Internet Computer

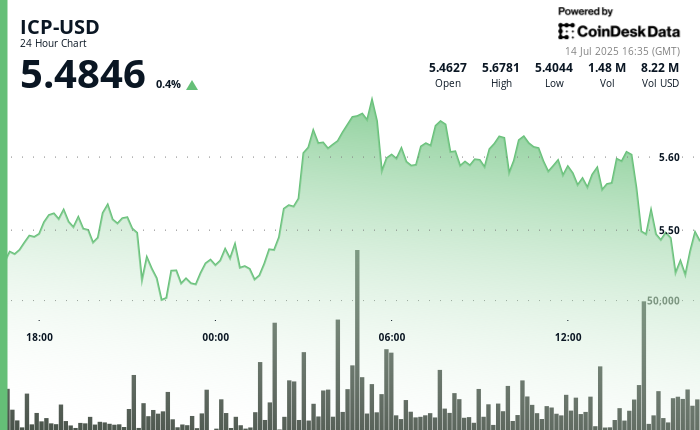

showed signs of resilience in a turbulent 24-hour window, climbing as high as $5.6781 before consolidating just below the $5.50 mark. Despite late-session selling, the token remains poised for potential recovery amid ongoing volatility.

Starting July 13 at 17:00 UTC, ICP began a steady ascent, reaching its session high of $5.6781 early on July 14. This rally was underpinned by a significant increase in volume, topping 800,000 units during its most aggressive upward leg between 02:00 and 05:00 UTC. Bulls briefly tested resistance above $5.67, a level that had historically capped upside momentum.

However, intense selling pressure set in shortly after the peak, driving prices downward in a rapid reversal. During the hour ending at 16:05 UTC on July 14, the token dipped 1% to $5.45, decisively breaking through the $5.48 support threshold. A volume spike near 50,000 units during the 15:48-15:49 UTC interval further confirmed heightened bearish activity.

Despite the pullback, ICP has found near-term stability in a lower trading channel between $5.44 and $5.46.

Technical Analysis Highlights

- ICP traded within a $0.28 range from $5.40 (low) to $5.68 (high), marking a 5% intraday spread.

- Price spiked from $5.47 to $5.68 between 02:00–05:00 UTC on July 14, amid 800K+ volume.

- Resistance hardened near $5.67–$5.68, curbing bullish continuation attempts.

- Final-hour decline from $5.50 to $5.45 showed a swift 1% retreat from 15:06–16:05 UTC.

- Key support at $5.48 was broken on high volume, signaling potential bearish continuation.

- Notable sell-off occurred between 15:48–15:49 UTC with nearly 50K units traded.

- Consolidation range has formed between $5.44–$5.46 as of July 14 at 16:35 UTC.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.