Ether (ETH), the native token of the Ethereum blockchain, has suffered its biggest monthly price decline since March 2020, tumbling alongside bitcoin in one of worst-ever starts to a year in cryptocurrency markets.

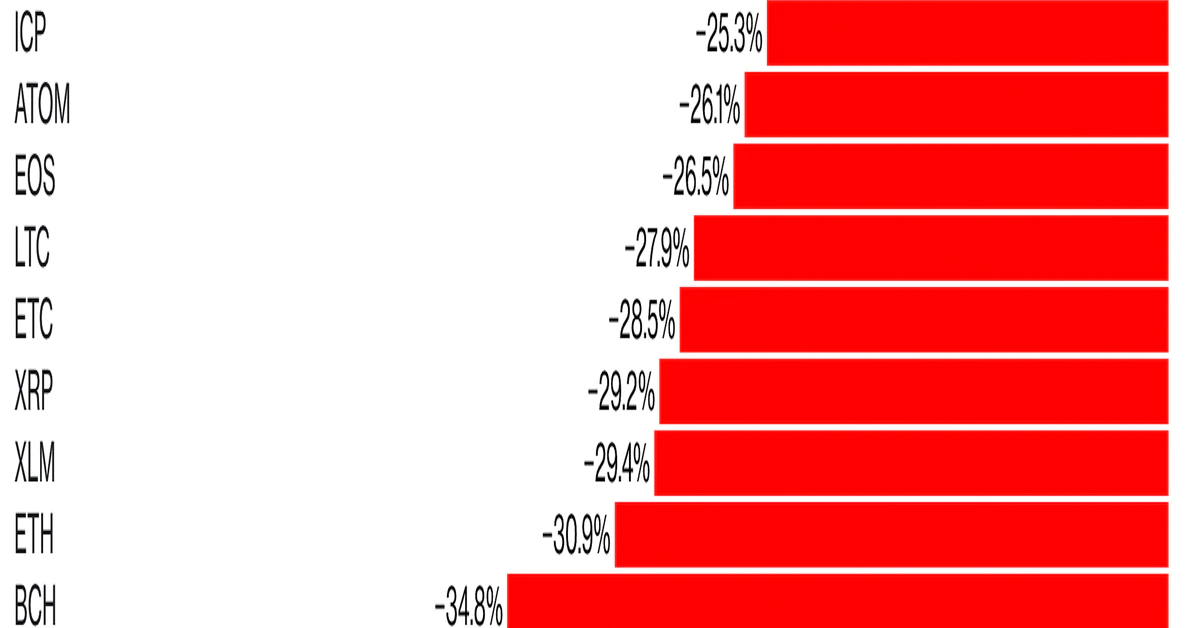

Ether is down 31% in January, while bitcoin (BTC) has fallen 22%.

The sell-off also claimed some of the hottest tokens from 2021, in several cases vaporizing half of their market value, or more. Terra’s LUNA has declined 50% in January, while Solana’s SOL has dropped 49% and Avalanche’s AVAX has lost 42%.

Bitcoin’s dominance ratio – its share of the overall crypto market capitalization – is sitting at about 42%, having dipped below 39% mid-January, according to Denis Vinokourov, head of research at Corinthian Digital. This time last year, bitcoin’s dominance was at 62%.

The numbers suggest that the past year’s rapid run-up in altcoin relative valuations has reversed recently amid the broader sell-off in crypto markets; the highest flyers have suffered the biggest comedowns.

Ethereum also continued to surrender its lead in decentralized finance (DeFi), where its dominance is at around 59%, according to data from defillama. The smart-contract blockchain’s prowess in DeFi slipped earlier this month to an all-time low of 57%.

“This points to strong risk appetite, as opposed to capital flight away from riskier assets,” said Vinokourov.

It’s become evident that the macroeconomic forces that helped to fuel crypto’s bull run previously are turning in the opposite direction, creating uncertainty. Those include the Federal Reserve’s pivot toward hawkish monetary policies – with tighter financial conditions designed to attack inflation – from a previously dovish stance of keeping borrowing costs low to stoke growth.

“This has led to the highest correlations between crypto and traditional markets since March 2020,” said Lucas Outumuro, head of research at IntoTheBlock. “By accelerating interest rate hikes and likely beginning quantitative tightening, the Federal Reserve is disincentivizing investment in order to manage inflation.”

According to Outumuro, the outlook “seems priced in now.”

“There is also potential upside surprise in the case that the Fed moves slower than expected,” he said.

Altcoins are unlikely to pick up until the bitcoin market turns positive, says Lennard Neo, head of research at Stack Funds. “Any action would likely begin with BTC or even ETH,” he said.

Neo doesn’t see the current downward action as a long-term issue, but rather says that markets are still in a phase of sideways trading and price discovery, with the inflation picture uncertain and interest rates set to rise.

All members of the CoinDesk 20 digital assets are in the red for the month. Filecoin (FIL) was down 44%, and Polygon’s MATIC lost 38%.

The last time the entirety of the CoinDesk 20 traded in the red over the course of a full calendar month was last June.