Coinspeaker

Litecoin Faces Mounting Pressure as Market Value Declines

Litecoin (LTC) has been facing a tough time recently, with its market value dropping by 36% since its peak on April 1.

This steady decline has caused worry among traders and investors, prompting some to question the long-term viability of the cryptocurrency.

“Shrimp Holder” Sell-Off Signals Waning Confidence

One of the most alarming developments for Litecoin in recent months has been the significant selloff by “shrimp holders,” a term used to describe smaller investors, in this case, those holding less than 1 LTC. According to data from Santiment, a leading on-chain analytics platform, these small-scale investors have liquidated over 45,200 LTC in recent weeks.

⚡️ Litecoin has not been lighting social forums on fire with its market value dropping -36% since its April 1st peak. A sudden liquidation of 45.2K net 0.1-1 LTC wallets indicate that small traders are finally capitulating out of the OG crypto asset. Small fish impatiently… pic.twitter.com/qiZ9B72eG6

— Santiment (@santimentfeed) August 27, 2024

This wave of selling is a stark indicator of the growing anxiety among retail investors. Typically, shrimp holders represent the broader retail market, and their actions can be seen as an indicator of general investor sentiment. The mass exodus from these smaller wallets suggests that confidence in Litecoin’s future is waning.

Panic selling, as witnessed here, often occurs when investors fear further losses and decide to cut their losses before the situation worsens. While some market analysts consider large-scale selloffs to be potential indicators that a market is nearing its bottom, the current technical indicators for Litecoin do not support this optimistic view.

Declining Technical Indicators

Currently trading around $63, Litecoin is significantly below its key moving averages, which have now become resistance levels. For the cryptocurrency to see any potential for a positive reversal, it would need to move back up to around $70, as the 200-day moving average is still much higher than its current price.

The Relative Strength Index (RSI), a momentum indicator, is at 44, suggesting that Litecoin is neither oversold nor attracting substantial buying interest. Additionally, low trading volumes underscore a lack of new investors coming into the market.

Institutional Interest Remains

Despite the bearish market conditions, some institutional investors continue to show interest in Litecoin. Grayscale, a significant player in cryptocurrency investments, has increased its Litecoin holdings over the past month, with its current holdings being the highest amount they have ever held. This suggests that some institutional investors still see potential value in Litecoin, even as smaller investors are exiting.

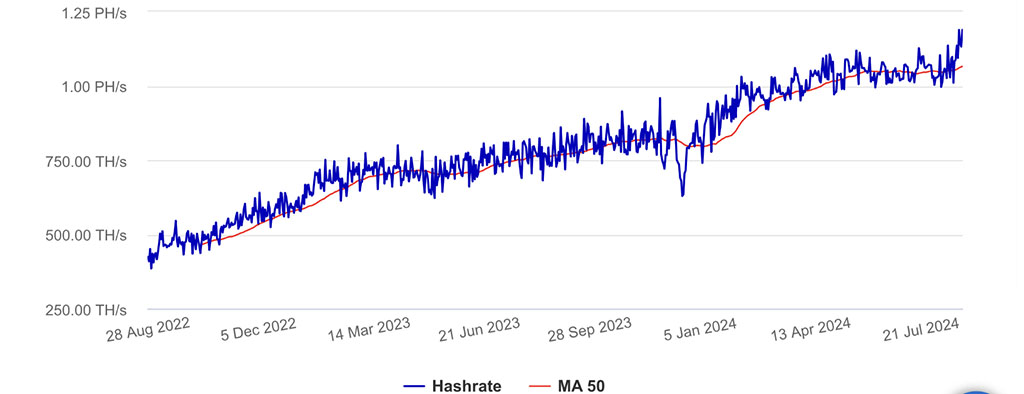

In addition, Litecoin’s network strength has been growing, with its hashrate reaching a new all-time high of 1.29 PH/s. This increase indicates ongoing commitment from miners, which could provide some foundational support for Litecoin’s long-term prospects.

Credit: PoolBay

While these developments might attract renewed interest from some investors, the outlook for Litecoin remains uncertain. Broader economic concerns and market sentiment will likely play a significant role in determining whether Litecoin can recover or continue its downward trend. For now, Litecoin is in a challenging position, needing a strong catalyst to regain investor confidence and improve its market performance.