Five years after the first Solana block was generated, the network is entering a new period of fear and uncertainty as the once-lucrative memecoin-casino starts to wind down.

To be fair, the layer 1 blockchain has overcome bigger obstacles before, staging an incredible comeback from just $8 in the aftermath of the 2022 FTX collapse to a new all-time high above $294 in January this year.

But the sudden evaporation of the memecoin market could pose a big challenge over the coming months — where are the activity and fees going to come from next?

After peaking in January, memecoin activity has nose-dived after a string of scandals and celebrity rug pulls, along with the dawning realization that memes can be every bit as extractive as any VC coin.

More than a decade on from the launch of Dogecoin, it would take a brave soul to predict the end of memecoins. But have memecoins peaked? And if so, what are the implications for Solana?

Solana’s memecoin market crash: Revenue and volume

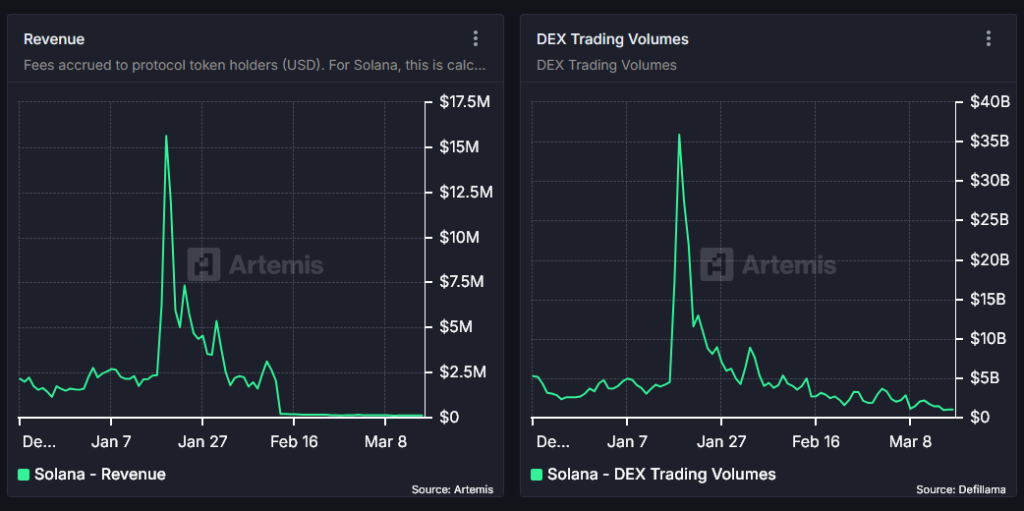

