A merge between crypto and philanthropy is already underway as decentralized autonomous organizations (DAO) and nonfungible token artists alike fundraise and donate crypto to nonprofits. But what does the age-old institution of philanthropy have to learn from emerging technologies in the crypto space? Additionally, what does crypto have to offer philanthropy that could improve the sector generally?

Crypto offers the potential for nonprofits to be governed in a decentralized fashion, creating conditions that maximize the influence of communities most impacted by these organizations.

Despite its meme-based reputation at times, the crypto industry is actually in the midst of a major push toward true democracy. This effort begins by leveraging blockchain technology that has created the conditions required for decentralization.

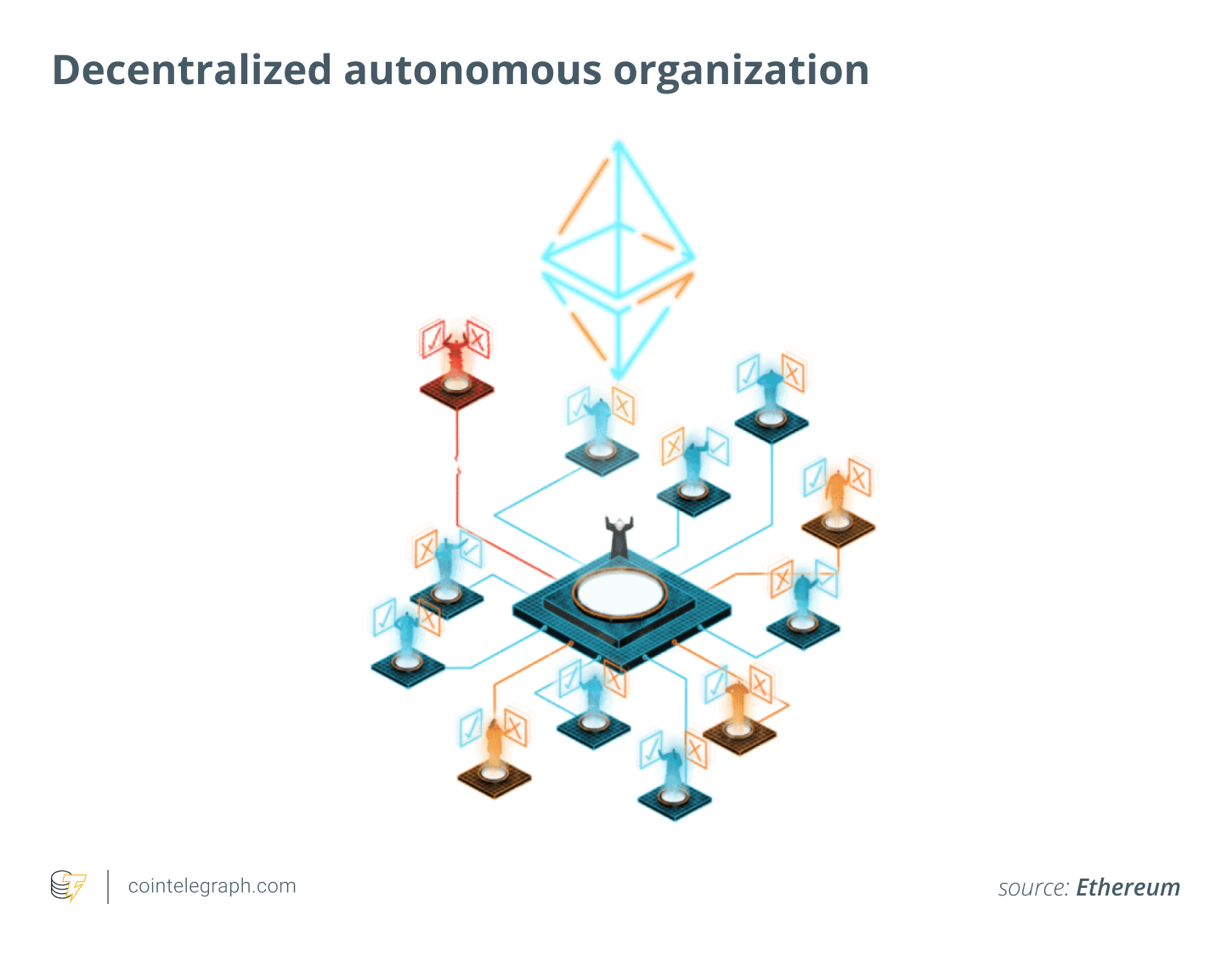

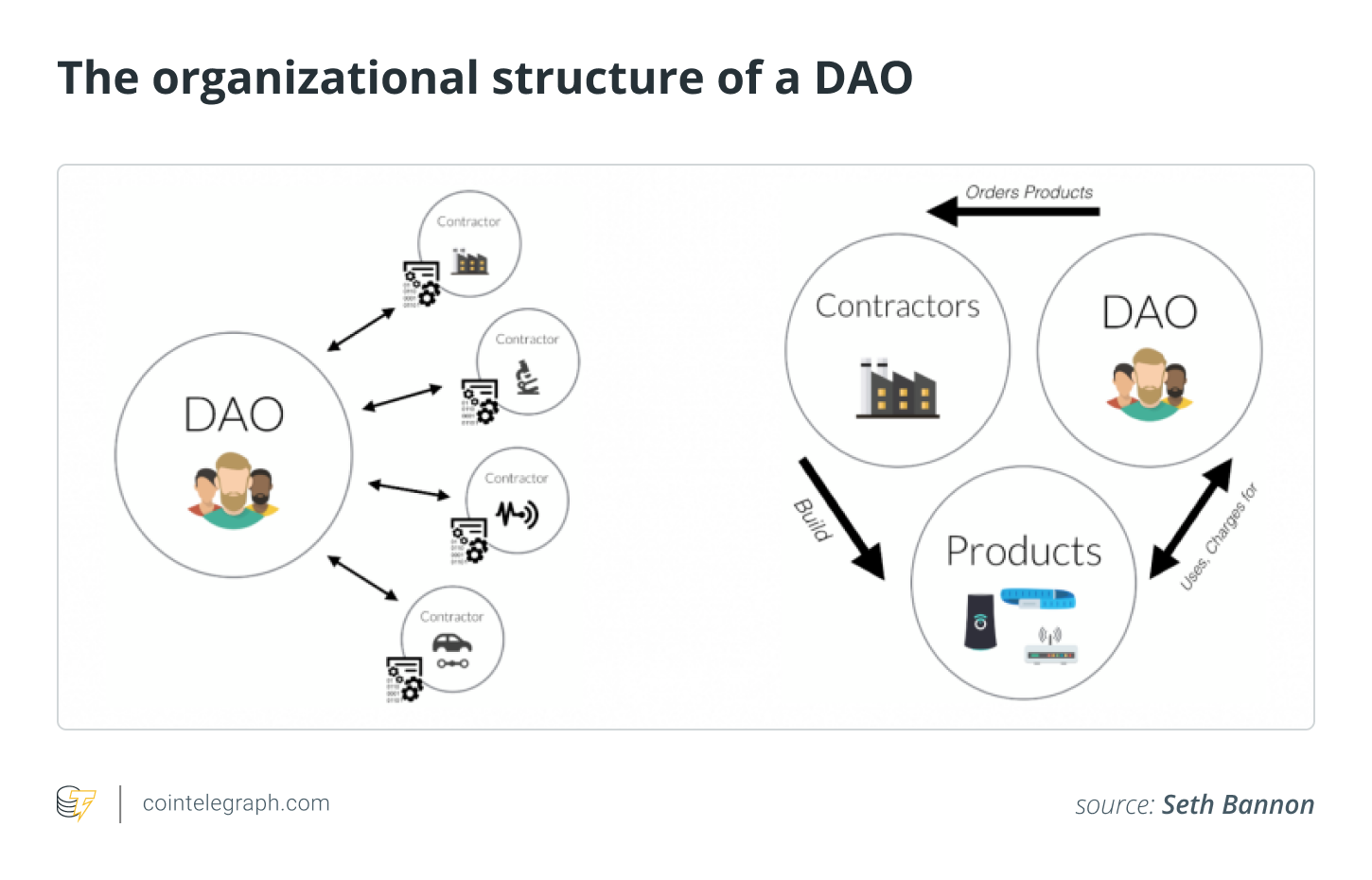

Blockchains can host smart contracts, a sort of unadjustable code that automatically enforces rules, removing the need for central figures of authority. Rather than an individual or group bearing responsibility for operations, smart contracts can be interacted with through token voting. When blockchains are built with tokens and smart contracts, they empower online communities to build systems of token-powered self-governance called decentralized autonomous organizations.

What if a nonprofit structured itself as a DAO in order to leverage the aforementioned benefits to further its mission? To successfully create a Community Foundation built on a DAO would transform fundraising, grant distribution and even nonprofit management into a transparent democratic process. This is the thesis that led us to create Endaoment as an organization that is completely on-chain and embraces the benefits of decentralized technologies.

