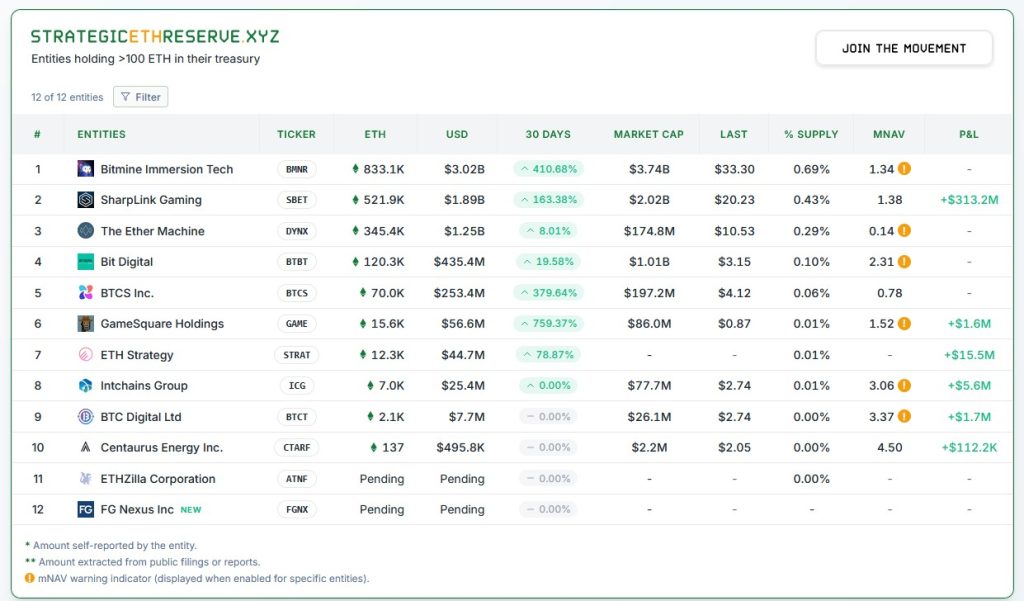

Since they emerged from stealth mode two months ago, a dozen Ethereum treasury companies have bought 2 million ETH between them, with Standard Chartered analysts estimating they’ll add another 10 million to that pile over time.

There’s growing excitement that billions worth of that ETH could flow into DeFi protocols as firms compete to chase yields greater than the 3%-5% on offer from staking and re-staking.

Etherealize’s Vivek Raman tells Magazine “healthy competition” between treasury companies for yield could light a fire under the DeFi sector before the end of the year.

“I’m actually pretty excited to see it. This could be the stimulus needed for DeFi Summer 2.0 — but on the institutional scale and bigger and better.”

GameSquare Holdings, BTCS, BitDigital, The Ether Machine and ETHZilla have all announced plans to juice ETH yields via DeFi, while Tom Lee’s BitMine Digital and Joe Lubin’s SharpLink Gaming are staking and restaking their ETH for now, while they refine their DeFi plans.

John Chard, vice president of operations for SharpLink, tells Magazine that he sees “selective DeFi participation as a natural next step beyond staking, leveraging Ethereum-native infrastructure not only to preserve value but also to grow it.”

“We also feel that, as more companies adopt ETH as a balance sheet asset, they will realize, sooner than later, DeFi isn’t just a curiosity — it’s a competitive edge,” he says.

GameSquare targets up to 14% return from ETH in DeFi

GameSquare Holdings is a successful digital media, entertainment and technology business that’s currently sixth on the ETH treasury leaderboard. It’s partnered with Ryan Zurrer’s Swiss crypto investment firm, Dialetic, to help grow its ETH treasury 5x its current size to $250 million.

Rhydon Lee, from GameSquare’s advisory board, tells Magazine that the 3% return from staking ETH can be considered the risk-free rate of return — akin to buying treasuries in traditional finance. But GameSquare is setting its sights much higher.

“We’re targeting 8%-14% yield generation on just our Ether alone — whether it’s other theses within Ethereum, such as digital NFTs, Web3 gaming, prediction markets, digital identity, stablecoins.”

Unlike parking money in an ETH ETF, investing in some of the more aggressive Ether treasury firms is more like hiring a DeFi portfolio manager to try and grow your holdings. The more successful they are at doing so, the more attractive their stock becomes to investors.

