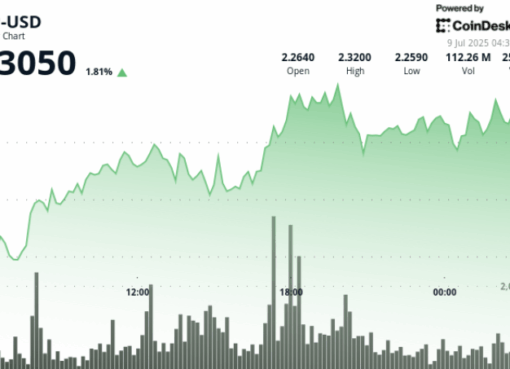

Ethereum price is up four consecutive days, reaching its highest point since July 3rd.

ETH has rallied by 20% from its lowest point this month, entering a technical bull market. Ether token was driven by three key catalysts. First, there is optimism that Donald Trump is the more crypto-friendly candidate and will win the U.S. election in November, especially if Joe Biden doesn’t bow out from the race.

These odds started rising after the first debate two weeks ago and accelerated after the former survived an assasisnation attempt over the weekend. Since then, many high-profile individuals like Elon Musk and Bill Ackman have officially endorsed the former president.

Trump is viewed favorably in the crypto community due to his support for the industry. He has sold NFTs as an ex-president, disavowed Central Bank Digital Currencies (CBDCs), and vowed to protect non-custodial wallets.

The second catalyst is the increasing likelihood that the Securities and Exchange Commission (SEC) will approve several spot ETFs. Companies like VanEck, Blackrock, and Invesco have already submitted their final filings, leading analysts to expect approval as soon as this week.

Ethereum’s ETF approval is signficant because it is the second-biggest crypto in the industry. However, as I wrote last week, investors will have to pay a fee and also forego staking rewards that Ether holders earn.

Third, Ether is rising as the volume of the token in exchanges drops. The supply dropped to a record low of 16.76 million, down from over 32.5 million in July 2016. This means that Ethereum is getting rarer as the ETF approval nears.

ETH balances in exchanges

Additionally, ETH price jumped as futures open interest continued rising. Data by CoinGlass showed that the open interest rose to over $13.4 billion on Monday, higher than this month’s low of $11.66 billion. Most of this interest was from Binance, Bybit, and Bitget.

ETH open interest

Ethereum price found strong support

ETH’s rebound happened after the coin found a strong support at around $2,850 this month. This was an important level since it was the lowest point on April 13th, May 1st, and May 14th of this year. It was also a notable level since it was slightly above the 50% Fibonacci Retracement point.

Therefore, with the token also flipping the 200-day Exponential Moving Average (EMA), traders expect that the rally can go on. Also, the accumulation and distribution indicator has continued rising, signaling that investors are buying the dip. The next key reference level to watch will be the psychological point at $3,500.