Minnesota state Senator Jeremy Miller has introduced the Minnesota Bitcoin Act, which he drafted after completely changing his stance on Bitcoin.

“As I do more research on cryptocurrency and hear from more and more constituents, I’ve gone from being highly skeptical to learning more about it, to believing in Bitcoin and other cryptocurrencies,” Miller said in a March 18 statement.

Miller said the bill aims to “promote prosperity” for Minnesotans by allowing the Minnesota State Board of Investment to invest state assets in Bitcoin (BTC) and other cryptocurrencies, just as it invests in traditional assets.

Several other US states have introduced similar Bitcoin-buying bills, with 23 states having introduced legislation to create a Bitcoin reserve, according to Bitcoin Laws.

A total of 39 different bills related to state investments in Bitcoin have been introduced across 23 US states. Source: Bitcoin Laws

Under Miller’s bill, Minnesota state employees would be able to add Bitcoin and other cryptocurrencies to their retirement accounts.

It would also give residents the option to pay state taxes and fees with Bitcoin. Colorado and Utah already accept crypto for tax payments, while Louisiana allows it for state services.

Investment gains from Bitcoin and other cryptocurrencies would also be exempt from state income taxes. In the US, up to $10,000 paid to the state can be deducted from federal taxes under the state and local tax deduction, but any amount beyond that is subject to both state and federal tax obligations.

Related: SEC could axe proposed Biden-era crypto custody rule, says acting chief

The increasing number of US states proposing Bitcoin reserve bills follows Senator Cynthia Lummis’ July Strategic Bitcoin Reserve Act, which directs the federal government to buy 200,000 Bitcoin annually over five years, totaling 1 million Bitcoin.

However, on March 12, Lummis proposed a newly reintroduced BITCOIN Act, allowing the government to potentially hold more than 1 million Bitcoin as part of its newly established reserve.

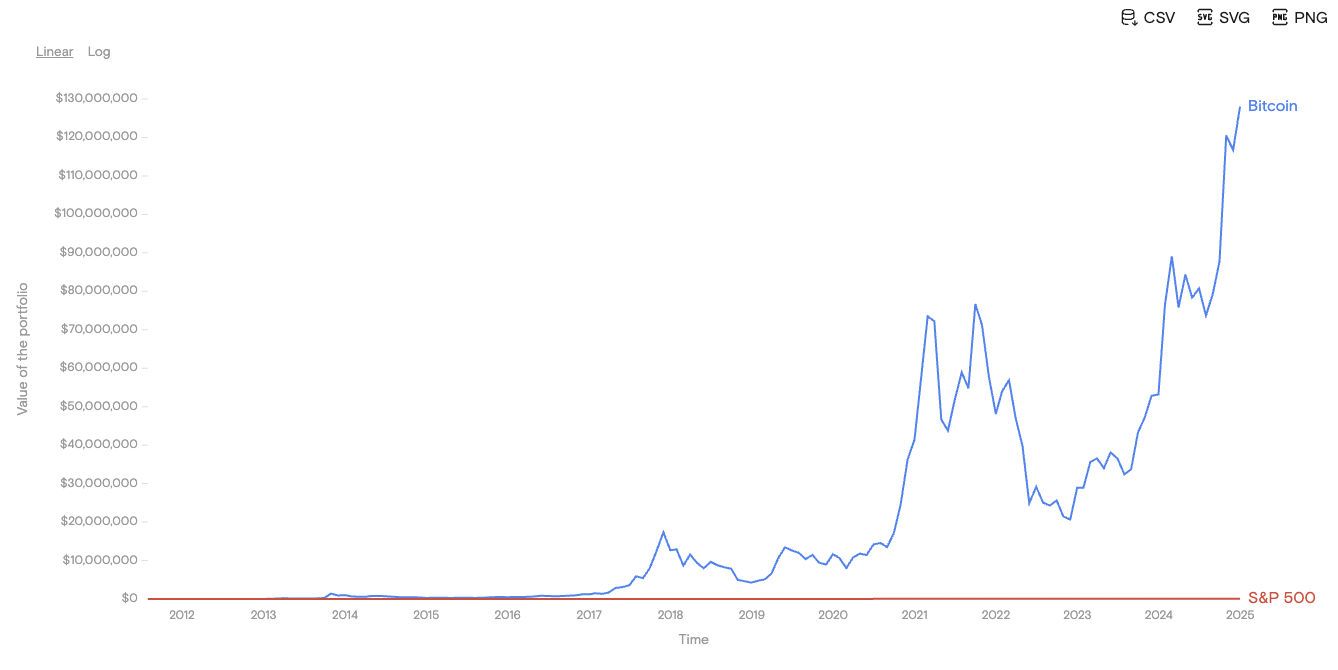

Bitcoin has shown significant gains compared to traditional assets in recent years. From August 2011 to January 2025, Bitcoin posted a compound annual growth rate of 102.36%, compared to the S&P 500’s 14.83%, according to Curvo data.

Bitcoin’s compound annual growth rate is significantly higher than the S&P 500s. Source: Curvo

Magazine: Crypto fans are obsessed with longevity and biohacking: Here’s why