Among the 20 most important cryptocurrencies by market capitalization, Chainlink (LINK) is currently recording the second-highest loss of -10.4 % in the last seven days. This puts it just behind Ethereum, which recorded a slightly sharper decline of -10.9 %.

Despite this, a glimmer of optimism emerges when delving into the 1-day chart of LINK/USD. The analysis suggests a potential turnaround on the horizon. Should the current market structure remain intact, there’s a promising indication that the recent corrective phase for LINK might be drawing to a close.

Chainlink Price Analysis: Indicators To Watch

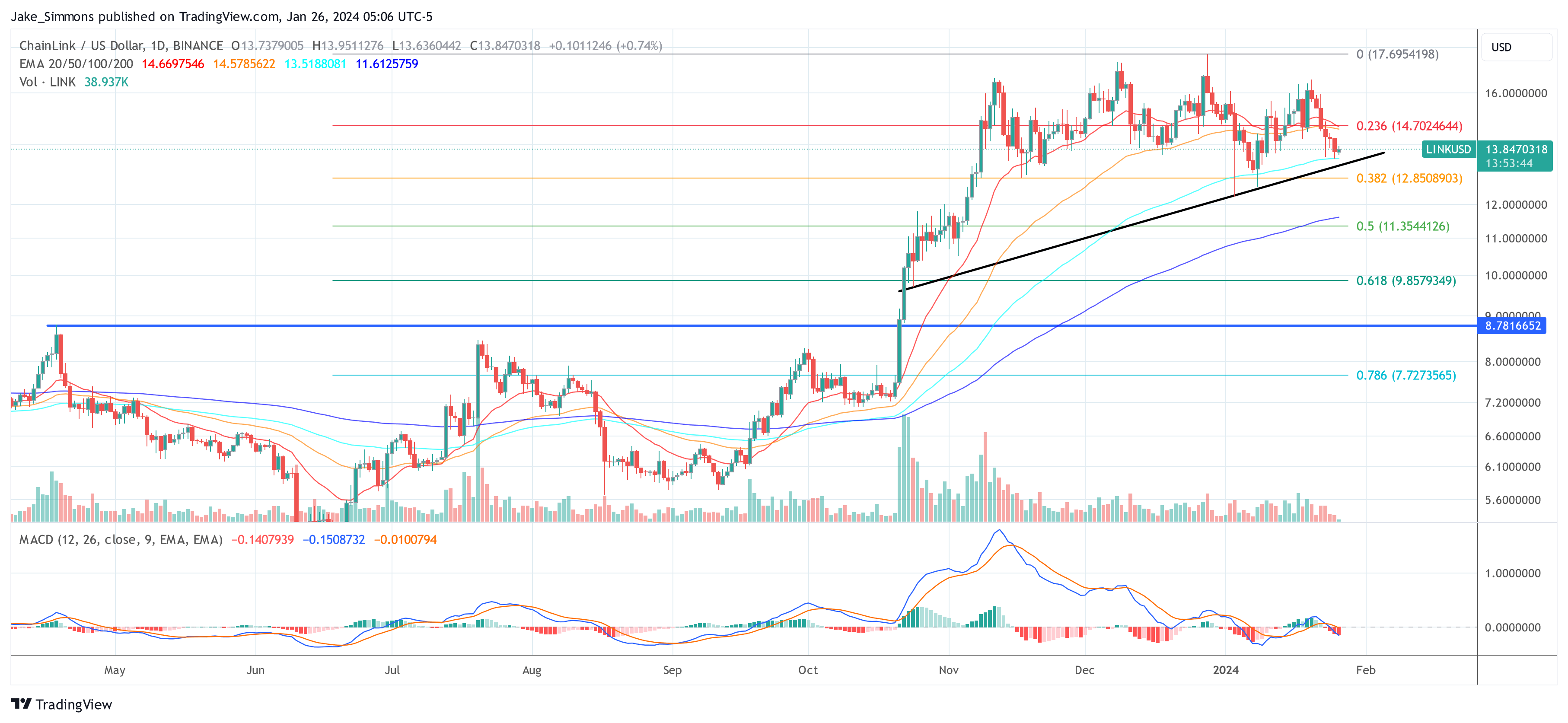

Several key indicators and patterns emerge that warrant the attention of traders and investors alike. Firstly, the price action has been demonstrating a series of higher lows, which could be indicative of an ascending triangle pattern forming – a bullish continuation pattern. As long as the LINK price holds above the rising trend (black line) established in late October of the previous year, the bulls remain in control.

At press time, LINK was trading at $13.82, presenting a nuanced narrative in its Exponential Moving Average (EMA) positioning. A critical observation is that LINK’s price is buoyantly positioned above the longer-term 100-day and 200-day EMAs, recorded at $14.6679316 and $11.61, respectively. This configuration typically signals a robust long-term bullish momentum, underpinning investor confidence in the asset.

Contrastingly, the short-term outlook is conveyed by the positioning of the 20-day and 50-day EMAs. With the 20-day EMA at $14.67 and the 50-day EMA at $14.58, both hover above the current price level, imparting a potential resistance zone. This immediate overhead resistance is indicative of a short-term bearish pressure or consolidation phase, possibly reflecting a market pause as traders and investors reassess their positions.

The Fibonacci retracement levels, drawn from the swing low in June to the peak in December, suggest that LINK has recently tested the 0.236 retracement level at $14.70 as resistance. The subsequent levels to watch are 0.382 at $12.85, followed by 0.5 at $11.53, which could serve as potential support levels if a bearish reversal occurs. Conversely, a break above the 0.236 level may open the door to test the $17.69 level, which stands as a significant resistance.

On the volume front, trading activity has been moderate, with no significant spikes indicating a decisive market direction. The Relative Strength Index (RSI) is hovering around the 50 mark, which typically denotes a neutral market sentiment without clear overbought or oversold conditions.

The MACD indicator exhibits a bearish signal with the MACD line at -0.1407939, positioned below the signal line, which is at -0.1508732. The negative value of the MACD line suggests that the short-term momentum is weaker than the long-term momentum, indicating bearish sentiment in the current market.

Furthermore, the distance between the MACD and the signal line is very narrow, as reflected by the small histogram value of -0.0100794. This small negative histogram value indicates a weakening of downward momentum, as the MACD line is close to crossing above the signal line.

Traders might view such a crossover as a potential change in momentum, possibly hinting at an upcoming bullish phase. However, until the crossover occurs, the prevailing sentiment indicated by the MACD remains bearish in the short term.

LINK/BTC: Bulls In Control

The LINK/BTC trading pair (weekly chart) is also favoring the bulls. The descending trend line, which has historically acted as a resistance since the peak in 2020, was decisively broken in October last year. This breakout is a key development, indicating a potential reversal of the downtrend that has dominated the LINK/BTC pair for a significant period.

Following the breakout, a retest of the descending trend line occurred, a move often anticipated by technical analysts. The successful retest occurred in the second week of January, when the price bounced off the trend line, reinforcing it as a new support level.

This retest is indicative of a shift in market sentiment, where former resistance levels transform into support, a classical sign of a trend reversal. A breakout above 0.0004472, and LINK could be exploding towards 0.0006875 or even 0.0009.

In summary, Chainlink’s technical posture is one of cautious optimism, with a clear upward trend since November but facing immediate resistance near the $14.70 level. Market participants should watch these technical indicators closely for signs of either a continuation of the uptrend or a potential reversal if support levels falter.

Featured image created with DALL·E, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.