Movement among Bitcoin whales, with just eight days until the U.S. presidential election, has significantly declined.

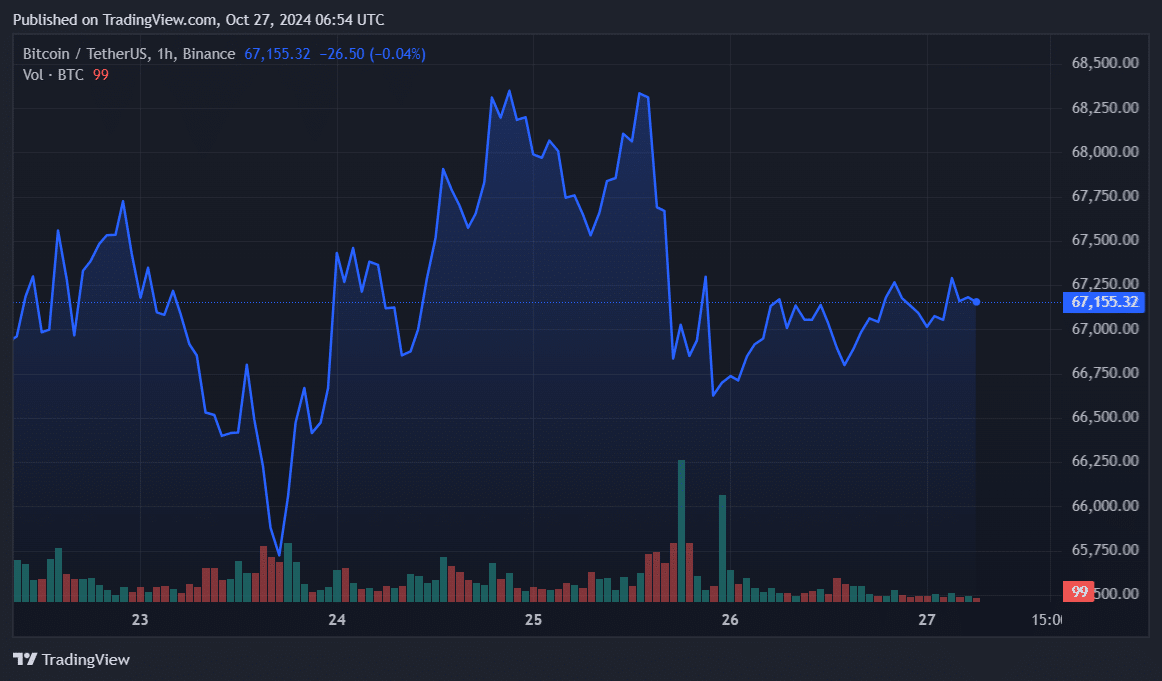

The asset’s price has consolidated around $67,000.

According to data provided by IntoTheBlock, the Bitcoin (BTC) large-holder net inflows plunged from around 38,800 BTC on Oct. 20 to 258 BTC on Oct. 26. This could indicate that whales are nervous as Election Day in the U.S., Nov. 5., approaches.

Notably, whales saw a net outflow of 4,750 BTC and 533 BTC on Oct. 21 and 22, respectively. Consequently, the selloff briefly sent the Bitcoin price below the $66,000 mark on Oct. 23.

Liquidations cool down

Moreover, the crypto liquidations plunged by 85% over the past day and the total amount is hovering around $59 million, according to Coinglass. Due to the market-wide cooldown, the distance between longs, $28.7 million, and shorts, $30.5 million, is very close.

Bitcoin saw $5.6 million in liquidations—$2.2 million longs and $3.4 million shorts.

Bitcoin has been consolidating close to the $67,000 mark over the past week with a total market cap of $1.33 trillion. Its daily trading volume decreased by 63% in the past 24 hours, currently sitting at $15.5 billion.

The decline in Bitcoin liquidations, trading volume and whale activity hints at uncertainty among investors.

ETFs remain strong

It’s important to note that the market still hasn’t entered a panic zone. After all, the U.S.-based spot BTC exchange-traded funds continue their inflows.

According to a crypto.news report, these investment products recorded a net inflow of over $3 billion this month alone. On Friday, spot BTC ETFs saw a net inflow of $402 million, led by BlackRock’s iShares Bitcoin Trust ETF—with an inflow of $292 million.

The total net inflow of these ETFs surpassed the $22 billion mark despite Grayscale’s $20 billion net outflows.

Bitcoin whales and 2024 elections

Bitcoin whale activity in 2024, amidst the global “super election year,” has shown heightened significance as large holders monitor and react to global political developments.

Elections in countries like the U.S., India, Mexico, Indonesia, and Taiwan have amplified market uncertainty, which tends to drive significant moves in cryptocurrency markets, especially by whales.

With elections across multiple major economies, leading to increased market volatility. Bitcoin — as a decentralized asset — is seen by some whales as a hedge against fiat currency risks tied to election outcomes, fiscal policies, and political instability.

Some whales might try to capitalize on expected post-election market turbulence. In countries with contentious elections, such as in the U.S., whales could position themselves for a potential flight to crypto-assets, especially if there’s fear of currency devaluation or restrictive capital controls.

Trump vs. Harris

In the U.S., the upcoming presidential election between Vice President Kamala Harris and Ex-President Donald Trump could lead to new or altered regulatory stances on crypto,

Any signs of regulatory tightening could lead whales to shift Bitcoin holdings to more favorable jurisdictions or sell off portions of their holdings in anticipation of market downturns.

Harris vowed to cut “needless bureaucracy and unnecessary regulatory red tape” regarding cryptocurrencies if elected. Trump, meanwhile, has been courting crypto billionaires, cashing in on non-fungible tokens, touting plans for a “Bitcoin and Crypto Advisory Council” and launching his own token.

Whale Sell-Offs and FOMO: As with any major political event, some whales might take a contrarian approach, offloading Bitcoin to secure gains ahead of potential election-induced volatility. This can create waves of FOMO (fear of missing out) buying from smaller investors who follow whale wallets.

Overall, Bitcoin whales in 2024 are likely operating with increased caution and strategic foresight, given the supercharged election cycle and its impact on global financial markets.