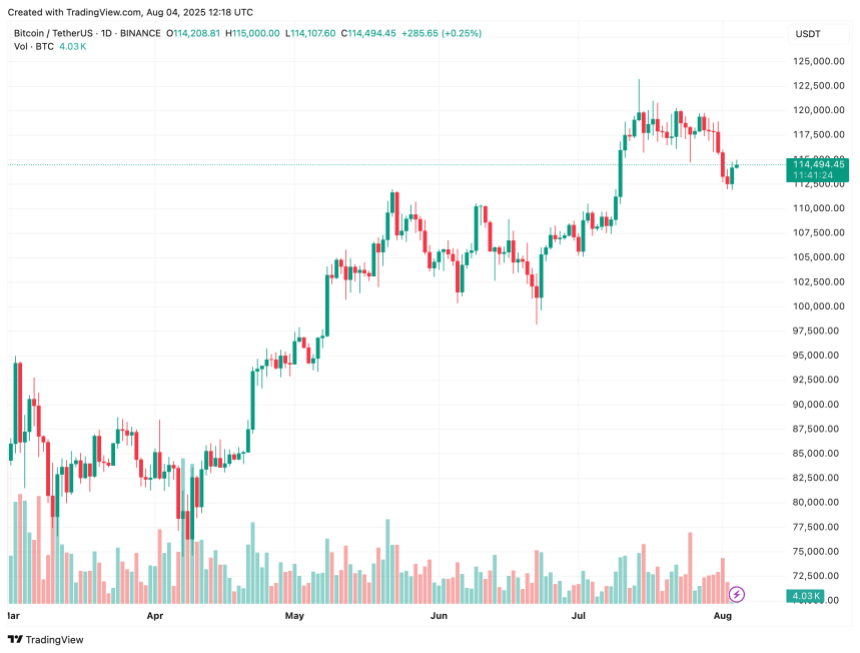

Bitcoin (BTC) is down 3.6% over the past week, falling from around $119,800 to the $114,500 range at the time of writing. This weakening price action is also reflected in spot Bitcoin exchange-traded funds (ETFs), most notably in BlackRock’s IBIT Bitcoin ETF, which saw over $2.6 billion in outflows on August 1.

IBIT Bitcoin ETF Sees Massive Outflows

According to a recent CryptoQuant Quicktake by contributor Amr Taha, BlackRock’s IBIT ETF recorded more than $2.6 billion in outflows on August 1 – the highest figure in the past two months across all listed Bitcoin ETFs.

Taha highlighted that the sharp reversal in institutional demand for Bitcoin ETFs comes after several weeks of positive inflows, and indicates a growing sense of caution among ETF investors. Data from SoSoValue confirms the trend.

Related Reading

For the week ending August 1, US-based spot Bitcoin ETFs recorded a net outflow of $643 million. This marked the end of a seven-week streak of positive inflows, which had totaled more than $10 billion.

