India’s Directorate of Enforcement (ED) says it has frozen more cryptocurrencies, including bitcoin, tether, and the Wazirx token. The action is part of its investigation of the mobile gaming app E-nuggets. In its latest announcement, the ED revealed that nearly 86 bitcoins found at crypto exchange Binance were frozen.

Indian Authority Freezes More Cryptocurrencies: Bitcoin, Tether, Wazirx Token

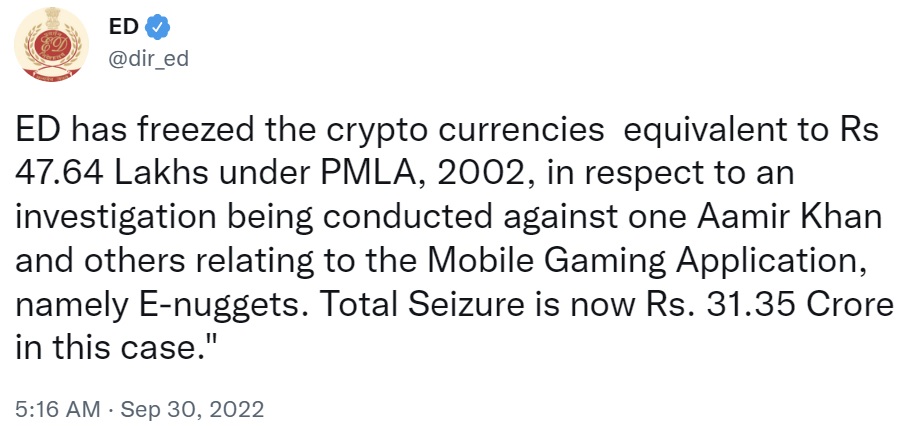

India’s Directorate of Enforcement (ED) announced Friday that it has frozen two more cryptocurrencies under the country’s Prevention of Money Laundering Act (PMLA). The ED is the Indian government’s law enforcement and economic intelligence agency. The announcement details:

Directorate of Enforcement (ED) has freezed the crypto currencies WRX (utility token of Wazirx) and USDT (tether, an Ethereum token that is pegged to the value of a U.S. dollar) equivalent to Rs 47.64 lakhs.

The ED initiated a money laundering investigation of Aamir Khan and others relating to E-nuggets on the basis of an FIR dated Feb. 15, 2021.

Aamir Khan, S/o Nesar Ahmed Khan launched E-Nuggets, “which was designed for the purpose of defrauding public,” the Indian authority said. “Further, after collecting handsome amount from the public, all of the sudden, the withdrawal from the said app, was stopped, on the pretext of one and other excuses.”

The agency explained that its investigations have revealed that the accused transferred the amount earned through the E-nuggets gaming app using a cryptocurrency exchange, elaborating:

Amount equivalent to Rs 47.64 lakh was found in the wallet of Wazirx (crypto exchange) belonging to Aamir khan and its associates and the same has been freezed under PMLA.

In addition, the ED noted that during searches conducted earlier against Amir Khan, Rs 17.32 crore cash was found and seized from the residential premises.

Indian Authority Freezes More Bitcoin at Binance

The latest announcement by the ED states:

85.91870554 bitcoins equivalent to USD $1,674,255.7 (equivalent to Rs 13.56 Cr approx. as per market exchange rate) found in balance in Binance exchange was freezed.

In an earlier announcement, the ED said it had frozen 77.62710139 bitcoins on Binance. That means the ED froze 8.29160415 more BTC.

Binance was believed to have acquired Wazirx in 2019. However, Binance CEO Changpeng Zhao (CZ) recently said that the acquisition “was never completed,” emphasizing that “Binance has never — at any point — owned any shares of Zanmai Labs, the entity operating Wazirx.”

The ED froze the bank assets of Wazirx worth more than $8 million in August. However, earlier this month, Wazirx said that its bank accounts have been unfrozen. Following Wazirx, the ED froze crypto and bank assets worth $46 million of Vauld, a crypto platform backed by Peter Thiel. In August, the agency searched crypto exchange Coinswitch Kuber. However, the exchange’s CEO said that it was not related to money laundering investigations.

What do you think about the Indian authority freezing more cryptocurrencies amid money-laundering investigations? Let us know in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Cryptox.trade does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.