Coinspeaker

Ethereum to Hit $8,000 but Sell-Off Likely First, Analyst Says

Ethereum (ETH), the second-largest cryptocurrency globally, has been a wild ride for investors in 2024. Despite some analysts’ continued skepticism, one prominent crypto analyst, known as “Bluntz” on X (formerly Twitter), predicts a spectacular rise for ETH, targeting a staggering $8,000 – a new all-time high (ATH). However, Bluntz warns that Ethereum must overcome some hurdles first.

Key Conditions for Ethereum’s Liftoff

In a video shared on June 9th, Bluntz outlined the key benchmarks Ethereum must meet to reach the coveted $8,000 mark. Currently, ETH is hovering near $3,000, potentially nearing the bottom of this bear market. However, according to Bluntz, a straight shot upward is unlikely. He anticipates a further price dip before the big rally.

The analyst pinpoints a crucial step: Ethereum must “sweep $2,800, take out the low and reclaim it”. This price point signifies the completion of a three-wave corrective pattern, known as an “ABC”, which could signal the end of the downtrend and usher in a significant upswing.

Bluntz’s video delves deeper, suggesting that the ABC correction will propel Ethereum to $6,000 before a pullback. This pullback will be followed by a final surge to the much-anticipated $8,000 peak, marking the cyclical high. Bluntz expects some sideways trading and testing of new lows before Ethereum embarks on its recovery journey.

Interestingly, Bluntz believes Ethereum hasn’t had its “big run” yet in this market cycle. Despite surpassing $4,000 earlier this year, Bluntz and other analysts foresee even more significant gains on the horizon.

Spot Ethereum ETF Launch Impact

One major factor fueling optimism is the highly anticipated launch of Spot Ethereum Exchange Traded Funds (ETFs). Bluntz acknowledges the potential for a price surge upon the ETF’s arrival. However, he throws a curveball, predicting a short-term sell-off post-launch.

This initial sell-off, according to Bluntz, could represent a “shakeout” of less committed investors. Following this, he expects a period of strong buying pressure, ultimately driving the price upwards. While the exact timing of the ETF launch remains uncertain, it undoubtedly adds another layer of intrigue to Ethereum’s price trajectory.

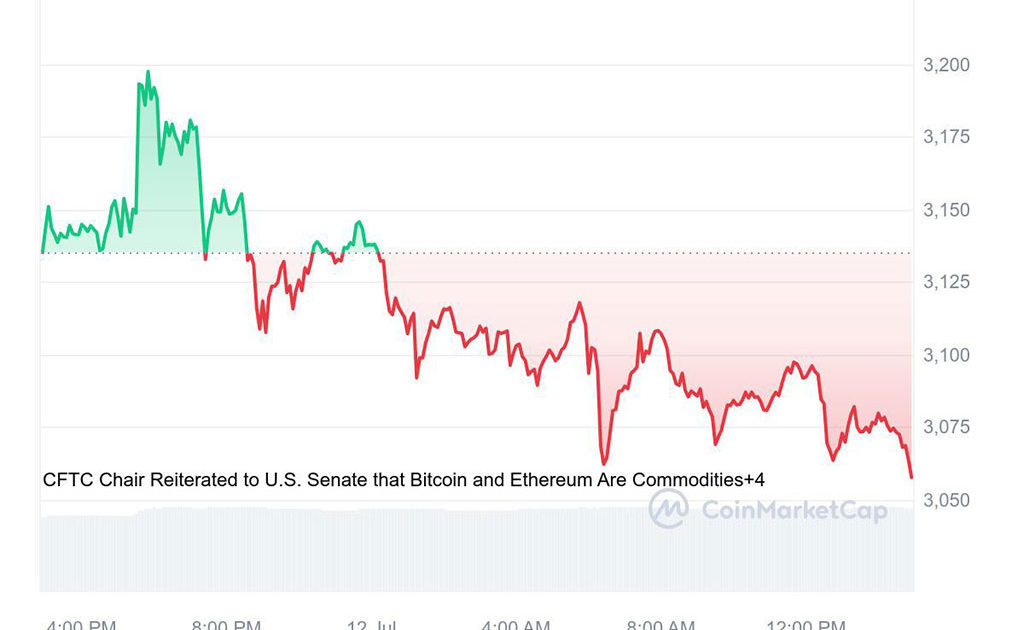

Photo: CoinMarketCap

At the time or writing, ETH is trading at $3,068, marking a 2.30% decline in the last 24 hours. Bluntz’s prediction of an $8,000 Ethereum is certainly attention-grabbing. However, his roadmap highlights the potential for volatility before reaching the summit.

Ethereum to Hit $8,000 but Sell-Off Likely First, Analyst Says