Since Dec. 31, 2022, ethereum’s market dominance has increased by more than 3% among the thousands of crypto assets worldwide, valued at roughly $856 billion on Jan. 11, 2023. According to coinmarketcap.com, a popular coin market capitalization aggregation site, ethereum’s crypto market dominance jumped from 18.4% to its current 19% dominance rating.

Ethereum’s Market Share Grows Amid Frenzied Surge in the Cryptocurrency Markets

Ethereum (ETH), the second-leading crypto market asset by market capitalization, has seen an increase in its market dominance over the past 11 days. ETH has managed to gain against the U.S. dollar, climbing approximately 0.48% during the last day. Seven-day metrics show ethereum has risen 6.55% against the greenback.

For ethereum and all other crypto assets, market dominance is calculated by dividing the market capitalization of ETH by the total market capitalization of all cryptocurrencies combined. As of Dec. 31, 2022, coinmarketcap.com (CMC) metrics archived on archive.org indicate that ethereum (ETH) had a market dominance rating of around 18.4% and the overall crypto economy was valued at $796.91 billion.

Data from Jan. 11, 2023, indicates ETH’s dominance is now at 19% among the 22,261 crypto assets listed on CMC, which are valued at roughly $856 billion. According to coingecko.com (CG), on Dec. 31, 2022, ETH’s dominance was around 17.4% and the overall crypto economy was worth $828 billion. It is important to note that CG’s metrics are different than CMC’s, currently, CG shows ethereum’s dominance is at 18%. CMC shows ethereum’s (ETH) dominance rating has increased by 3.26%, and according to CG, the increase was by 3.44%.

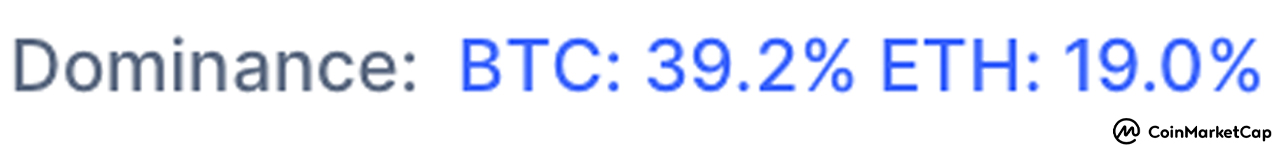

Both coin market cap aggregation websites show that bitcoin (BTC) dominance has decreased. CMC metrics indicate BTC’s dominance dipped from 40% to 39.2% over the past 11 days. While CG statistics show BTC’s dominance rating on that website was 38.5% and it is now at 37.6% on Jan. 11, 2023. Ethereum’s market dominance has seen a steady increase in recent days as both crypto market aggregation websites show this is the case. The trend of decreasing dominance of bitcoin is also consistent in the data provided by both websites.

What are your thoughts on ethereum’s increasing market dominance in the crypto industry over the last 11 days? How do you see this trend evolving in the future? Let us know in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Cryptox.trade does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.