During the first couple of months of 2019, the price of Bitcoin (BTC) stayed put under the $4,000 mark, thereby solidifying fears that the market was indeed in the midst of a long crypto winter. Not only that, but all through 2018, this space witnessed the simultaneous collapse of around 2,000 cryptocurrencies — which lost around 80% of their combined market cap.

Additionally, it can be seen that over the course of 2018, the general perception of the crypto sector was greatly tarnished thanks to a number of scams and illegal actions that caused investors to lose a whole lot of money (estimated to be worth millions of dollars). As a result, high-profile personalities such as Nouriel Roubini, a Nobel Prize-winning economist, went on record to claim that BTC was the mother of all financial bubbles, thereby causing market panic to spread globally at quite a rapid pace.

Additionally, Ernst & Young also released a market study in early 2018 that showed cybercriminals were able to steal around $1.5 million per month in initial coin offering proceeds, totalling around $400 million of the funds raised.

As a result of these shady developments, a whole host of legitimate projects went underground, waiting for the unwanted noise to settle down — thus causing the crypto market to suffer a great deal. To put things into perspective, Forbes’ “Fintech 50 — 2019,” a list comprising of the world’s most promising tech companies, featured only six blockchain projects. In comparison, 11 crypto companies were included in the 2018 list.

A closer look at the matter

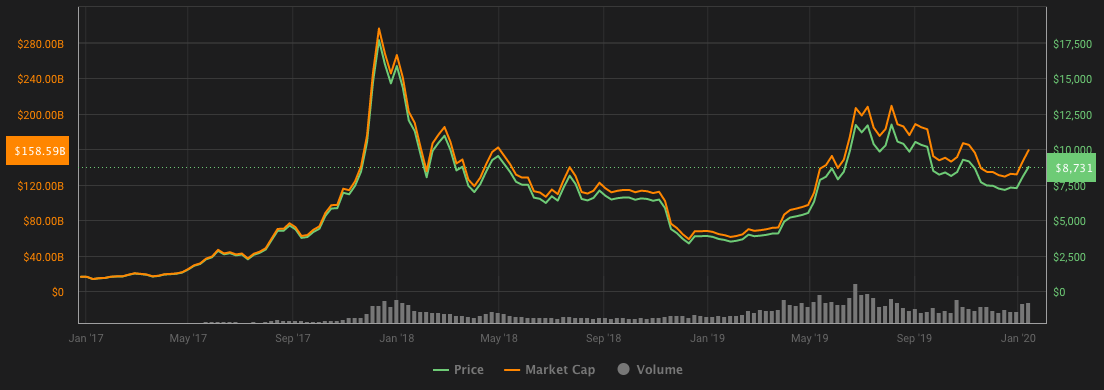

The bull run of 2017 really expanded the global reach of the crypto market, with many novice investors becoming aware of Bitcoin and its potential around that time. However, after the flagship crypto asset hit its all-time high value of nearly $20,000, most analysts and experts started to realize that this positive momentum could not be sustained for much longer and that the market would invariably move to a more bearish mode of operation.

Indeed, such was the case after the first few months of 2018, when BTC’s value tumbled down to $3,300. It was also around this price range that a number of experts thought Bitcoin had found its bottom. Whenever an asset finds its bottom, its overall volatility generally tends to decline. The same was observed for BTC — so much so that during the first half of January 2019, the currency’s native volatility dropped to extremely low levels.

BTC volatility chart, 2017–2020

Source: Coin360

Another important indicator that seems to suggest that Bitcoin bottomed out between December 2018 and January 2019 is its hash ribbon quotient. In its most basic sense, a hash ribbon can be thought of as a computational tool that combines the hash rate and mining difficulty of Bitcoin in order to identify certain time periods when buying the digital currency is at its most lucrative. In this regard, when the hash ribbon marker sends out a buy signal it often indicates that a local bottom has been formed — which is exactly what happened with BTC at the start of 2019.

“The smart ones bought Bitcoin between $3K and $4K,” Jeroen Van Lange told CryptoX. The independent analyst believes the run from $3,000 to $13,000 had a lot to do with market psychology and in particular the fear of missing out:

“This was the ground layer for people who were already invested in 2017 but lost money in the bear market, however, they still had a big belief in Bitcoin.”

Van Lange also outlined other reasons he believes helped push the price of Bitcoin in an upward direction:

- The currency finding support on its 200-week moving average.

- BTC’s volatility touching extremely low levels at the start of 2019.

- The asset dropping by almost 85% from its all-time high value.

