According to current statistics, the Bitcoin network is fewer than 56,000 blocks away and less than 400 days away from the next reward halving. After the next halving, the block reward will be reduced by 50%, and the current block subsidy of 6.25 bitcoins will drop to 3.125 bitcoins per block post-halving. In addition to the Bitcoin halving getting closer, the Litecoin network is expected to see a block reward halving this year on or around August 3rd.

Bitcoin Reward Halving Inches Closer; Litecoin Expected to Slash Its Block Reward in August

As of March 29, 2023, there are 395 days left until the next Bitcoin halving, which is scheduled to occur anywhere between April 21-28, 2024, at a block interval speed of ten minutes per block. At present, there are fewer than 56,000 blocks left to mine until the block reward subsidy is cut in half. Depending on block time speeds, the estimated date for April could change.

The Bitcoin network halves its block reward every 210,000 blocks mined, and if blocks are mined at an average rate of around ten minutes, every halving takes place roughly every four years. The first halving took place on Nov. 28, 2012, at block height 210,000. The next reward halving occurred on July 9, 2016, and another took place on May 11, 2020. After the April 2024 halving, the fifth halving is expected to occur in 2028.

Using today’s BTC exchange rates, the current reward of 6.25 BTC, not counting network fees, is just over $177,000 per block. If the price of BTC remains the same when the reward halves to 3.125 bitcoins, the block reward would be valued at $88,500 per block. Of course, bitcoin miners and network participants expect BTC’s price to increase by the time the next halving occurs.

Regardless of BTC’s price at the time, miners’ revenues will be cut in half, and they will have to adjust accordingly. Bitcoin’s inflation rate per annum is currently 1.71%, and after the next halving event, it will drop to 0.84%. Over the last 2,016 blocks mined, metrics show the network’s average hashrate was around 338.3 exahash per second (EH/s), and just recently, the hashrate reached 400 EH/s.

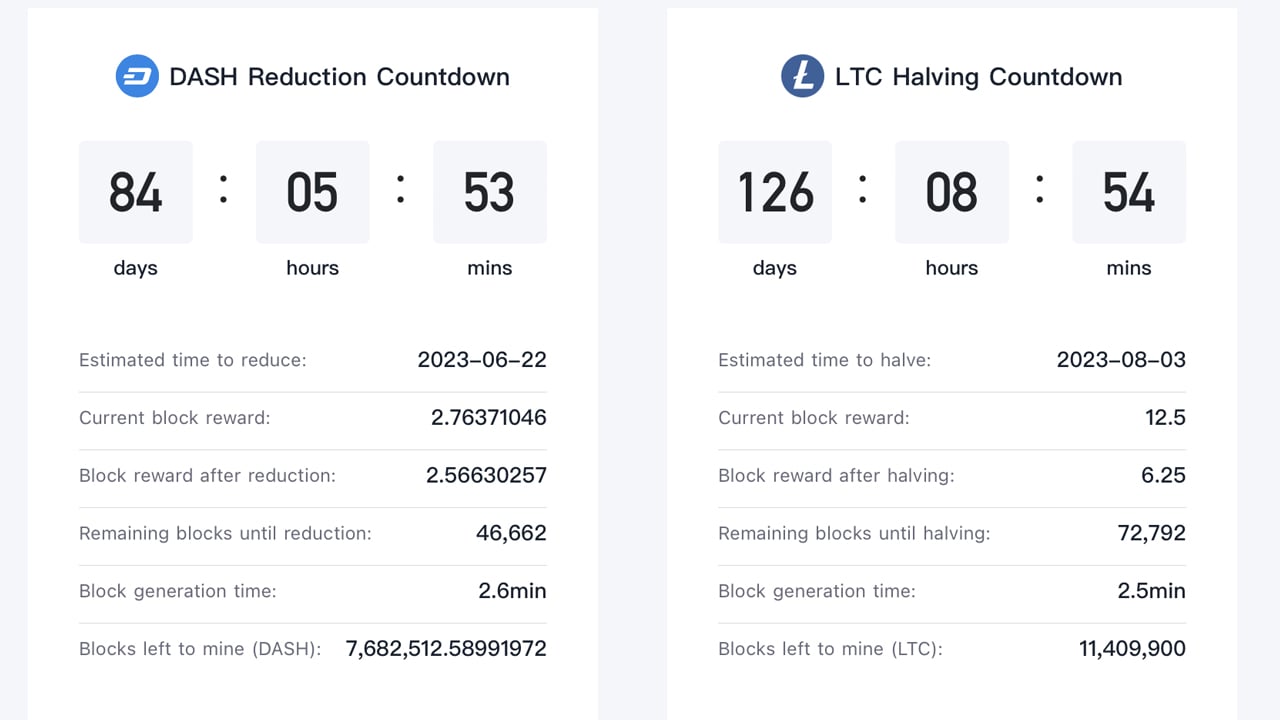

While Bitcoin’s halving is expected to happen in less than 400 days, Litecoin’s reward halving is estimated to occur this year. According to current LTC block times, the Litecoin network will halve on Aug. 3, 2023. Litecoin rewards will be reduced from 12.5 LTC to 6.25 LTC, and there are roughly 11.4 million LTC blocks left to mine. Although it’s not quite a halving, the Dash network is expected to see a reward reduction in 84 days, according to current statistics. After the reduction, the reward will shrink from 2.763 DASH to 2.566 DASH.

What do you think about the Bitcoin blockchain’s upcoming halving? Let us know what you think about this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.