Coinspeaker

Ethereum Restaking Surge Driven by Lower Staking APRs

The Ethereum staking landscape is undergoing a transformation. While the decline in annual percentage rates (APRs) has raised concerns, a novel strategy, restaking, is gaining traction. Driven by the diminishing returns of traditional staking, restaking offers investors a way to maximize their earnings and contribute to network security.

Staking, a fundamental aspect of Ethereum’s Proof-of-Stake (PoS) consensus mechanism, involves locking up crypto assets to validate transactions and earn rewards. Historically, staking has been a lucrative venture, offering returns far surpassing traditional savings. However, as the popularity of staking has grown, so too has the competition, resulting in lower individual rewards.

In response, restaking has gained traction. As decentralized finance (DeFi) evolves, restaking enables investors to use their already staked tokens to earn additional rewards. By unlocking the potential of these “locked-up” assets, restaking generates more income for investors while also reinforcing Ethereum’s security by promoting ongoing participation.

Restaking Spurs ETH Growth

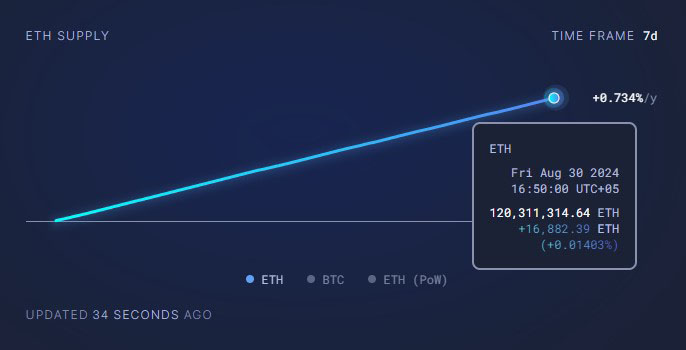

The recent rise in restaking can be linked to multiple factors. On August 15, 2024, Ethereum’s token supply surpassed 120 million, partly due to increased restaking, according to Ultrasound.money. As investors discover the potential to restake and earn more rewards, demand for restaking grows, which in turn drives up ETH issuance.

Source: Ultrasound.money

Furthermore, broader trends contribute to the surge in restaking. Artemiy Parshakov, Head of Staking at P2P.org, notes that higher network participation reduces individual staking rewards, leading to expectations of lower APRs for traditional staking. Consequently, restaking becomes a more appealing option for investors aiming to maximize their returns.

Parshakov also emphasizes the role of competition in the staking ecosystem. He points out that competition among staking service providers, custodians, and wallets to deliver higher returns and innovative technologies has accelerated the adoption of restaking.

Restaking offers advantages beyond just investor gains. Parshakov explains that it allows protocols to bolster security without additional operational costs or the need for proprietary mechanisms, benefiting both investors and network security.

Ethereum’s Recent Developments Drive Restaking Growth

The recent rise in restaking is driven by developments within the Ethereum space. Alessandro Maci, Senior Product Manager at P2P.org, points to the recent launch of EigenLayer, which now allows users to claim rewards on restaked assets through the EIGEN token.

Additionally, the emergence of permissionless restaking protocols like Symbiotic presents a viable alternative to EigenLayer. Maci sees this protocol as a strong competitor, further fueling the growth of the restaking market.