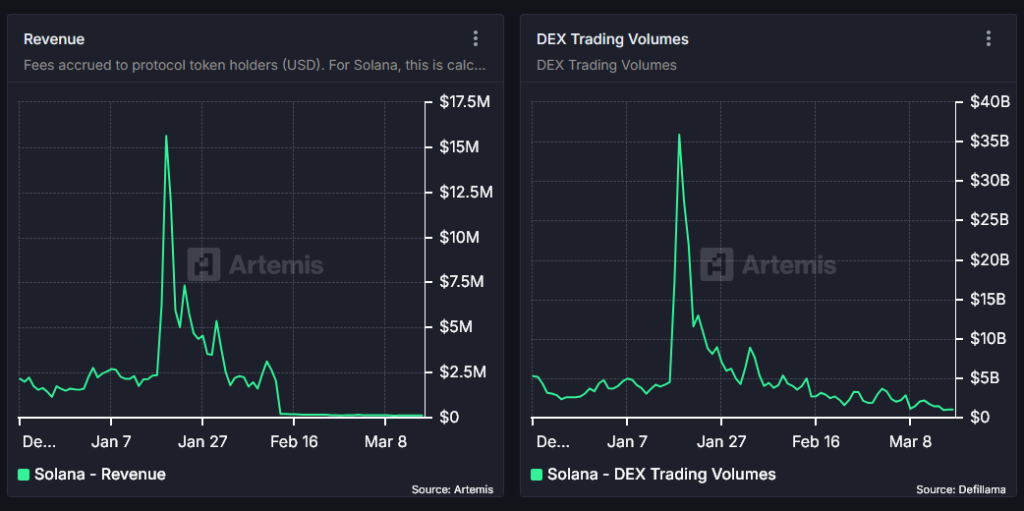

The latest statistics look grim. Solana network revenue has plunged by 93% since the January peak, with transaction fees down 83% in the past month alone. Decentralized exchange volumes fell from a daily peak of $35.9 billion on Jan. 21 to just $979.5 million on March 15, according to Artemis — the lowest figures recorded since October last year. Pump.fun’s daily volume is down by 70%.

Actively daily addresses have more than halved from 6.4 million in November to 2.8 million in March, according to Token Terminal.

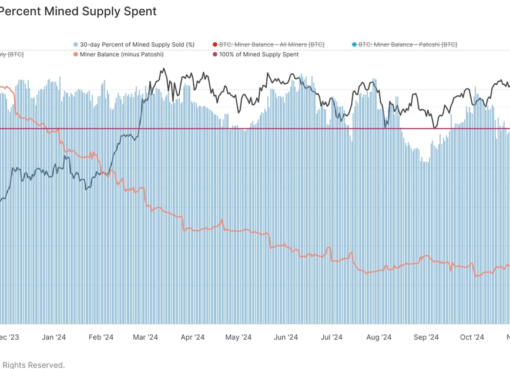

And following the failure of inflation-busting proposal SIM-228 last week, the network is still being subsidized to the tune of $228 million each month, while taking just $39.25M in fees in the past 30 days. Figures compiled by Helius last year suggest that more than half of all validators would be unprofitable without subsidies.

Adding to the gloom, 11.2 million Solana (SOL) was unlocked on March 1, hitting the price of SOL, which is now down 58% from the peak.

