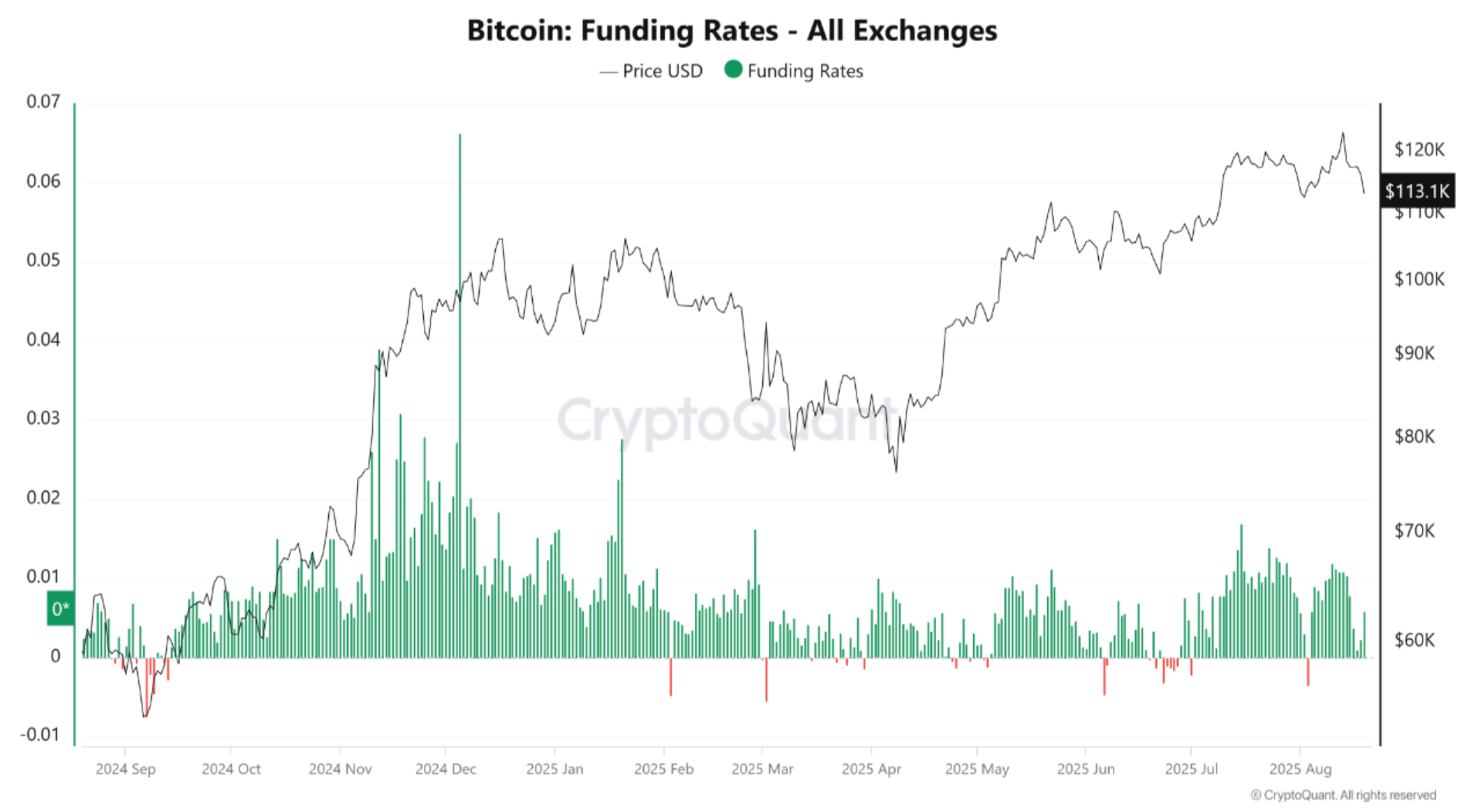

The CryptoQuant contributor added that despite this surge, the funding rate has remained positive, showing a strong long bias. While this reflects market optimism, it also signals a crowded trade, with most participants betting on further BTC appreciation.

As a result, the risk of a long squeeze – forced liquidations of long positions due to aggressive leverage – has risen. XWIN Research Japan explained in their analysis:

A sudden price drop can trigger a cascade of forced selling, amplifying volatility. In other words, Bitcoin’s short-term moves remain at the mercy of speculative flows.