Dialectic uses an algorithmic trading system called Medici that monitors the activity of successful yield farmers to find the best risk adjusted returns across different liquidity pools and protocols. It can automatically enter and exit hundreds of positions at a time.

“There’s a whole team of devs that operates that for Dialectic that’s programmatically allocating to specific pools based on specific parameters or based on even things like watching smart money wallets and where they’re going into it.”

GameSquare even swapped equity for a CryptoPunk, which Lee believes can multiply returns, given blue chip NFT prices tend to go up in ETH, even as ETH goes up in USD terms.

“If we have 10 Ether, I hope we can have 11 Ether next year,” Lee says. “And based on the returns that Dialectics has had over the last four years, I think that’s achievable.”

ETH treasury companies are more than they seem

ETHZilla, which emerged on Ethereum’s 10th birthday with a $425-million raise, is pursuing a similar strategy. It partnered with DeFi asset manager Electric Capital on a “differentiated, onchain yield generation program” to generate between 3% and 10% annually.

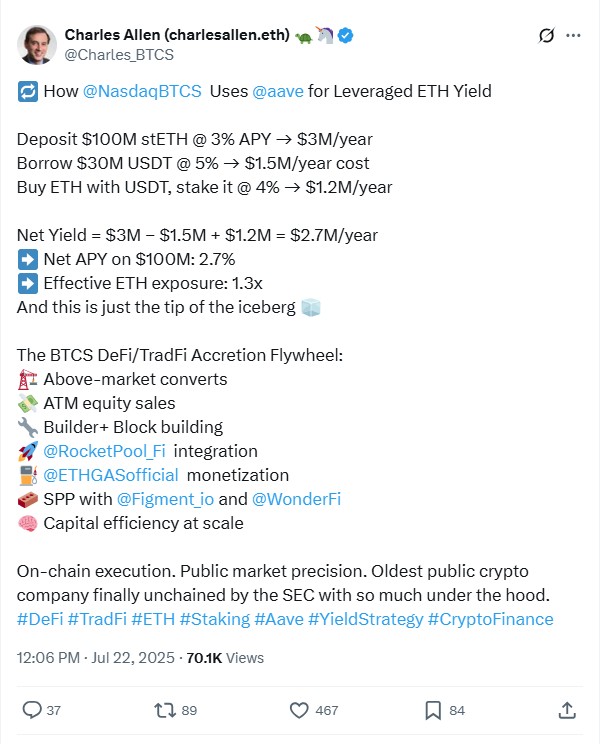

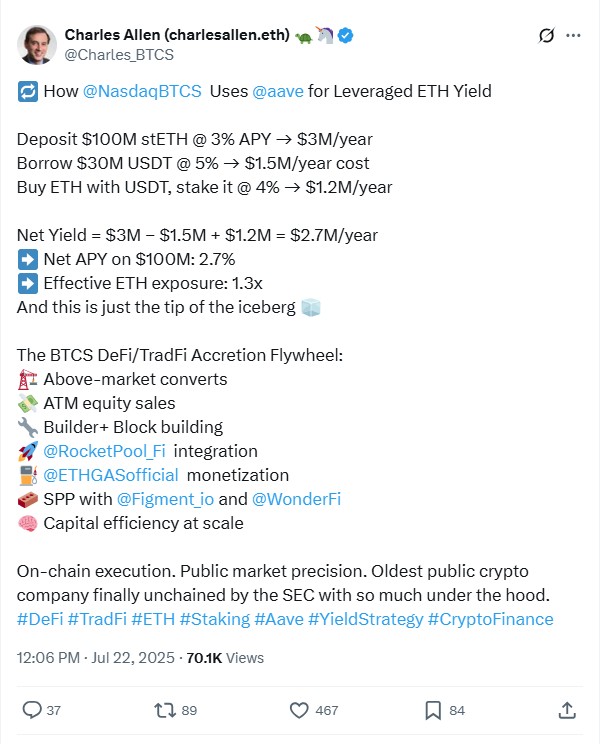

BTCS, meanwhile, is the oldest listed crypto company in the US, having gone public in 2014. It shifted from Bitcoin mining to Ethereum infrastructure in 2017-2018 and now runs validators, analytics and block building.