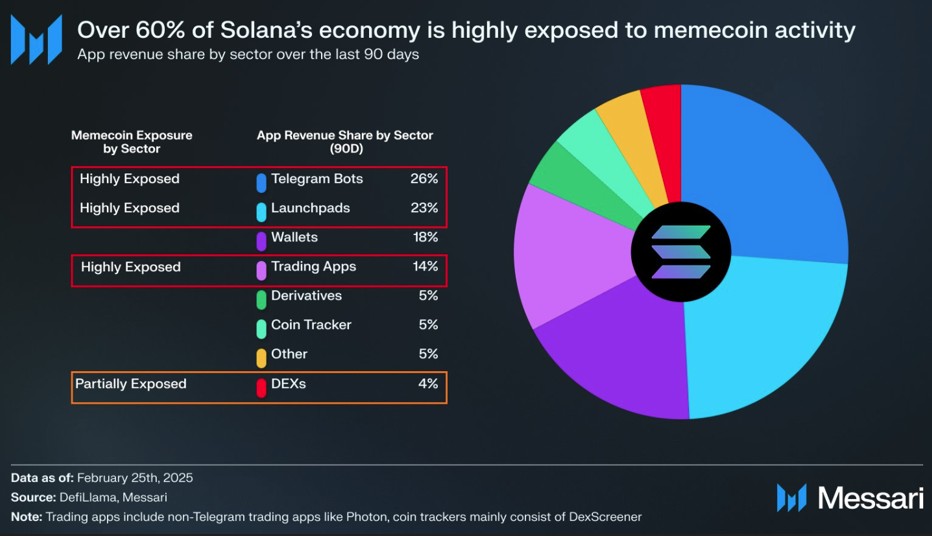

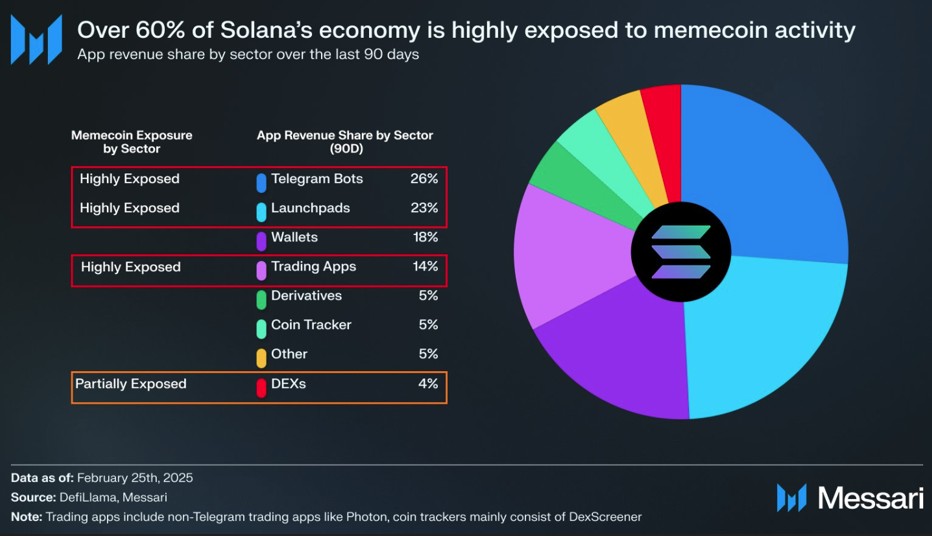

“Today, it’s not unfair to say Solana is a ‘memecoin economy,’” Messari analyst Sunny Shi said in a Feb. 26 thread highlighting the issue. “And that means a deep contraction in memecoin volumes could cause a cascade of revenue declines.”

We have passed ‘peak memecoin’ this cycle

Former Ethereum-maxi turnedSolana-memecoin enjoyer Kain Warwick from Infinex believes we probably have passed peak memecoin, at least for this stage of the cycle.

“I’m not ready to declare memecoins dead yet,” he says but adds: “They’re a lot deader than they used to be. So I am willing to say that the likelihood of us returning to an environment where 90% of the attention is on memecoins in the short term feels unlikely to me.”

Helius founder and Solana maximalist Mert Mumtaz also thinks we may have seen the zenith of memecoin popularity but points out the current lull is linked to macro conditions that have hammered risk assets more generally.

“Memecoin decline, in is somewhat temporary in that all risk ‘assets’ (I understand calling memecoins an asset is a stretch) are declining globally, but also BTC, ETH, SOL are all down massively,” he says.

“I think they will come back though I doubt it will be to the same extent. One key theme across all crypto cycles is that they’ve all had massive speculative elements (ICOs, NFTs, memes) — so it’d be a very strong claim to assume they never come back.”

Memecoins have played a huge part in Solana’s success to date, accounting for up to 70% of Solana DEX volumes in February. Memecoin-dependent Telegram bots, launchpads and trading apps generated approximately 60% of Solana’s $3.3 billion app revenue per year.

