The crypto industry is known for its dramatic price action, euphoria and bubbles. In the latest sustained fad since the 2017 initial coin offering, or the ICO boom, the decentralized finance niche of the industry now captivates the attention of many participants. One particular asset within this niche, YFI, has pumped to amazing price heights, totaling at least 4,400% gains inside a two-month span. Is this price action warranted, and does the token have actual value?

“YFI’s value lies in its design as a governance token, allowing the community to vote and decide on the direction of the Yearn Finance project,” Jason Lau, the chief operating officer of the OKCoin crypto exchange, told Cryptox. “As activity within the project and vaults grow, YFI holders can change strategies, launch new vaults, and potentially even redirect treasury or fees to themselves at a later date.”

“While YFI currently does not offer any returns, there are proposals in the works that could see YFI holders that stake their YFI for governance, [they] would get a portion of the performance fees — and potentially even redirect treasury or fees to themselves at a later date,” Lau added, pointing to a relevant blog post.

Although crypto exchanges see value in YFI, their appraisals of the token may be biased because of the profits they gather by hosting trading for a popular asset. Binance, OKCoin and numerous other exchanges provide YFI trading on their respective exchanges.

Setting the scene

YFI is the token associated with the DeFi yield aggregation platform Yearn.finance. Essentially, the project stands as another opportunity for DeFi participants to shift their money around by borrowing and loaning assets for collateral and earning interest on holdings while also trading various pumping assets.

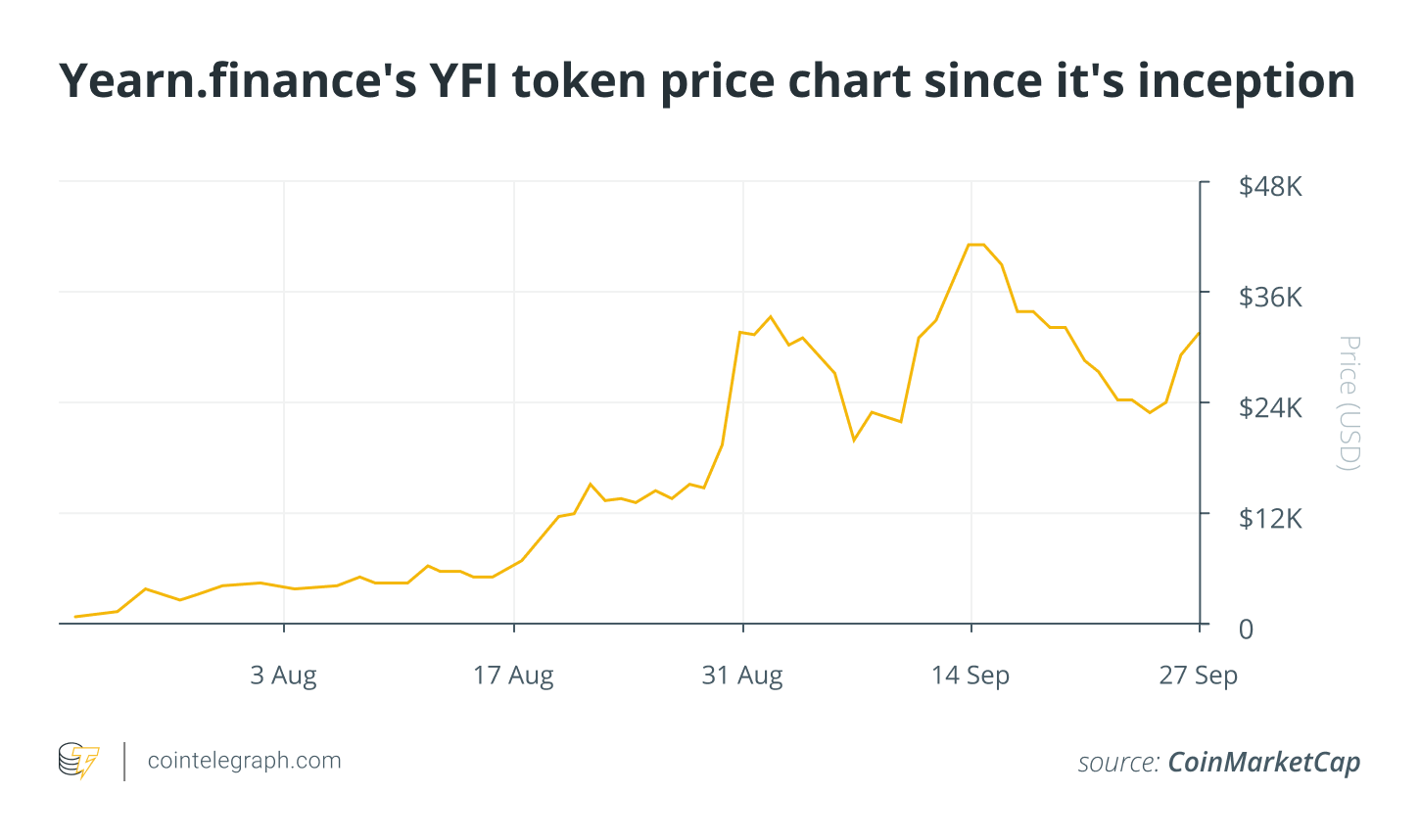

Between late July and the first half of September 2020, YFI ballooned from $850 to $43,000, according to CoinMarketCap, tapping a $1-billion market cap at one point in its price journey. It currently ranks 24th on CoinMarketCap’s list of the world’s largest assets at press time. The asset also holds a very small supply — just 30,000 tokens — which serves as a factor contributing to the speed of the price rally.

