Ethereum (ETH) price has steadied above the $2,300 on Feb. 6 while Bitcoin (BTC) and the rest of the crypto markets battle a $37 billion setback.

Vital on-chain data trends highlight how rising ETH 2.0 staking inflows ahead of the upcoming Dencun upgrade have contributed to the positive start to February despite prevailing bearish headwinds across the crypto markets.

Ethereum price has outperformed the market in February

Ethereum price has bucked market trends this week, making sizable gains in the first 5 days of February 2024, while the Bitcoin (BTC) and rest of the crypto market has stumbled.

Between Jan. 31 and Feb. 6, ETH price has increased from $2,241 to $2,326 as depicted in the chart below. Meanwhile the total crypto market capitalization has shrunk 2%, shedding $37 billion during that period.

Effectively, this illustrates that Ethereum price is currently outperforming the overall market trend. Ethereum’s resilience amid the broader market downturn suggests several underlying factors at play.

Rumors surrounding the ETH spot ETF continue to swirl. But notably, the recent uptick in the coins deposited on the ETH 2.0 beacon chain appears to be the dominant driver of Ethereum’s relative strength in February 2024, so far.

Staking deposits cross $300M ahead of Dencun upgrade

Ethereum 2.0 staking has become a key factor within the Ethereum ecosystem since the Shappella upgrade marked the completion Proof-of-Stake (PoS) transition back in April 2023.

More recently, Vitalik Buterin mooted a series of network improvement proposals including a gas limit increase. Also, the much-anticipated Dencun upgrade, also known as Cancun-Deneb, which is expected to be completed in Feb. 7 is largely focused on increasing scalability.

This flurry of positive network developments appear to have buoyed stakeholder confidence in recent weeks.

