Coinspeaker

Ethereum Underperformance Hits 3-Year Low: What’s Next for ETH?

Since this market cycle bull run began, Ethereum

ETH

$2 302

24h volatility:

-4.4%

Market cap:

$276.89 B

Vol. 24h:

$15.45 B

has trailed most of its peers, such as Bitcoin

BTC

$58 753

24h volatility:

-2.0%

Market cap:

$1.16 T

Vol. 24h:

$27.18 B

and Solana

SOL

$132.0

24h volatility:

-2.7%

Market cap:

$61.79 B

Vol. 24h:

$2.26 B

. ETH underperformance persisted even after the US spot ETH ETF approval in July.

Over the weekend, the ETHBTC ratio, which tracks ETH’s value relative to BTC, dropped below 0.04 and hit a yearly low last seen 3.5 years ago. According to Alex Thorn, Head of Research at Galaxy Digital, this marked a worrying trend since the post-Merge upgrade.

“ETHBTC just traded on a 0.03 handle for the first time in 3.5 years (Apr 2021). -53% since the Merge in September 2022. What stops this train?” Thorn pondered.

At the time of writing, ETHBTC broke below its descending channel and could be pushed to 0.035 or 0.030 if more investors rotate capital to BTC.

Photo: TradingView

What’s Next for ETH?

Thorn claimed that the altcoin could only see significant reversal through a fundamental shift in narrative.

“Big forces are at play here. I don’t think technical breakout is the thing that does it here. It needs a fundamental narrative shift,” He wrote.

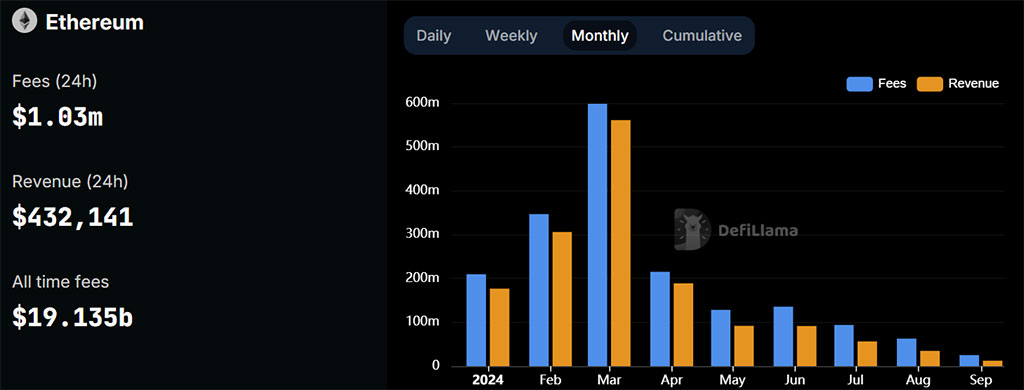

For context, after the Dencun upgrade in March, ETH’s fees took a huge hit, and L1 network activity declined, which some pundits blamed on ‘parasitic and extractive L2s.’ The monthly revenue tanked from nearly $600 million in March to $100 million in September.

Photo: DefiLlama

Over the same period, ETH has also become inflationary (more tokens being issued than burned), denting its ‘ultra-sound money’ status after the Merge.

In addition to these worrying fundamentals, David Doung, Global Head of Research at Coinbase, linked ETH price underperformance to the current market structure. Duong cited the weak seasonals (in September) and competition from other altcoins.

“Our view is that crypto natives are also driving the market at the moment, and this cohort may be crowded into altcoins and other crypto positions that are getting more difficult to exit,” Duong wrote.

Per Duong, the short-term narrative could shift only if ETH brings more RWA (real-world assets) and applications with broad public appeal into the network.

Photo: Cowen

Meanwhile, crypto analyst Benjamin Cowen projected ETH/BTC could bottom at 0.30 – 0.40 by December and rally in 2025. In short, ETH’s relative underperformance could continue before a rebound. Cowen warned that the ETH/BTC crash could derail an altcoin rally.

“But history shows that when ETH/BTC crashes, the ALTs will follow,” Cowen cautioned.

ETH was valued at $2.3K at press time, down nearly 10% from its monthly high of $2.56K hit in early September.

Ethereum Underperformance Hits 3-Year Low: What’s Next for ETH?