Although the token has rocketed in price, Andre Cronje, the person responsible for building Yearn.finance, said YFI holds no real value, according to his comments in July. Cryptox reached out to Cronje for updated comments, but he did not respond as of press time.

“This statement probably has to be understood in its context,” a representative from Binance Research, the analysis and data wing of the Binance crypto exchange, told Cryptox. “Andre was publicly criticized for having too much control over ‘custodied’ tokens and launched this governance token as an immediate reaction,” the representative added.

“As such, Andre said that he mentioned in a blog post the intent for YFI to be worthless, but later clarified that he simply didn’t expect that governance rights alone would be valued accordingly,” the representative noted, pointing to a Medium post from Cronje published upon the launch of the token.

Understanding Cronje

Following his comments on YFI as worthless, Cronje told Cryptox that he is quitting DeFi due to a hostile community in March and then in August, Decrypt published an article in which Cronje described himself as “tired, broke and close to quitting DeFi.” This marked two instances where Cronje hinted at leaving the crypto space, blaming the same factors for his frustration, he described the social vibe in the DeFi niche as “toxic.”

One report alleged that Cronje holds access to millions of dollars associated with Yearn.finance. The article included a number of other details on the developer, his responses to critics and his frustrations with the DeFi sector. Additionally, the community reportedly controls the supply of YFI, as the project’s founder has seemingly transferred all the tokens to users through three liquidity pools.

Cronje seemingly simply wanted to give the industry a sound, community-controlled project, birthing the token to give the industry participants governance over the project while aiming for the asset to hold no price value. In return, however, he still received significant backlash.

Exchanges seeing value in YFI

When asked about YFI’s value, Binance listed a pair of use cases for the token. “Firstly, it is a governance token and can thus be used to vote on proposed changes to the YFI ecosystem,” the Binance Research representative said. “Secondly, YFI allows for a pro rata distribution of protocol earnings that are created by fees.”

Based on the mentioned roles of the token, YFI has worth because “the governance aspect tentatively enables high-value protocol users to align incentives,” the Binance representative said, noting a link to stablecoins and their importance in DeFi. Additionally, “the aspect of shared protocol earnings informs the expected earnings,” the representative added.

Related: DeFi app overview: How to navigate crypto’s new finance wave

“Yearn Finance’s secret sauce is its yVaults — which attempt to maximize the yield one can make by routing capital through different DeFi mechanisms and protocols,” Lau said. Regarding YFI’s value, he believes that “the premise is to pool user capital, thus reducing the often-expensive cost of transacting on Ethereum — which are near ATH rates.” Furthermore, he added:

“Due to the current high returns of up to 100% APY, Vaults have become Yearn.finance’s most popular product line by far, especially as traditional investments continue to offer little to no yield. yETH (its Ethereum vault) recent launch has had strong activity ahead of ETH 2.0’s PoS launch and allowing ETH holders to earn some return. Until the ETH 2.0 PoS launch, ETH is an unproductive asset in yield terms, while other yVaults are providing strong returns.”

Additionally, Lau said that Yearn.finance’s recently unveiled insurance endeavor, yInsure, has potential. Still, the DeFi niche as a whole remains in its infancy, hosting upside potential, he added, expressing Yearn.finance as an up-and-comer.

Further explanation on YFI’s price

As to why YFI’s price has risen to such heights, the representative from Binance Research pointed at a pair of mentioned use cases, while additionally noting speculation as a big cause.

Amid the ballooning DeFi sector, Yearn.finance and its surrounding elements and participants have also expanded, cementing an integral position in the overall niche, the representative posited. “As such, a bet on a growing value of YFI is in many ways also a simple bet on a growing DeFi ecosystem,” the representative said, adding:

“Instead of explaining the speculation with a bullish sentiment on DeFi, it is also possible to drill down and focus on the aspect of liquidity mining. YFI was distributed to liquidity providers who deposited in Yearn.finance smart contracts. Since high TVL (total value locked) typically attracts more liquidity miners, there is some sort of (positive) feedback loop between TVL and the price of staked YFI tokens.”

YFI is just one aspect of the growing DeFi bubble. The crypto space exudes mixed feelings on the sector as a whole, which is a normal response to new innovation. The future will tell whether the niche eventually dies or becomes the next big technological advancement.

Related: Caught in two minds: DeFi meme coins spark debate over their intentions