BTC Fund Holding By Institutions Rises

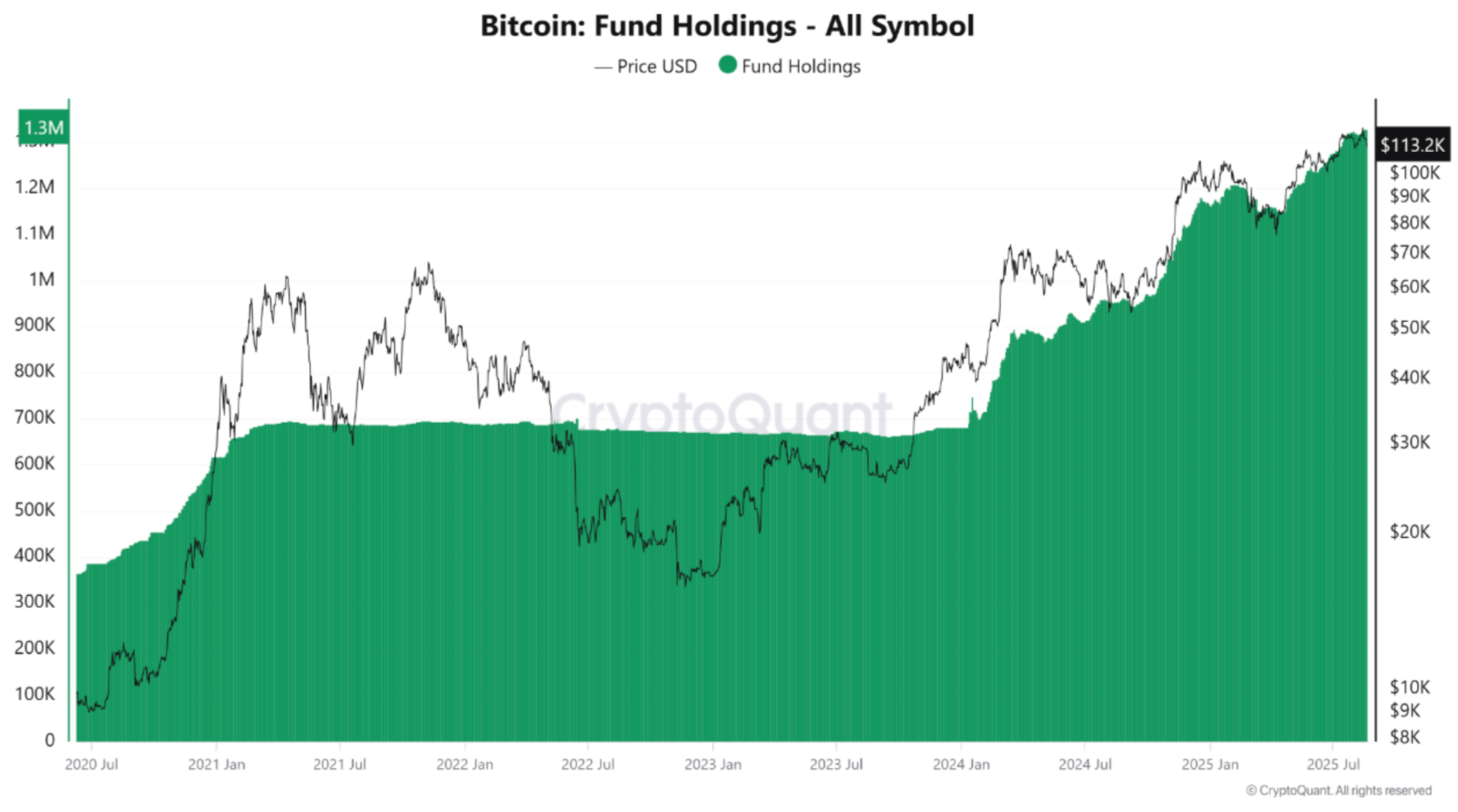

Despite speculative froth from excessive leverage in the market, BTC fund holdings by Bitcoin exchange-traded funds (ETFs) and institutional investors continue to surge, exceeding 1.3 million according to latest data.

Spot ETFs and corporate treasuries absorbing BTC provides the digital asset a structural bid that steadily reduces its available supply. According to data from SoSoValue, US-based spot Bitcoin ETFs currently hold $146 billion in net assets – representing 6.47% of BTC’s market cap.

Related Reading

That said, this week alone has seen more than $645 million in outflows from spot Bitcoin ETFs, following two consecutive weeks of inflows totaling nearly $800 million. Among the ETFs, BlackRock’s IBIT leads with $84.78 billion in net assets as of August 19.

Still, not all signals are bearish. For instance, while BTC slipped below $115,000, its spot trading volume surged past $6 billion, giving bulls hope for a potential rebound.

Similarly, technical analyst AO recently suggested that BTC could be mirroring gold’s trajectory, with an ambitious target of $600,000 by early 2026. At press time, BTC trades at $113,845, down 1.5% in the past 24 hours.

Featured image from Unsplash, charts from CryptoQuant and TradingView.com