Interdependent revenue for memecoin trading apps

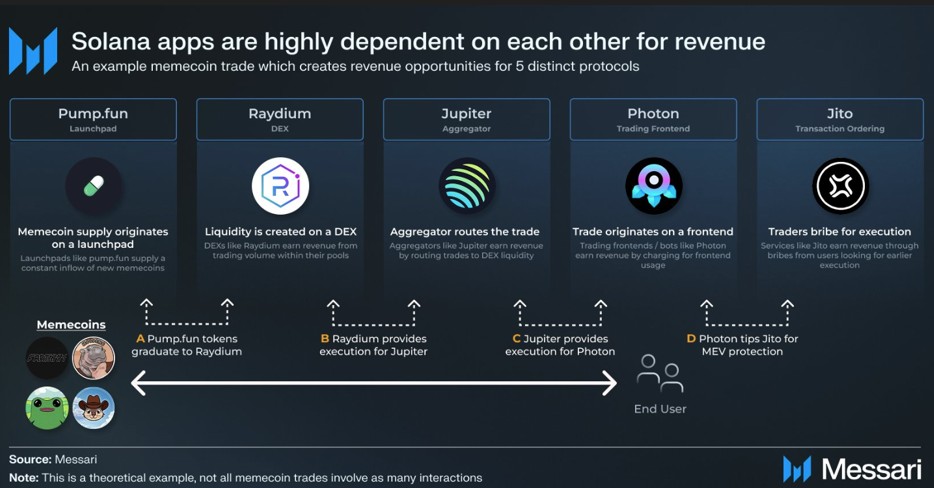

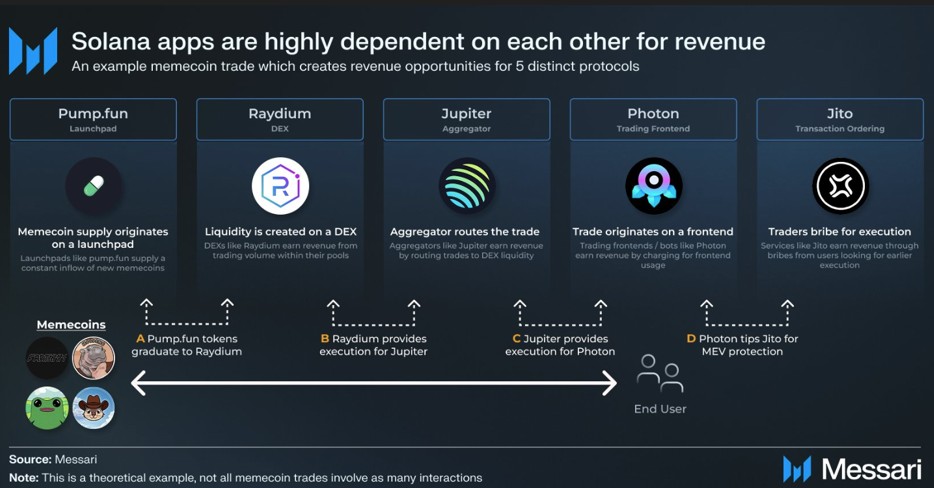

Amplifying the effects is the fact that a number of big memecoin trading apps rely on each other for revenue. A single memecoin trade can create revenue for five distinct apps, as Messari shows below.

Matthew Nay, a Messari research analyst who collates Solana’s quarterly report, explains that this inter-dependency is because Pump.fun takes the fees initially from a memecoin’s launch, but after a token graduates and launches on Raydium, the automated market maker then gets the fees.

But as many users prefer trading on Jupiter, that aggregator gets a cut of those fees, as does Raydium. Telegram bot BonkBot, meanwhile, takes its own trading fees while also providing fees for Jupiter and Raydium downstream, and the Photon trading bot sends fees down the river to everyone.

“One memecoin transaction on Photon definitely trickles down, and some of that revenue is also included to the Jitos, the Raydiums, the Jupiters,” Nay says.

Memecoins on Solana: From Bonk to $40 billion daily volume

Nay traces the beginnings of Solana’s memecoin frenzy to the 900% price increase in the Bonk memecoin in November 2023.

This, in turn, saw users scrambling to pay almost any price to get their hands on the unloved Solana Saga phone in December 2023, which came with a 30 million Bonk airdrop. Shortly after, Dogwifhat surged 5,000% and the memecoin casino was open for business in earnest.

Solana was a natural home for lower value speculation, thanks to its sub-cent to five-cent fees and high TPS compared to a few dollars to many dollars for Ethereum transactions.

“I think this would have happened anywhere, it just happened on the cheapest, fastest chain,” Nay says. “It was just so expensive to launch a token back on Ethereum mainnet back in those days and that’s why everyone kind of went over to Solana.”

“You can go launch a token on Pump.fun for pennies now. And so that’s why we’ve seen the memecoin explosion happen.”

The memecoin frenzy was spurred on by the fact you could launch a coin on Pump.fun with a funny name for $2 and watch its market cap soar to $74.9 million market cap like Fwog (FWOG) did.

Read also

By the final quarter of 2024, Jito’s fees had grown 12,405% compared to Q4 a year earlier, while Jupiter and Raydium’s fees surged by more than 2,000% each.

Almost 80,000 new tokens were being created per day by the end of January, and Solana’s DEX market share briefly overtook that of the entire Ethereum ecosystem.

