Société Générale, France’s third-largest bank, has debuted its native euro-pegged stablecoin, making it one of the first European banking giants to foray into the stablecoin market.

The euro-pegged stablecoin, EUR CoinVertible, will debut on the Luxembourg-based Bitstamp crypto exchange, the Financial Times reported. EUR ConVertible will be fully backed by the euro, allowing bank customers to participate in the digital asset market. The native stablecoin will be available to a broad customer base and can be used for trading.

Jean-Marc Stenger, the CEO of Société Générale Forge, noted that the new stablecoin highlights the bank’s role in the evolving crypto domain while stressing the necessity for a stablecoin denominated in euros.

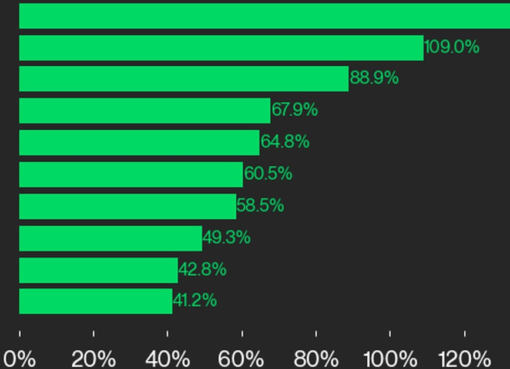

The private crypto stablecoin market is dominated by United States dollar-pegged stablecoins, with Tether and Circle being the only two key significant players. While crypto exchange platforms and market leaders like Tether are working toward expanding the stablecoin market to the European region, Stenger called the bank’s move more than a novelty.

The CEO highlighted that the new stablecoin has been developed with a focus on its usage in settling trades involving digital bonds, funds, and various assets. He added that the broad applicability of this stablecoin extends beyond Société Générale’s platform, allowing it to be embraced across different financial service providers.

Related: French financial markets ombudsman reports jump in crypto-related mediations

Axa Investment Managers used the native Eur CoinVertible stablecoin to invest in the bank’s digital green bond. The bond has a value of 10 million euros (around $11 million) and a maturity of three years.

The French banking giant’s move into the euro-pegged stablecoin market might be a major development for the European landscape, especially with the European Union’s MiCA regulation set to come into force next year.

However, Société Générale is not new to the crypto domain and has been actively involved in offering crypto exposure to its customer base for years. Earlier in July this year, the banking giant’s crypto subsidiary, Forge, became the first company to obtain the highest access license for providing crypto services in the country.

Magazine: Experts want to give AI human ‘souls’ so they don’t kill us all