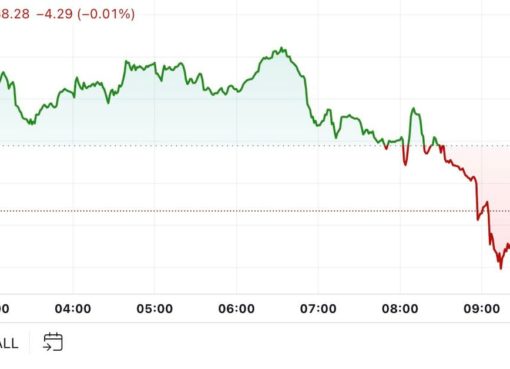

Ether (ETH) price nosedived below $1,100 in the early hours of June 14 to prices not seen since January 2021. The downside move marks a 78% correction since the $4,870 all-time high on Nov. 10, 2021.

More importantly, Ether has underperformed Bitcoin (BTC) by 33% between May 10 and June 14, 2022, and the last time a similar event happened was mid-2021.

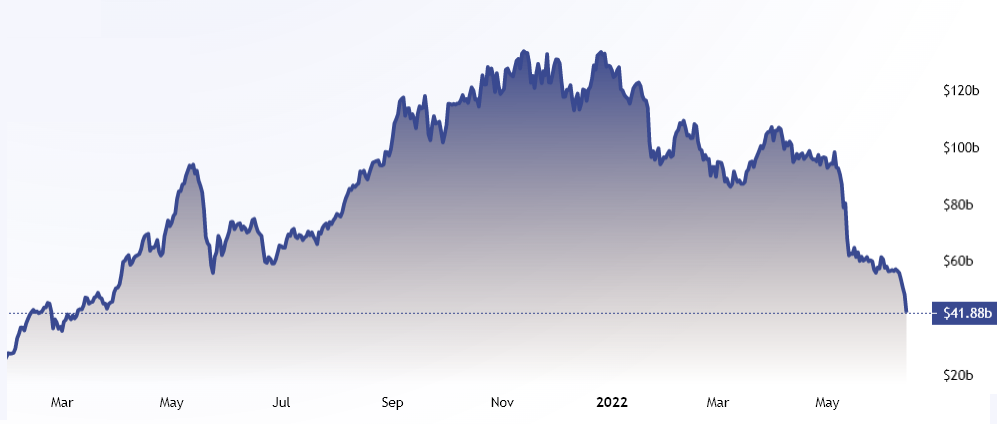

Even though Bitcoin oscillated in a narrow range two weeks before the 0.082 ETH/BTC peak, this period marked the “DeFi summer” peak when Ethereum’s total value locked (TVL) catapulted to $93 billion from $42 billion two months earlier.

What’s behind Ether’s 2021 underperformance?