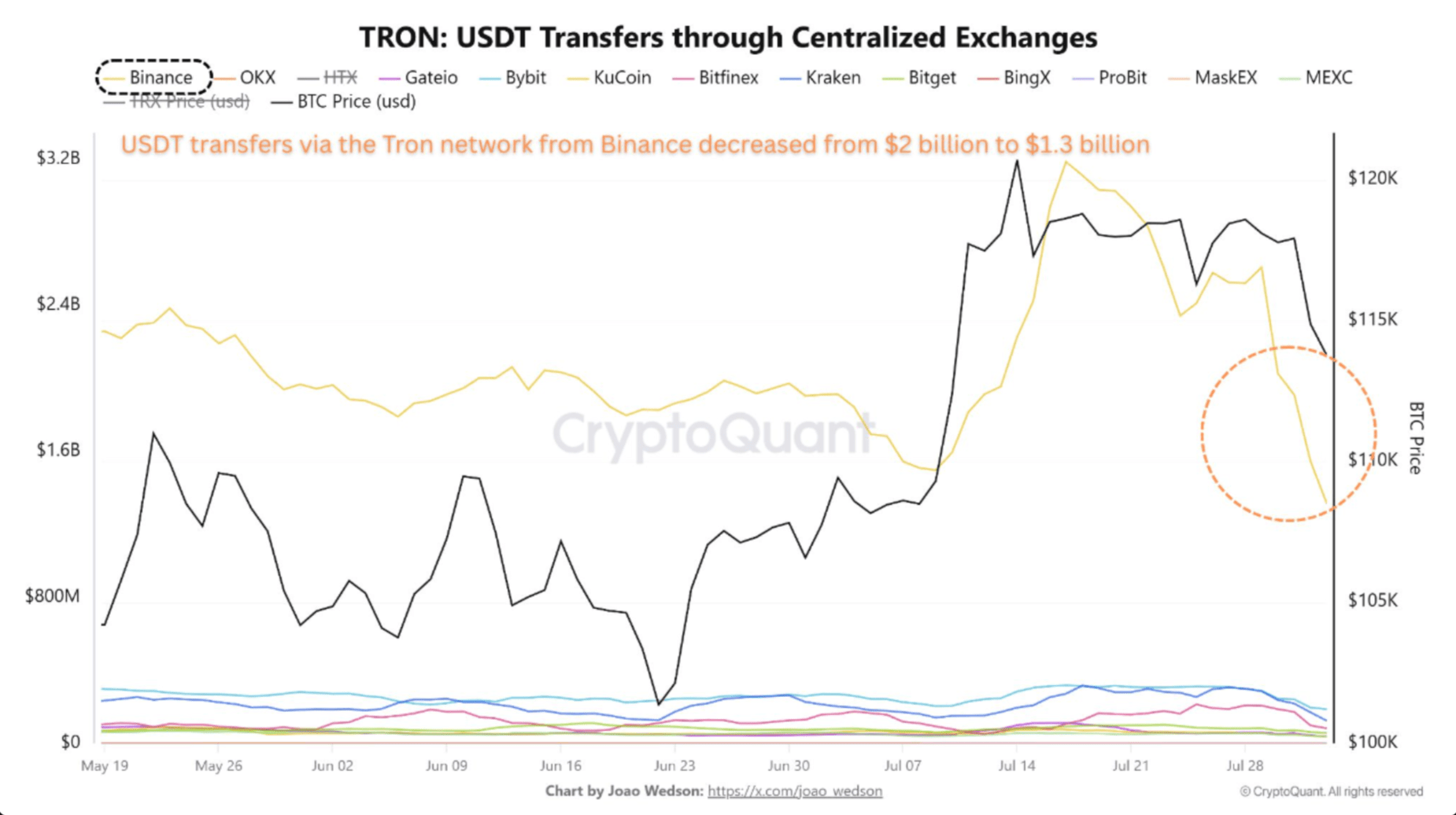

Another important point is that the $2.6 billion outflow from BlackRock’s IBIT ETF was not mirrored by other ETFs. Analyst Taha also identified a correlation between IBIT outflows and Binance-origin USDT transfers on the Tron network.

In his analysis, the CryptoQuant contributor noted that alongside the IBIT outflows, USDT transfers on Tron from Binance fell from approximately $2 billion to $1.3 billion – a sharp 35% decline. Taha added:

The timing strongly suggests a link between the ETF-driven selling pressure and the accelerated pace of stablecoin withdrawal via Tron, a blockchain renowned for fast and cost-efficient transactions.

Tron network’s low fees and speed make it a preferred blockchain for both retail and institutional stablecoin transfers. Therefore, a drop in USDT transfers from Binance – occurring in tandem with IBIT outflows – suggests that institutional interest in BTC may be temporarily cooling off.

Recent on-chain data shows Binance continues to lead other exchanges such as OKX, HTX, and KuCoin in terms of Tron-based USDT transfers. As a result, Binance volume trends often serve as a reliable indicator of investor sentiment shifts.

Fresh Data Presents Mixed Forecasts

Beyond weakening ETF demand, new exchange data signals potential headwinds for Bitcoin in the near term. For example, Binance’s net taker volume dropped to -$160 million last week, indicating increased sell-side activity.

Related Reading

From a technical standpoint, things appear less than optimistic. Crypto analyst Josh Olszewicz recently predicted that BTC could remain range-bound until October 2025.

Still, not all signs are bearish. A recent report from CoinShares estimates that Bitcoin could rise to $189,000 if it captures just 2% of global M2 money supply or 5% of gold’s market cap. At press time, BTC trades at $114,494, up 0.3% in the past 24 hours.

Featured image from Unsplash, charts from CryptoQuant and TradingView.com