Key takeaways:

-

Bitcoin’s STH cost basis, MVRV data, and other technical indicators suggest that BTC price is on track toward $117,000.

-

Analysts suggest a breakout above $109,000-$110,000 could push BTC to fresh all-time highs.

Bitcoin (BTC) has been trading in a “well-defined” range over the past six months as traders anticipate a potential breakout.

Onchain indicators, including the short-term holder (STH) cost basis, point to a potential upward breakout toward $117,000 or higher.

Bitcoin price eyes $117,000 next

Since January, Bitcoin’s price has generally traded in a large range stretching from $78,000 to $110,000, per data from Cointelegraph Markets Pro and TradingView.

This is a “well-defined” range marked by the short-term holder (STH) cost basis bands, according to onchain analytics platform Glassnode. STH cost basis refers to the average purchase price of investors who have held Bitcoin for less than 155 days.

Related: Bitcoin profit-taking makes $140K key BTC price point: Research

The price touched the upper band of this metric in May at $112,000, when it hit its current all-time high. If BTC rises to retest the line, it will likely rise toward $117,000 in the short term.

“The upper boundary of the STH cost basis was tested only once in late May and currently stands at $117,113,” the market intelligence firm said in a July 2 post on X, adding:

“This level can be seen as the upper band of the short-term price action.”

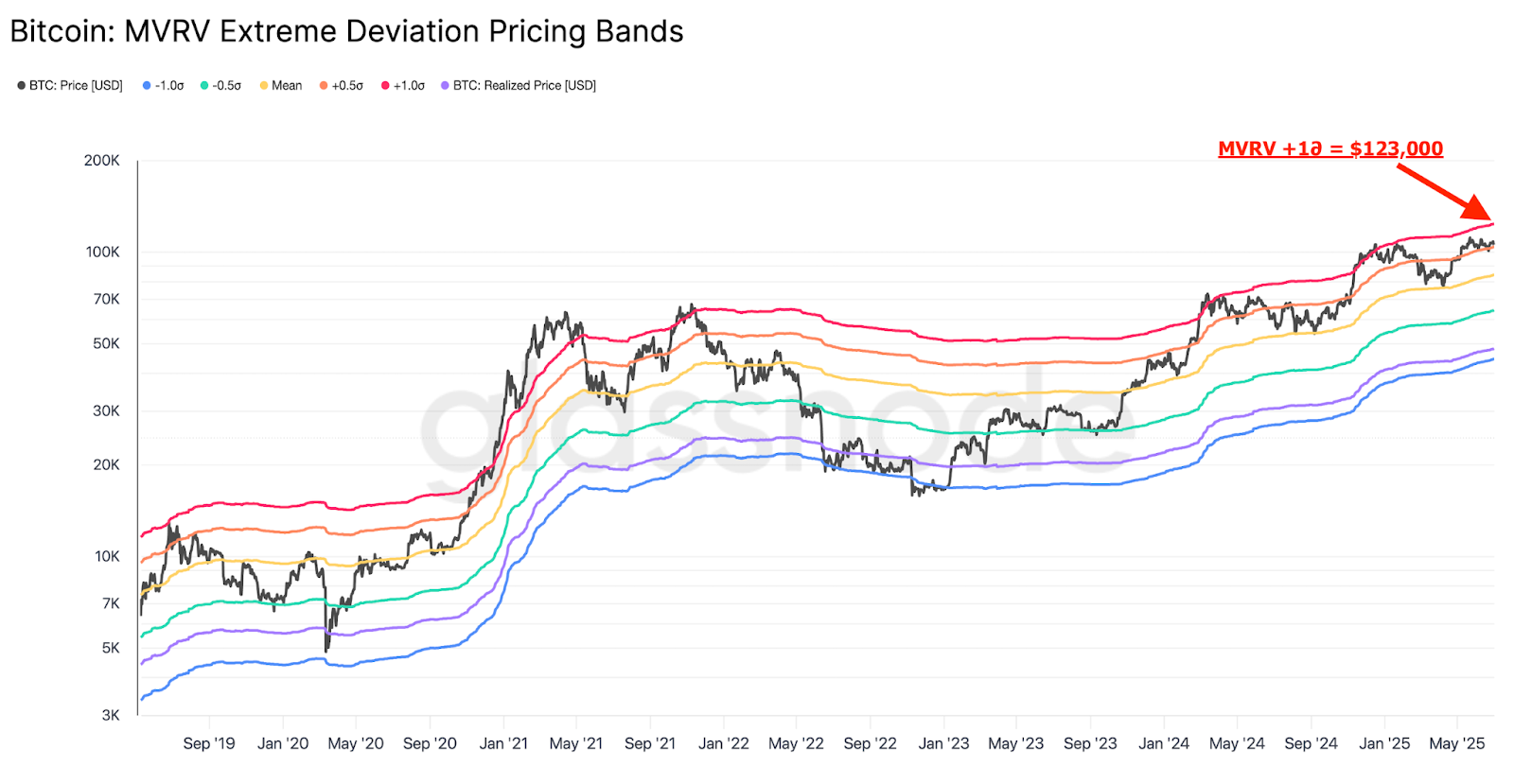

The market value realized value (MVRV) metric, a metric that measures whether the asset is overvalued or not, suggests that BTC price still has more room for further expansion before the unrealized profit value reaches an extreme level represented by the upper MVRV band around $123,000.

When will BTC price breakout?

Meanwhile, popular trader and analyst Rekt Capital shows that Bitcoin is already retesting its multimonth descending trendline.

“How many more rejections from the daily downtrend line before Bitcoin finally breaks out?” he asked, wondering whether the level was weakening as a point of rejection.

An accompanying chart revealed that the downward trendline at $109,000 is now a key breakout level.

“Bitcoin needs a daily close above and retest of the downtrend line as support to confirm the breakout.”

Fellow analyst Jelle opined that Bitcoin will break out once it closes above the upper boundary of a bull flag at $110,000 on the daily time frame, with a measured target of $130,000.

#Bitcoin is pushing for a breakout from the bullish flag! 👀

Break above $110k, and the first target is $130k. 📈 pic.twitter.com/fWzYZZiArd

— Jelle (@CryptoJelleNL) July 2, 2025

As Cointelegraph reported, several Bitcoin traders are cautiously optimistic about a decisive break of the resistance at $109,000.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.