The current Ethereum price analysis is bearish due to multiple instances over the previous day of rejection for additional upward. As a result, we anticipate ETH/USD to drop below $1,900 and then retest $1,800 as support.

Ethereum Rejects Upside

Since reaching a daily high of $2012, Ethereum has corrected by 6.6%. The price range between $1700 and $1800 is the crucial support level, and it is crucial for ETH to maintain above it to stop any further falls.

Technically speaking, Ethereum is advancing inside a rising wedge (in yellow), which is a bearish trend. The trade volume on Binance is also declining concurrently. This implies that the number of buyers is gradually dropping.

Assume that the bulls can prevent the pair from breaking below the important support in the $1,700–$1,800 region (shown in green). In this instance, it is anticipated that after a temporary retreat, the rising trend will carry on with $2200 as the target. On the other hand, if the price drops below the indicated support, bears will have a chance to hit $1350-1280. (in light blue).

ETH/USD 4-hour chart. Source: TradingView

Since the beginning of August, when a significant higher high was recorded slightly below $1,600, the price of ethereum has been moving strongly in the direction of the bulls. After some consolidation, the ETH/USD pair on Wednesday overcame previous resistance at $1,800.

After that, positive momentum increased until it reached the $1,900 resistance, where it briefly stabilized once more. Retracement, however, did not occur because another upward spike led to the current swing high being made at $2,000.

Yesterday, as the $2,000 barrier was momentarily surpassed before bearish momentum rapidly returned, the price of ethereum tried to rise even higher. Another lower local high was established overnight to today, leading to a breach below the $1,900 support over the last few hours and paving the door for much more decline.

On-chain Info

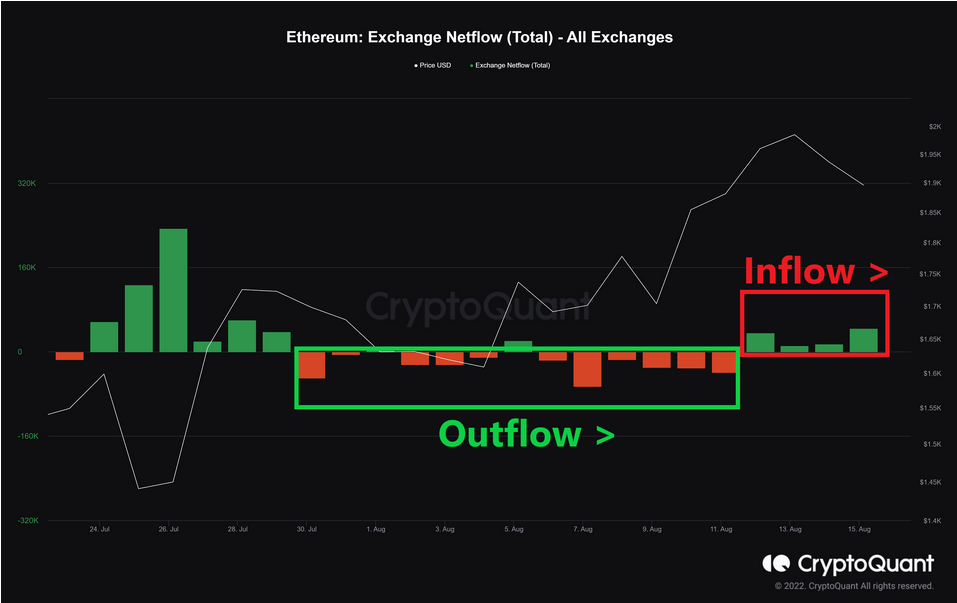

The graph below demonstrates how the decline in exchange reserve has coincided with the growing trend of ETH. The outflow is greater than the intake, as seen by the red histogram bars. The histogram bars have changed color to green during the past four days.

Source: Cryptoquant

This suggests that investors put their coins on deposit in anticipation of a potential selloff. Knowing that this influx is connected to the spot market is helpful.

Featured image from Coinmarketcap, chart from TradingView.com, Cryptoquant