BTCS CEO Charlie Allen told “The Milk Road Show” podcast that running its own solo ETH validator nodes or via Rocket Pool provides “about a 40% increase on the earnings” it could make using third-party staking. It’s also employing some arcane strategies in DeFi that may seem risky to some.

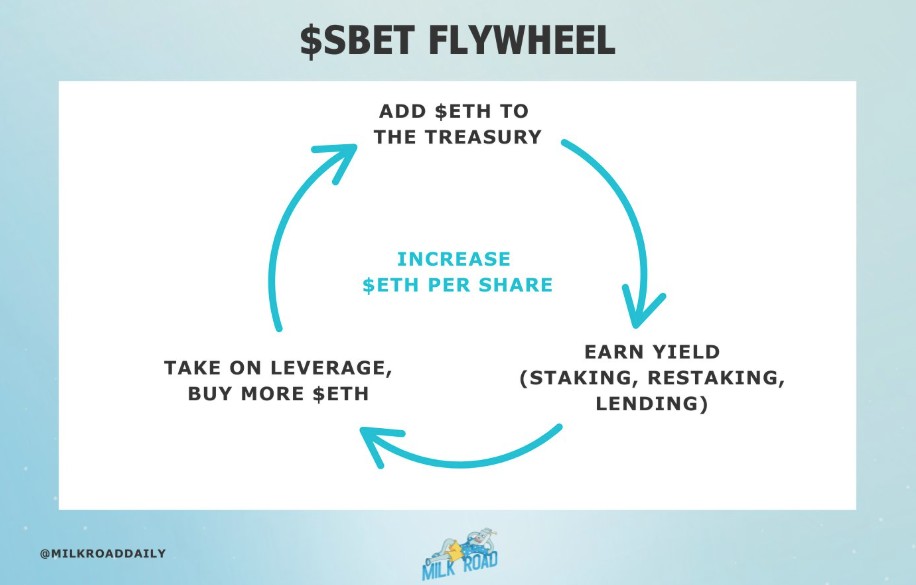

Allen revealed the company recently deposited $100 million in ETH to Aave for its flywheel strategy. It borrows USDT against the ETH collateral and uses it to buy more ETH, which is then staked via “solo or Rocket Pool nodes to kind of maximize yield.”

Bit Digital’s “alphamaneuvers”

Another former Bitcoin miner, Bit Digital operates a cloud infrastructure business for generative AI with $100 million in contracted revenue, as well as blockchain validator infrastructure and custody services.

CEO Sam Tabar said on “Bankless” that Bit Digital is already looking at “more alpha maneuvers” and intends to be “a little bit more aggressive on the risk curve to make sure that our yields are above average.”

He also committed to publishing Bit Digital’s monthly returns on its website.

“I would like to call out the other companies and see if they could show their yields… and see who is generating more yield for their ETH.”

Tabar believes that only a handful of top ETH treasury companies will survive over the long term, with valuations based on their ability to acquire more ETH.

Ethereum treasury of The Ether Machine

The Ether Machine takes its very name from its mission “to produce additional Ether,” says founder Andrew Keys, formerly of Consensys.

Its head of DeFi is Dairus Pryzdzial, a core contributor to the OG DeFi protocol Synthetix.

At this stage, it’s not YOLOing into weird strategies in DeFi, preferring instead to stake and restake most of its ETH. Keys characterizes the firm’s “eventual” DeFi strategy as being “measured” and focused on “battle-tested blue chip DeFi protocols.”

Risks and opportunities with staking and DeFi

However, brokerage firm Bernstein cautions that even just staking ETH to secure the network is more difficult to manage and riskier for treasury companies than simply holding Bitcoin.

It can cause liquidity issues due to the uncertain length of the staking exit queue, and the further companies get into DeFi, the riskier things become.

“More complex yield optimization such as restaking (such as Eigenlayer restaking model) and DeFi-based yield generation would involve managing smart contract security risk,” Bernstein’s analysts noted.

Read also

As a result of the additional risks, Raman expects the majority of Ether raised will simply be staked.

“3% on $1 billion of treasury is $30 million a year,” he says. “So, I feel like they don’t have to take as much risk.”

But he believes that up to 30% could move into DeFi as firms compete to grow their Ether holdings per share.

The risk of ETH treasury companies blowing up chasing yield in Defi

Chasing higher yields in DeFi means taking on higher risks, says Lee.

