Australia’s next federal election, set for mid-May, could be a key inflection point for institutional crypto participation, according to crypto exchange OKX Australia’s newly appointed CEO.

Speaking to Cointelegraph, OKX Australia CEO Kate Cooper said one of her hopes for the upcoming election is the introduction of the crypto legislation that’s already been designed and consulted on for the last two years.

In August 2022, the Australian government announced that it would initiate a series of consultations with industry players, investors and stakeholders to start drafting a regulatory framework for the cryptocurrency sector.

Source: Kate Cooper

“I think the industry as a whole has been crying out for clarity of regulation and also fit-for-purpose regulation,” she said.

There is already an inflow of retail users thanks to the current bull market, according to Cooper, but regulatory clarity will spur greater institutional adoption.

Before taking the helm at OKX on March 6, Cooper had stints at major Australian banks NAB, where she was executive of digital assets and head of innovation, and at Westpac as the head of innovation.

She was also the Australian CEO of the institutional crypto platform Zodia Custody.

“Certainly, when I was at NAB, the key barrier to really entering or moving beyond the proof-of-concept stage was regulatory clarity,” she said.

“I think for institutional adoption to take hold, we need regulatory clarity. I think for retail consumers, almost a third of Australians already hold some form of digital asset, mostly cryptocurrencies; they need protection.”

A change of government could be on the horizon for Australia, with a federal election set to be held on or before May 17.

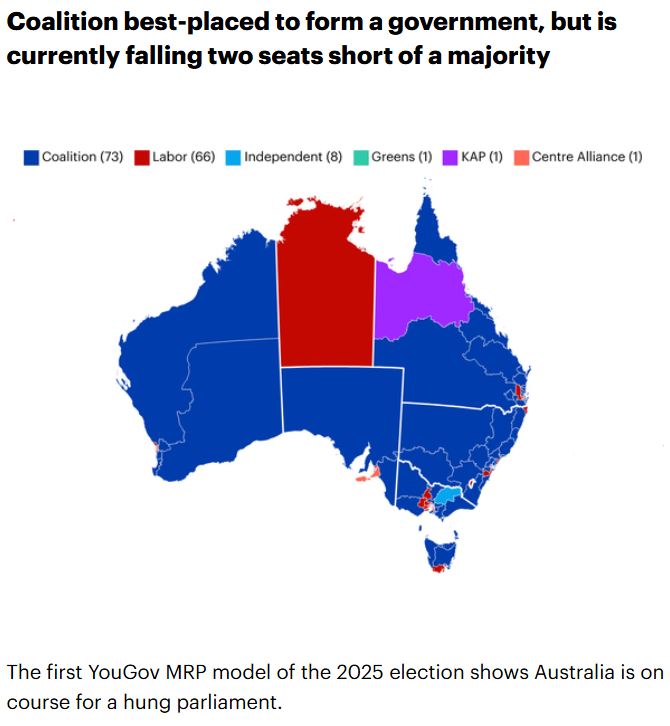

The two major contenders are the center-right coalition and the current government, the center-left Labor party. The latest YouGov poll shows the coalition holding a slight lead over the Labor government, leading 51% to 49%.

The latest YouGov data predicts the coalition holds a slight lead over the Labor government. Source: YouGov

Meanwhile, crypto investors could be an influential voting bloc, with a Feb. 19 YouGov survey of 2,031 Australian voters finding that 59% of current crypto investors are more likely to vote for a pro-crypto candidate.

If the victorious party were to implement legislation, Cooper predicts “a proliferation of activity with stablecoins” could follow.

“Globally, we saw 2024 as the year of the stablecoin, moving out of proofs-of-concept and into real-world applications,” she said.

“Assuming there’s clarity provided with a new regulatory framework, I know for a fact there are players in Australia who are poised to be able to jump on that opportunity.”

Related: Australian crypto investors ‘sitting on the sidelines’ for clearer laws: Swyftx CEO

Stablecoins saw massive adoption in 2024, with annual stablecoin transfer volume reaching $27.6 trillion, surpassing the combined volumes of Visa and Mastercard by 7.7%, according to a Jan. 31 report by crypto exchange CEX.io.

Cooper says the banking community, for one, is already engaging in crypto and digital assets more broadly as the first new asset class in 25 years.

“It’s been a long journey, but certainly, we’re seeing an increased maturity in banks adopting. I think we’re moving […] to tangible, real-world use cases,” she added.

Leading into the election, it’s understood Australia’s current ruling party has no plans to establish a crypto reserve, despite US President Donald Trump announcing the effort in the United States on March 2.

Cooper says the decision is understandable because “Australia has more of a conservative watch and see what other jurisdictions do” approach.

However, she thinks regardless of who wins the election, they need to address how Australia will position itself as a leader in the digital economy and create a strategy to capitalize on blockchain’s potential.

Magazine: Elon Musk’s plan to run government on blockchain faces uphill battle