The challenge with creating compliant nonprofit DAOs, at least in the United States, is transitioning a nonprofit organization to a DAO governance structure without compromising its charitable status.

Related: NFT philanthropy demonstrates new ways of giving back

The roadmap

For a nonprofit organization to become a DAO while remaining compliant with U.S. Internal Revenue Service rules, traditional entities such as committees, officers and boards would need to remain intact. DAOs, however, can leverage blockchain tools to govern the privileges of those groups. Through the use of smart contracts, a nonprofit DAO could assign and manage responsibility for electing board and committee members, creating and composing committees, and assigning responsibilities and privileges to each of those entities. The DAO in this case would serve as the sole member of the nonprofit, with DAO members collectively making decisions through token-based voting.

Token distribution

Before tokens can be used to manage voting, they must first be distributed fairly and transparently among DAO members. Some considerations must be taken into account when designing a token that will govern a nonprofit DAO in order to maintain compliance and create a system based on transparency and fairness:

Contribution to a nonprofit mission and DAO sustainability

- The token should be distributed as a reward to those who meaningfully contribute to the DAO’s operations and goals.

- Tokens should signal an individual’s influence and participation in the platform’s ecosystem.

Perpetual rewards

- Following the genesis distribution, the reward schedule should be kept indefinite to continuously reward regular participants with voting power (tokens) and without relying on board-determined inflation events. (See: Incentive structures)

Token cap and user considerations

- Cap the total number of tokens that will ever be in circulation while rewarding members in proportion to the size of the user base to incentivize bringing other users to the platform.

Determination of funding and donation outcomes

- The token should in no way affect the funding nonprofits receive.

Intuitive rules

- Tokenomics and governance should be as simple as possible to avoid confusion. Incentives and oversight are most effective when they’re designed to be understood.

Limiting self-awards

- To avoid conflicts of interest, checks should be put in place to limit the ability of committee and board members to self-reward with tokens or otherwise easily manipulate the system for a tangible benefit.

Voting

Once the token is created and distributed to community members, they can use that token to vote. First, however, they must signal their interest and commitment to participate in governance by “locking” their tokens, which helps to avoid double voting or gaming the voting mechanics of the system. When users lock tokens, they give up access to those tokens for a set amount of time and gain the privilege of participating in votes concerning the DAO’s governance. At the end of the allotted time, users can choose to retrieve their tokens or continue to keep them locked and maintain their voting power.

While participants’ tokens are locked, they can do things such as elect identity-verified individuals to the nonprofit’s board, remove officers, and create and compose committees. In short, they can govern the organization. We plan to continually build out existing and new governance structures to create fairer and more equitable decision-making that fulfills our mission.

Related: A blockchain-based replacement for traditional crowdfunding

Incentive structures

What is the incentive for participating in this philanthropic DAO (outside of genuine altruism)? In addition to enabling DAO members to vote on the management of the entire organization, voting tokens can also be used to reward specific types of participation among members of the entire ecosystem. As a result of this system, fees collected through the use of the platform could: (1) be used to compensate active participants to the Endaoment ecosystem, and (2) be distributed through our philanthropic system to nonprofits according to community voting.

For rewards to be distributed fairly, a DAO-elected committee is tasked with establishing transparent and easily understood parameters to measure the impact within the organization. Based on user interactions, members are assigned a score and can receive a proportional reward on a recurring basis.

DAOs for nonprofit

Nonprofit organizations are full of rhetoric about emboldening and creating platforms for the communities they impact — and many do just that — but few, if any, are truly democratic or inherently transparent. By fusing the innovations of Web3 with traditional philanthropy, we hope to realize an opportunity that would empower communities to manage the very nonprofits created to aid them. Individuals receive voting power proportional to the work they contribute or interactions they have with the nonprofit DAO.

The nonprofit DAO can utilize blockchain technology to create transparent and easily understood structures and processes so that community members have full faith and confidence that their role is both legitimate and valued. Fusing these two disparate sectors creates an opportunity to create a new type of organization: one that takes advantage of new technology to bring democratic, transparent and incentivized systems to the nonprofit space in a manner previously not possible.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

The views, thoughts and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cryptox.

Noah Gallant leads protocol and human interface design at Endaoment. Previously, he was the director of the Design For America studio at Columbia University, coordinating the execution of design-forward impact projects for local nonprofits and community organizations. Noah then founded a design and development studio called Sight, which focuses on creating products across the crypto, e-commerce, social impact and art spaces. In 2021, he joined Endaoment with the goal of utilizing human-centered design and Web3 toolkits to help build new and efficient forms of philanthropy and nonprofit funding.