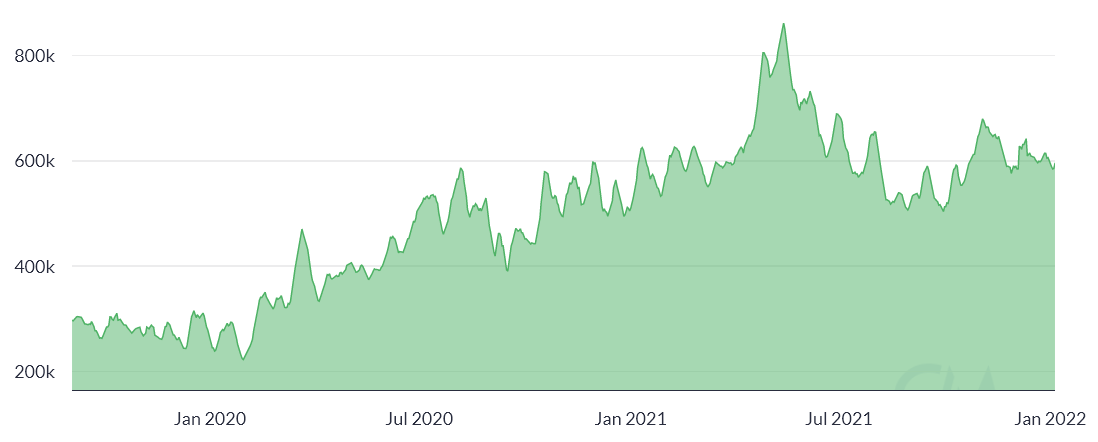

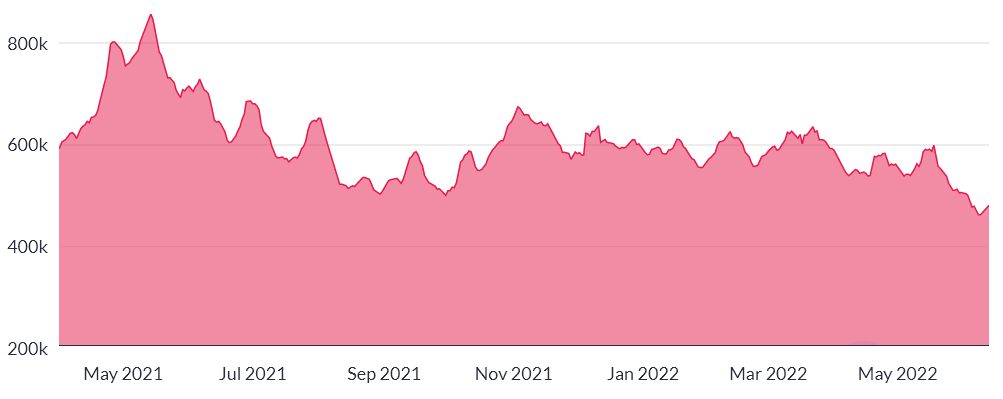

Before jumping to conclusions, a broader set of data is needed to understand what led to the 31% correction in the ETH/BTC price in 2021. Looking at the number of active addresses is a good place to start.

Data shows steady growth in active addresses, which increased from 595,620 in mid-March to 857,520 in mid-May. So, not only did the TVL growth take investors by surprise, but so did the number of users.

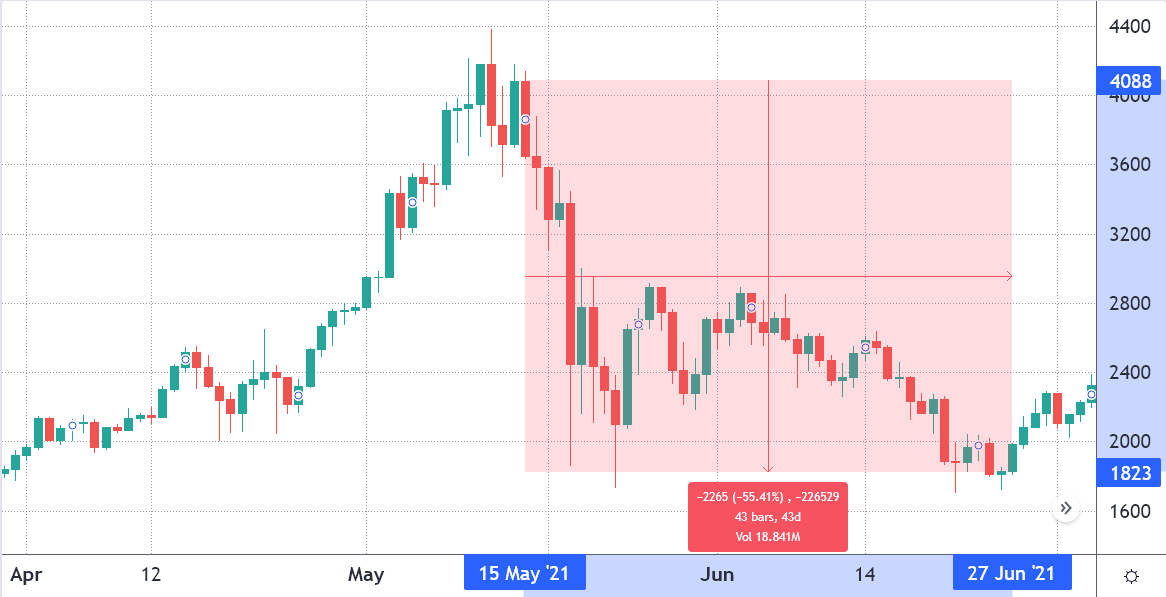

The 31% Ether underperformance versus Bitcoin back in June 2021 reflected a cool-off period after unprecedented growth in the Ethereum ecosystem. The consequence for Ether’s price was devastating and a 56% correction followed that “DeFi summer.”

One must compare recent data to understand whether Ether is heading to a similar outcome. In that sense, those who waited for the 31% miss versus Bitcoin’s price bought the altcoin at a cycle low near $1,800 on June 27, 2021 and the price increased 83% in 50 days.

Is Ether flashing a buy signal right now?

This time, there is no DeFi Summer and before this year’s 33% negative performance versus Bitcoin, the active address indicator was already slightly bearish.

By May 10, 2022, Ethereum had 563,160 active addresses, in the lower range from the past couple of months. This is the exact opposite of the mid-2021 movement that occurred as Ether price accelerated its losses in BTC terms.

One might still think that despite a relatively flat number of users, the Ethereum network had been growing by presenting a higher TVL.

Data shows that on May 10, 2022, the Ethereum network TVL held $87 billion in deposits, down from $102 billion a month prior. Therefore, there is no correlation between the mid-2021 cool-off after “DeFi summer” and the current 33% Ether price downturn versus BTC.

These metrics show no evidence of similarity between the two periods, but $1,200 might as well be a cycle low, and this will depend on other factors apart from the network’s use.

Considering how weak active addresses and TVL data were before the recent price correction, investors should be extra careful when trying to predict a market bottom.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cryptox. Every investment and trading move involves risk. You should conduct your own research when making a decision.