Then the wheels fell off.

Memecoin downturn: Celebrity rug pulls and the Libra fiasco

Since January, memecoins have declined in popularity almost as fast as they grew, as users started to internalize the fact the deck really was stacked against them.

The chance of making $10,000 on Pump.fun (one in 243) is roughly as likely as giving birth to twins or being born with an extra finger.

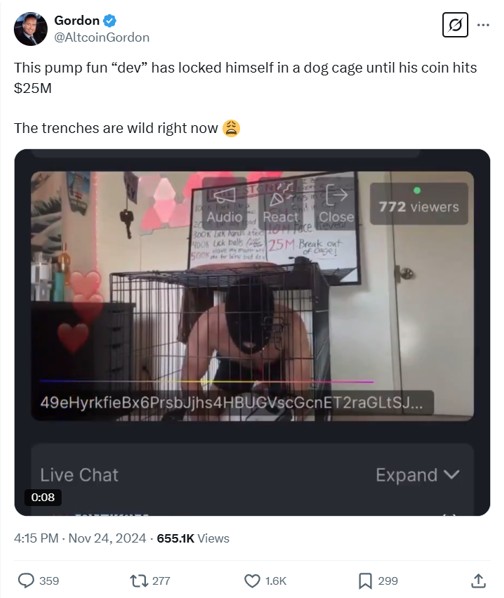

Sentiment first began to sour in November amid Pump.fun’s livestream scandal, where racial slurs, sexual abuse, threats of violence and self-harm were regular features in depraved stunts broadcast in a desperate attempt for attention to help pump tokens.

January’s launch of the pre-inauguration TRUMP memecoin, with 80% of the supply locked for insiders, was initially seen as bullish — after all, the incoming president had just launched a cryptocurrency! But the extractive launch of MELANIA to cash in on the hype two days later robbed TRUMP of liquidity and the mood darkened.

Ethereum co-founder Joe Lubin has seen similar cycles play out with ICOs, DeFi Summer and the NFT boom.

“Each innovation starts as a genuinely valuable new construct,” he tells Magazine. “Then weaker copycats follow. Then programmatic high-scale exploitation follows, which eventually causes damage and pain to the later comers.”

The final nail in the coffin was Argentine President Javier Milei’s ill-advised promotion of the Libra memecoin. Insiders made a small fortune from its explosion to $4.5 billion in value before the price crashed by 98%.

“I don’t think it was very different from a HawkTuah coin or a Trump coin launch,” says Nay. “But I think it was just like finally everyone decided that ‘OK, we as a market, we’re going to stop rewarding these bad actors.’”

“When memecoins started becoming very similar to the low float, high FDV (Fully Diluted Value), VC coins … this was kind of like the final straw. We became the thing we were trying to stop.”

Analysts from investment research firm Bernstein labeled the Libra launch a “fiasco” and predicted in late February that market liquidity will move away from “useless memecoins” and back to DeFi, gaming and NFTs.

It’s not completely dead, though.

Hopefuls are still churning out more than 21,000 new coins on Pump.fun each day, but only 187 are managing to graduate, with the average market cap of all coins graduating a paltry $37,316, according to Dune.

Solana is ‘100 times better’ thanks to memecoins

While memecoin activity might be on the wane, the huge volumes they brought to the chain have battle-hardened Solana’s infrastructure, says Warwick.

“One of the cool things about the memecoin speculation is it drove a huge investment in infrastructure on Solana,” says Warwick. “Solana as a chain is 100 times better than it was pre-memecoin.”

Nay says the Trump launch is a good example, as Solana was able to handle almost $40 billion in volume in a day without going down (despite some wobbles).

“That’s 10% of what the Nasdaq does in a 24-hour regular trading period. So you kind of see that the chain and the infrastructure benefited from the insane volume that these memecoins generated,” he says.

With the planned Firedancer upgrade (in development since 2022) due to bring even higher TPS, Nay says the network’s long-term goal is coming to fruition.