Additionally, in relation to the matter, Craig Russo, owner of Peer, a Boston-based startup behind the popular media outlet SludgeFeed, told CryptoX that he believes several factors combined to fuel the rise of Bitcoin’s price during the first half of 2019, including “the supply/demand dynamics of the upcoming block reward halving and renewed belief in the inherent value of BTC as a result of major financial institutions and companies entering the space.” Russo also believes that the BTC price has predictably reacted to the market situation:

“It also stands to reason that Bitcoin was recovering from significantly oversold conditions that fueled a short squeeze at a few key levels between $3K and $10K. However, after topping out at around $14K, it has become apparent that BTC is now stuck in a larger range.”

Other key factors that helped thaw the crypto winter of 2018–19

Chinese backing

On Oct. 25, 2019, when the price of BTC lay at around $7,500, Chinese President Xi Jinping announced that he will be accelerating his country’s efforts to adopt blockchain in order to promote novel technological innovation across a host of China’s local industries. This was seen as a massive endorsement for the industry as a whole because by Oct. 27, the price of a single Bitcoin surged to just under the $10,000 mark.

If that wasn’t enough, it also came to light last year that China is looking to release its very own central bank digital currency sometime during 2020. Termed the “digital yuan,” the currency will essentially serve as tokenized form of money and will be backed by China’s central banking authority — the People’s Bank of China.

Frank Fu, managing director of Fenbushi Capital, however, believes that the value of BTC has indeed increased because of the announcement, telling CryptoX that it was “purely due to general public‘s speculation.”

Related: Chinese National Cryptocurrency Turns Out Not Being an Actual Crypto

Increased mainstream adoption

Over the last 12 months or so, a number of established financial entities, such as JPMorgan Chase and Wells Fargo, announced that they were either working to create their very own crypto tokens or making use of blockchain tech to streamline their internal work processes. These mainstream endorsements helped increase confidence among investors operating within this relatively nascent market space.

Bitcoin halving anticipation

Another reason why the market turned bullish is the possible spread of FOMO that permeated this space thanks to the Bitcoin halving event that is scheduled to take place on May 12, 2020.

Related: Bitcoin Halving, Explained

Following this latest halving event, BTC’s native block reward quotient will reduce from 12.5 to 6.25 BTC. Accordingly, this will result in the number of Bitcoin that can be sourced per block becoming more scarce.

Cyclical market movement

The digital currency market goes through periodic cycles of monetary ups and downs. For example, after surging through all of 2014, the value of Bitcoin dropped quite considerably the following year. A similar trend was observed in 2017 and 2018.

To gain a better understanding of this dynamic ebb-and-flow trend, CryptoX reached out to Jeffery Liu Xun, CEO of XanPool, a peer-to-peer fiat gateway that is instant and does not require customers to take any custody risks. “It was about time — Bitcoin is an asset designed to go up,” he said, going on:

“Now, as with all markets, people go through greedy phases, fearful phases, and after the greedy phase of 2017, it’s only natural that Bitcoin experienced a bearish fearful phase for a duration. Mind you that Bitcoin has always reached new all-time highs if you’re looking at a time frame of three years.”

Libra announcement

Earlier in 2019, Mark Zuckerberg presented to the world his vision of a mainstream cryptocurrency that would allow users of social media platform Facebook to facilitate their local/international payments with the touch of a button.

While Libra may not have been able to garner the mainstream support that Zuckerberg and his team might have initially expected, it did help legitimize and educate people about the immense potential of this novel asset class.

Launch of Bakkt

September 2019 saw the launch of Intercontinental Exchange’s long-awaited digital asset platform, Bakkt. The platform was extremely hyped before its launch because it finally gave institutional players a road to enter this burgeoning domain in the easiest, most hassle-free manner possible.

The platform’s daily Bitcoin futures volume hit its all-time high during November 2019, thereby pointing toward an increasing amount of consumer interest in this market space. At the start of 2020, FTX and CME also joined the market, which should continue to drive up demand.

The end?

While the crypto sector made a respectable recovery in 2019 — with the price of a single Bitcoin scaling up to the $13,000 mark once during June and then again in July — all through November and December, the market continued to showcase bearish signals that forced the price of the premier cryptocurrency to recede and hover around the $7,500 region.

This was possibly due to the fact that during the first half of November, the founders and creators of the PLUS token Ponzi scheme were taken into custody by Chinese law enforcement agencies for scamming investors to the tune of $3 billion worth of Bitcoin.

PLUS token was one of the largest cryptocurrency-related Ponzi schemes ever uncovered, with the project promising to provide its investors with ridiculous monthly returns ranging between 9% and 18%. It is believed that after the unearthing of this scam, a lot of investors started to cash out their holdings in order to minimize their losses (via a shot of different Chinese exchanges such as Huobi and OKEx), thereby forcing Bitcoin’s value to drop and stay put around the $7,500 price point.

With that being said, since the turn of the new year, things have looked much better for the market as a whole, with Bitcoin gradually gaining value and sitting at a respectable price point between $8,600 and $8,800 over the past few days.