Bitcoin (BTC) tapped $40,000 after the Dec. 8 Wall Street open as United States employment data shrunk market bets on interest rate cuts.

Bitcoin holds firm as jobs data unsettles U.S. dollar

Data from Cointelegraph Markets Pro and TradingView covered the latest BTC price action as risk assets reacted to the latest U.S. inflation cues.

Nonfarm payrolls came in above expectations at 199,000 versus 190,000, while unemployment was lower than forecast at 3.7% versus 3.9%, per an official release from the U.S. Bureau of Labor Statistics.

Both suggested that the full impact of Federal Reserve monetary tightening had yet to show itself, and while other data had already captured declining inflation, markets treated the labor figures nervously.

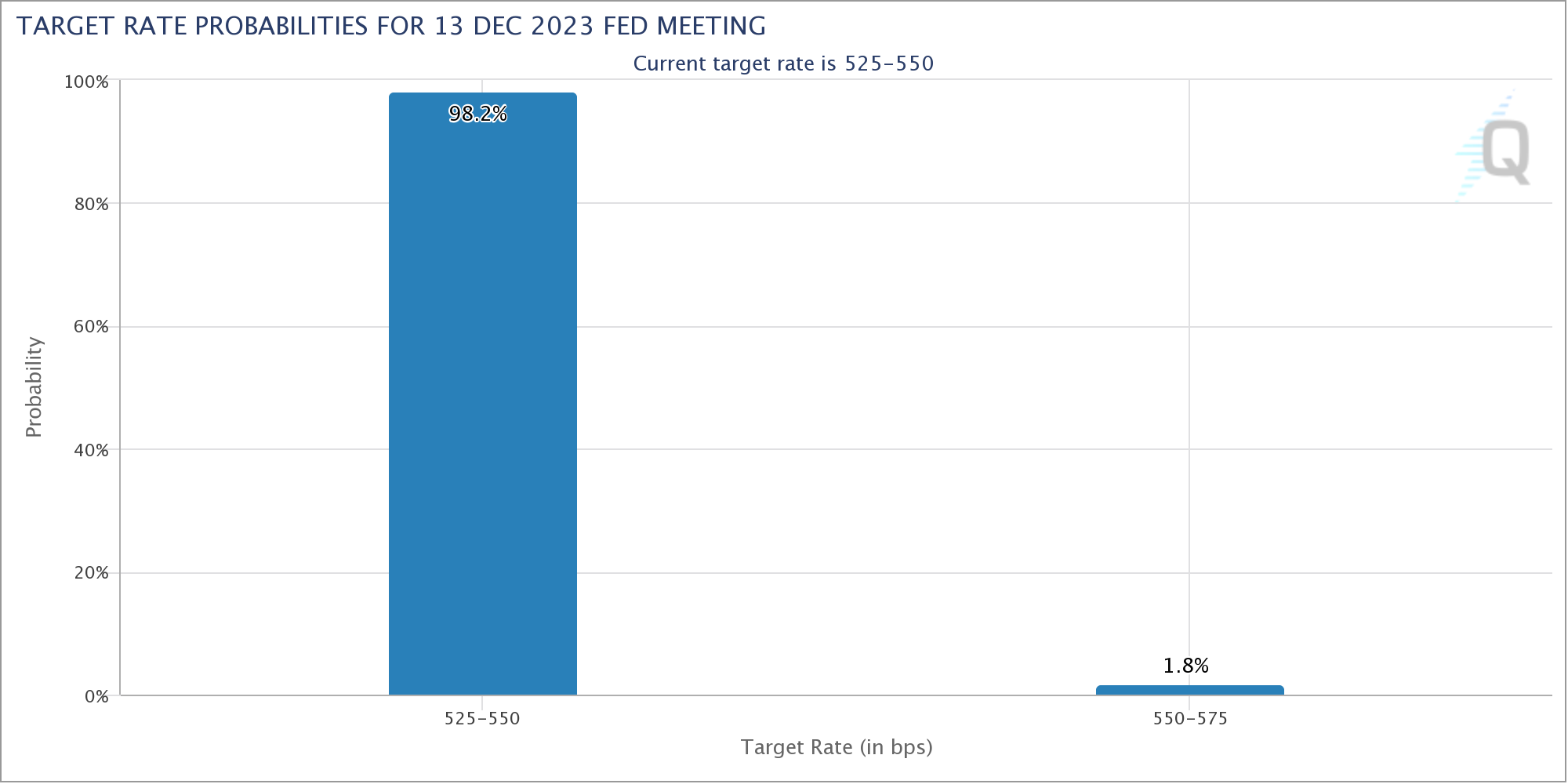

JUST IN: Interest rate futures shift from showing rate cuts beginning in March 2024 to May 2024 after jobs report.

Prior to the November jobs report, markets saw a 60% chance of rate cuts beginning in March 2024.

Odds of rate cuts beginning in January 2024 fell from 16% to 6%.… pic.twitter.com/hFYFLVP5xv

— The Kobeissi Letter (@KobeissiLetter) December 8, 2023

Data from CME Group’s FedWatch Tool nonetheless put the odds of anything other than a rate change freeze continuing at next week’s Fed meeting at practically zero.

The U.S. dollar index (DXY) saw particularly pronounced volatility around the data, briefly hitting its highest levels since Nov. 20 before erasing its gains to trade at 103.8 at the time of writing.

Liquidity crowds BTC price amid consolidation

While gold was down 0.8%, Bitcoin managed to avoid a straight comedown despite the decreased belief in lower interest rates coming sooner.

Related: ‘Early bull market’ — Bitcoin price preps 1st ever weekly golden cross

The largest cryptocurrency stayed locked in a multi-day trading range as traders looked for signs of trend continuation.

“Bitcoin still consolidating in an uptrend and holding strong after the recent move,” popular analyst Matthew Hyland wrote in part of analysis on X (formerly Twitter).

“Clear support around $43k now.”

Fellow trader and analyst Daan Crypto Trades meanwhile noted significant areas of liquidity directly around spot price.

#Bitcoin Liquidation Map

Has been building some thick clusters on both sides due to ranging in this same area for some time now.

Most notably: $42.9K & $43.8K

Keep an eye out for those levels. pic.twitter.com/Vz6eYVVwy5

— Daan Crypto Trades (@DaanCrypto) December 8, 2023

Ongoing attention focused on altcoins versus Bitcoin, with Ether (ETH) and Solana (SOL) taking the lead overnight amid renewed anticipation of a form of “alt season” returning.

“Bitcoin still consolidating around $43K, while Ethereum is taking more momentum,” Michaël van de Poppe, founder and CEO of MN Trading, told X subscribers.

“The bottom for ETH/BTC is close or maybe in. Coming two months are going to be electric for altcoins further.”

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.