“That goal of creating a decentralized Nasdaq is in view, and that thesis and that narrative is a lot easier to explain now when we say, ‘yeah, we’ve handled $40 billion in volume and are a 10x away from what the Nasdaq does.”

Read also

He said Solana is also well placed to benefit from the regulatory changes coming out of the SEC and CFTC, and the new pro-crypto legislation that is wending its way through Congress and the Senate.

“The memecoin mania kind of pushed the infrastructure and made it stronger, and now there’s enough block space for real, relevant projects to come out of this,” he says.

“The regulation is looking to reward good actors that are providing value to the ecosystem.”

Future of Solana: DeFi, DePIN and gaming

On the topic of which sector could replace memecoin speculation on Solana, opinion is divided, but a few key themes emerge.

“It could be DePIN. It could be DeFi. It could be AI again. It could be any number of things. It’s very hard to pick that from the outside,” says Warwick.

But if you force Warwick to choose, the Synthetix founder cites the one closest to his heart.

“DeFi is just an obvious one. Like DeFi is the thing that’s going to break out and cross the chasm.”

Warwick adds that while memecoins were never going to go mainstream, something like Aave — a decentralized lending and borrowing protocol — could get wide adoption.

Mumtaz largely agrees.

“I think DeFi is going to be much bigger going forward with the network getting much more efficient, faster, and doubling blockspace,” Mumtaz says.

“I believe payments, DePIN, and SocialFi will also be strong going forward.”

That said, DeFi on Solana is currently hampered by the high inflation rate and would have been more attractive if inflation-busting proposal 228 had passed. Multicoin Capital’s Tushar Jain appeared on Unchained this week and explained that the yield from staking SOL “sets a high hurdle rate for people to participate in DeFi.”

He said that it’s not rational to make an investment that “returns you less than the risk-free rate … And in an ecosystem like Solana, the return to staking is the risk-free rate.”

Jain used the hypothetical example of an AMM offering liquidity providers a 5% return. There’s no incentive to take on that risk if users can get the same return risk-free by staking.

Ever wondered why rates on Solana DeFi are usually low? ⬇️ The ecosystem might be fighting an uphill battle… ⚔️

With staking rewards setting a high bar for returns, @TusharJain_ argues a lower inflation rate would’ve made DeFi more attractive on SOL. pic.twitter.com/dqPUOAlccA

— Laura Shin (@laurashin) March 17, 2025

Decentralized Physical Infrastructure on Solana

Nay predicts big things for DePIN on Solana and highlights the decentralized wireless project Helium, which he says is “a fantastic leader in that space,” along with the mapping project HiveMapper.

“Those are great projects that are being built onchain and are a great use case of crypto. I think we also see it with projects like Parcl, where I can go and speculate on the dollar value of one square foot in Atlanta, Georgia, my hometown, or rental prices in New York City where I am currently,” says Nay.

He says the project is a good example of financial inclusion, enabling individuals to “get exposure to real estate, even though I don’t have enough money to go buy an actual property.”

Another boost for the network could come when the 140,000 preorders of the new Solana Seeker phone are delivered mid-year, and he also believes gaming could really take off this cycle on Solana.

“We’re seeing innovation and the infrastructure behind gaming to make onchain games actually viable and make sense from a tokenomics value in driving revenue to these platforms. And so I think we could see those really exploding.”

And Nay also believes it’s possible that a new and improved version of memecoins could gain popularity, for example, a creator coin supporting a new Mr. Beast-style influencer, giving investors a share of their future YouTube earnings. So while we may have passed peak memecoin, he says, it’s not the end of the road.

“I can’t think of a single person more famous than President Trump launching a coin that, for one single token, will ever get that amount of hype and craziness around the launch,” he says.

“But from an aggregate approach, we might see a bigger aggregate if they take this next evolution, and not just be a random picture of an animal, and have some utility.”

Subscribe

The most engaging reads in blockchain. Delivered once a

week.

Andrew Fenton

Based in Melbourne, Andrew Fenton is a journalist and editor covering cryptocurrency and blockchain. He has worked as a national entertainment writer for News Corp Australia, on SA Weekend as a film journalist, and at The Melbourne Weekly.