“Higher rates of return maybe require more automation, more esoteric markets and a kind of better understanding. The more efficient a market is, maybe the less return that’s possible there,” he says.

But he says a well-run company with good DeFi risk management strategies wouldn’t allocate more than 0-30 bps of its assets to a single pool, mitigating the risk to the treasury company from a loan getting liquidated or a protocol getting hacked. In that case, he says:

“I would think that the likelihood of a blow up would, you know, hopefully be low.”

BTCS’s Allen anticipates there will “definitely be companies to go out of business” but plans to minimize the risks to his own firm by keeping the loan-to-value ratio below 40% and sticking to battle-tested platforms like Aave.

“I don’t think we’re overleveraged, but we’re definitely leveraged,” he said.

Lee argues the bigger threat to listed treasury companies is raising significant amounts of money on the stock market as USD debt but having the firm’s crypto assets crashing in price below the value of the dollar denominated debt.

“So, if you have a mismatch, you know, dollar-crypto liability-asset, I mean, to me, that is the bigger scenario of a blow up then hopefully single-digit bps in liquidity pools.”

Will DeFi tokens pump as a result of ETH treasury companies?

To what extent all this new activity will help pump the prices of DeFi tokens is debatable.

DeFi lending and borrowing giant Aave already has more than $50 billion in total value locked, which is greater than Standard Chartered’s prediction for the total amount of ETH that treasury companies will eventually amass.

If simply sticking extra billions into Aave pumped prices, Aave’s token wouldn’t be languishing at number 30.

But over and above the raw numbers, treasury companies will also play an important role in introducing Wall Street to the potential of DeFi.

SharpLink’s Chard says the ETH treasury companies will demonstrate in real time “that onchain finance can outperform legacy rails.”

“We’re talking about sustained, long-term liquidity from institutionally driven actors. If the first cycles of decentralized finance were driven by innovation and grassroots experimentation, this next evolution will be shaped by regulatory clarity, security frameworks and the integration of traditional financial infrastructure onchain,” he says.

Read also

“We believe treasury participation can anchor the next evolution of onchain growth, bringing legitimacy, volume and new forms of capital coordination.”

And as Keys points out, every quarterly report and earnings call for The Ether Machine will advertise DeFi to TradFi analysts.

“When we have quarterly guidance calls with the public markets, we’re going to be educating: ‘What is DeFi?’ And we’re going to explain ‘What is Aave?’ and ‘What is staking?’ and ‘What is restaking?’” he said. “Half of this is the ability to explain what Ethereum is, institutionally.”

Etherealize’s Raman says the institutional legitimacy bestowed on Ethereum will be priceless.

“I think it’s legitimacy and by funneling more assets and just showcasing those use cases, it’s shown that these protocols are pretty battle-tested and resilient. They can have real volume and scale,” he says. “That’s going to be really powerful.”

“I’m sure all the DeFi tokens will start doing well as well.”

Goff Capital’s Lee also believes it could provide a nice price bump for DeFi protocols.

“I would think it would be positive for prices. But I think it has to be enduring activity.”

Subscribe

The most engaging reads in blockchain. Delivered once a

week.

Andrew Fenton

Andrew Fenton is a journalist and editor with more than 25 years experience, who has been covering cryptocurrency since 2018. He spent a decade working for News Corp Australia, first as a film journalist with The Advertiser in Adelaide, then as Deputy Editor and entertainment writer in Melbourne for the nationally syndicated entertainment lift-outs Hit and Switched on, published in the Herald-Sun, Daily Telegraph and Courier Mail.

His work saw him cover the Oscars and Golden Globes and interview some of the world’s biggest stars including Leonardo DiCaprio, Cameron Diaz, Jackie Chan, Robin Williams, Gerard Butler, Metallica and Pearl Jam.

Prior to that he worked as a journalist with Melbourne Weekly Magazine and The Melbourne Times where he won FCN Best Feature Story twice. His freelance work has been published by CNN International, Independent Reserve, Escape and Adventure.com.

He holds a degree in Journalism from RMIT and a Bachelor of Letters from the University of Melbourne. His portfolio includes ETH, BTC, VET, SNX, LINK, AAVE, UNI, AUCTION, SKY, TRAC, RUNE, ATOM, OP, NEAR, FET and he has an Infinex Patron and COIN shares.