Decentralized Applications (DApps) on the Ethereum network recorded over 1.2 million new users in 2019. Continuous growth of the ETH ecosystem is an essential fundamental factor for its long-term price trend.

Report shows there is fast growth everywhere for Ethereum

The main area of parabolic growth for Ethereum throughout the past year has been Decentralized Finance (DeFi). In the years ahead, industry experts forecast DeFi to be the biggest driver of Ethereum adoption.

Alongside DeFi, the solid growth rate of DApps is a crucial fundamental factor for ETH in the long run because it indicates increasing usage of Ethereum across various markets outside of finance.

The DApp.com 2019 annual report read:

“Ethereum has over 1.4 million active dapp users throughout the year, including 1.28M new users and 137K old users, which accounted for 10% of the total amount of active users.”

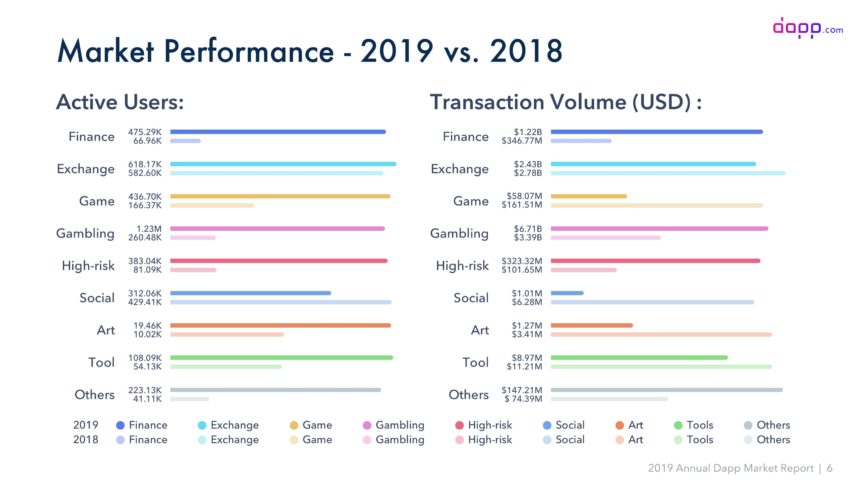

Currently, gambling accounts for the overwhelming majority of DApp usage on both Ethereum and other major smart contract protocols.

That does not necessarily allude to conventional gambling as it includes prediction markets that enable users to place wager on varying topics.

For instance, through smart contract protocols, users on Ethereum can bet on anything from football matches to presidential elections.

The report discovered:

“The amount of gambling users has increased by 372%, with its volume doubled. The amount of high-risk dapp user growth is also 372%, with its volume up 218%.

The amount of blockchain gaming users has a great increase of 162% as expected since 2018. More gaming products are launched targeting a border market. However, the investment hype (or presale hype) of dapp games has weakened, its volume has also decreased significantly – a 60% drop compared to 2018.”

It provides a glimpse into the future of Ethereum: in the next several years, there is high probability that the major use cases of ETH will revolve around gambling and DeFi.

2018 vs 2019 performance comparison for DApps on Ethereum and other major smart contract protocols (source: DApp.com)

The sports betting market in itself is anticipated to reach $8 billion in the next five years, according to data from MGM Resorts, Hard Rock and Mohegan Sun.

As reported by NewsBTC on January 20, several investment firm executives believe that if Ethereum grabs hold of even a small percentage of the global financial market through DeFi, it can reach a valuation of a trillion dollars.

How can such adoption be reached?

The most basic and fundamental infrastructure DeFi platforms and DApps need is scalability.

Ethereum is moving towards the release of 2.0, which would center around second-layer scaling solutions and the highly anticipated move to proof-of-stake (PoS) consensus algorithm.

PoS would eliminate miners from the blockchain network, further optimizing transaction settlement to alleviate pressure off of DeFi and DApps.

Even then, users would need some sort of incentive to switch from centralized platforms to decentralized platforms. In that regard, executives expect DeFi to play a major role.

An overall increase in DeFi and DApp usage will positively affect the long-term price trend of Ethereum, as it would require more economic bandwidth. It would require the price of ETH to increase to create more value in the market.