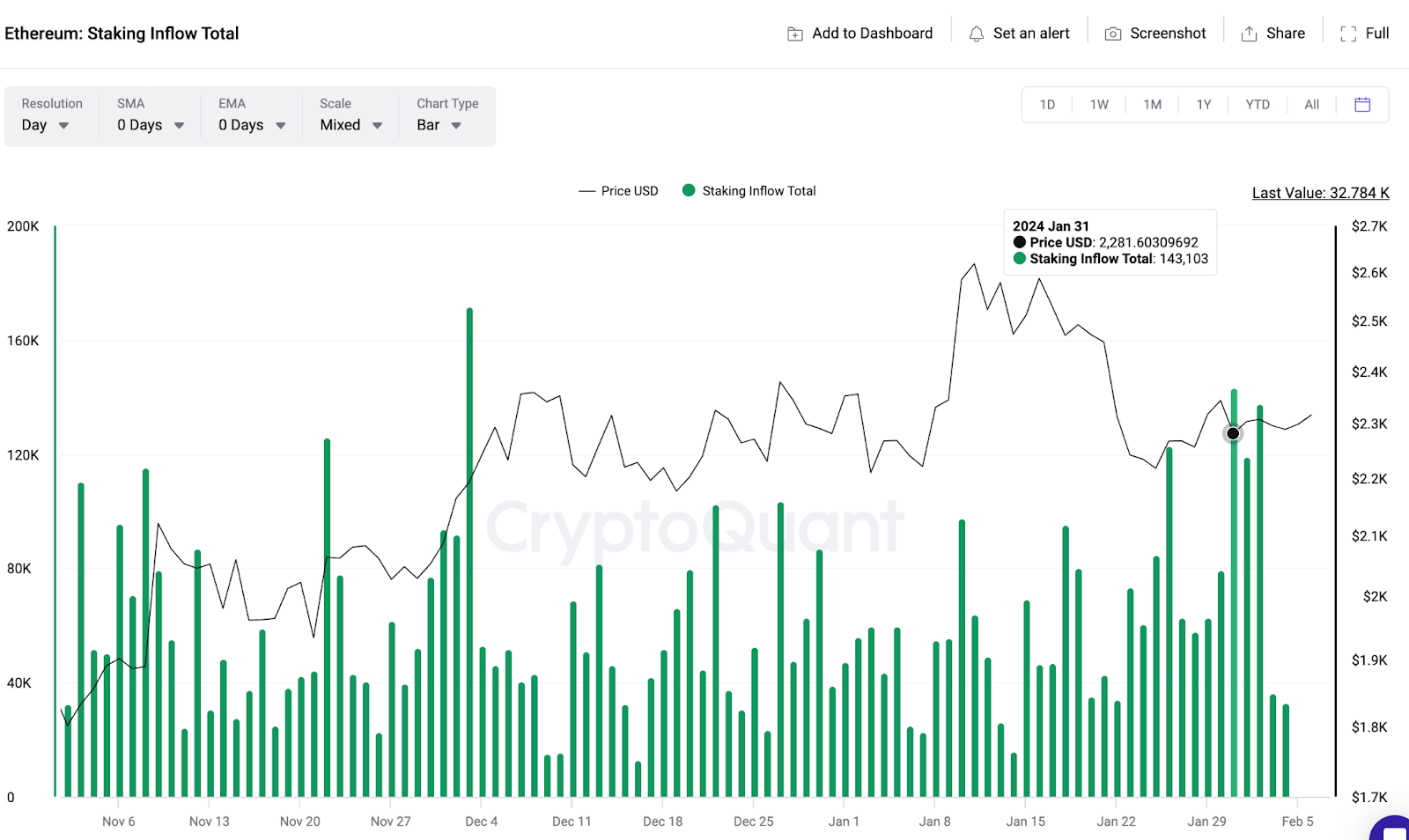

Cryptoquant’s Staking Inflow metric tracks the number of coins deposited in ETH 2.0 beacon chain contracts daily. The chart below shows that 143,103 ETH (~$329 million) staking inflows on Jan. 31, and 137,472 ETH on Feb. 2 were the highest recorded since Dec. 3, 2023.

Staking deposits are crucial to the security and functionality of any PoS network. However, when there is a noticeable increase in staking during a broad market downturn as observed above, it suggests that investors within that cryptocurrency ecosystem are maintaining a positive long-term outlook.

Hence, rather than join the market sell-off, Ethereum holders are increasingly staking to tide over the market correction by earning passive income.

Albeit temporarily, staking deposits effectively douse selling pressure as it reduces the number of coins readily available to be traded on exchanges. This partly explains how ETH price has managed to outperform the market in February 2024 so far.

The timing also suggests stakeholders are confident of a positive outcome from the upcoming Dencun upgrade.

Ethereum price forecast: $2,500 target in focus

In summary, increased staking and positive sentiment surrounding upcoming network upgrades have propped up ETH price action in recent weeks. With these factors still in play, Ethereum could stage another attempt at the elusive $2,500 price target in the days ahead.

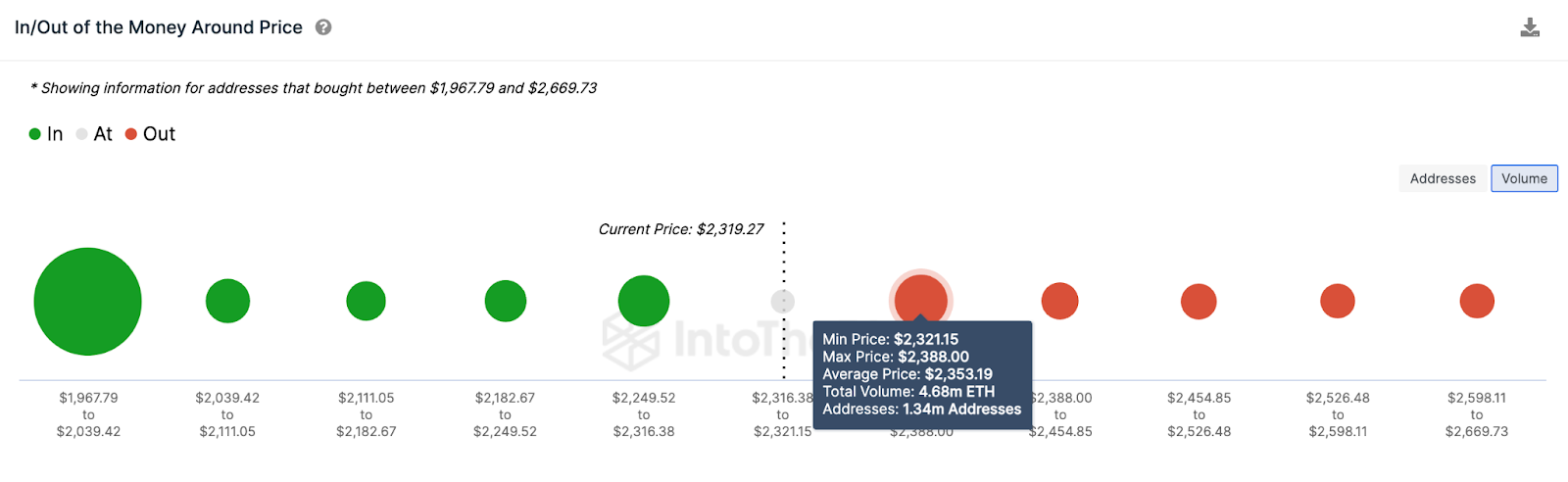

However, the bulls face significant short-term resistance at the $2,350 area.

IntoTheBlock’s global in/out of the money data shows that 1.34 million current holders had acquired 4.68 million ETH at the average price of $2,358. Having held at a loss for nearly a month, they could be tempted to exit once price approaches their break even point.

But if the bulls can scale that resistance, it could open the doors to a $2,500 retest as predicted.

On the flipside, the bears could negate this optimistic prediction by forcing a reversal below the $2,000 area. However, as depicted above, the bulls could mount a formidable support buy-wall at $2,040.