Roughly six years ago in July 2016, an Ethereum hard fork was used to address the infamous DAO hack. This specific fork saw the chain split into two factions, and a new crypto asset called ethereum classic was introduced to the crypto community. For years now both chains have co-existed using the same proof-of-work (PoW) consensus algorithm, and with The Merge coming up, speculators assume Ethash PoW miners will transition to ethereum classic mining. During the last two weeks, ethereum classic has climbed more than 124% against the U.S. dollar, and the network’s hashrate has spiked a great deal as well.

Ethereum Classic Catches Triple-Digit Gains During the Last Two Weeks

Ethereum classic (ETC) is six years old this month and it’s seen some significant gains during the last 14 days. In fact, ever since the penciled-in date for The Merge was revealed, ETC has risen in value alongside its counterpart ethereum (ETH).

While ETH has seen a significant double-digit 45.7% gain in two weeks, ETC has jumped 124.2% in that same period of time. Despite the 124% rise, year-to-date, ETC is still down 34% and around 80% lower than the crypto asset’s all-time high at $167 per unit.

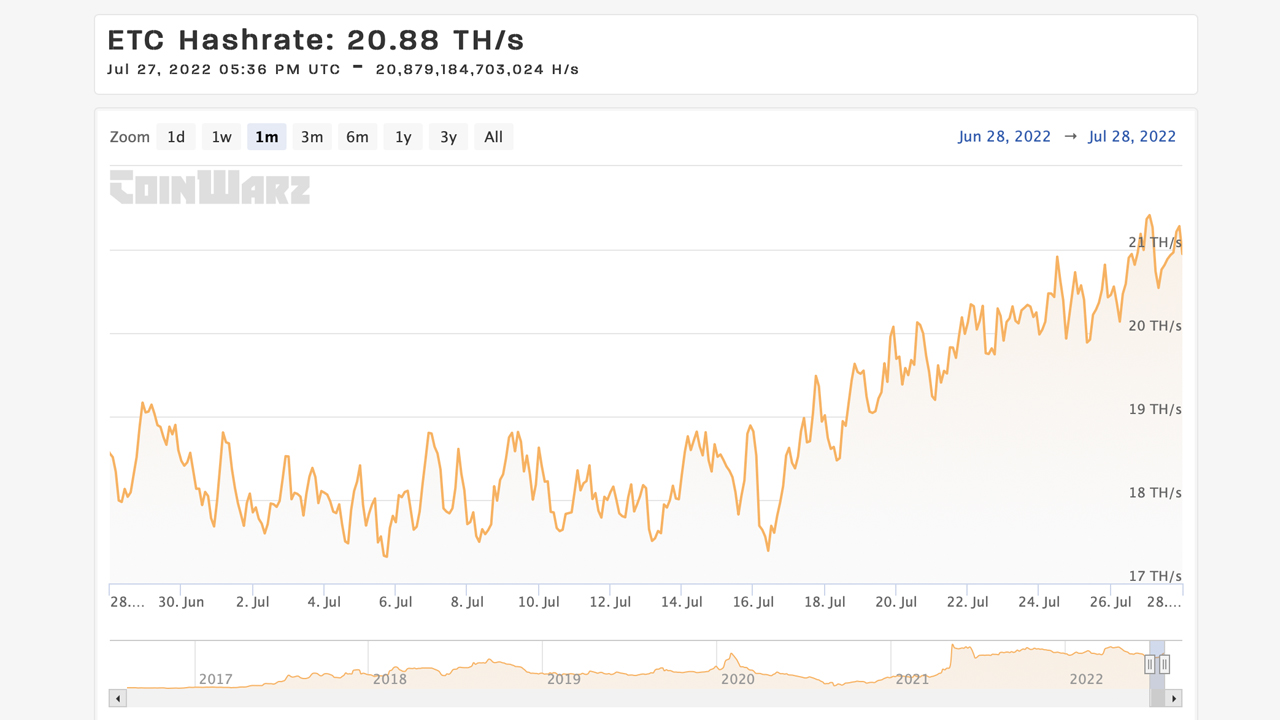

ETC shares the same consensus algorithm as ETH and it seems PoW miners that used to miner ether, are starting to transition and are now mining on the ETC chain. In mid-July, when the preliminary Merge date was penciled-in, ETC’s hashrate was 17.39 terahash per second (TH/s) and today, it’s 20% higher at 20.88 TH/s.

ETC hit a high this week at 21.41 TH/s and the network is also nearing the all-time high it tapped last year. ETC’s all-time hashrate high was 28.53 TH/s on May 7, 2021, at block height 12,695,074. At the pace the Ethereum Classic hashrate has been going, it’s quite possible the hashrate could surpass its all-time high in the near future.

Korean Won Represents More Than 20% of Ethereum Classic Trades

ETC’s average fees are much cheaper than ETH’s average fees, as the average ETH fee today is 0.002 ETH or $3.31, while the average ETC fee is 0.000096 ETC or $0.0031 per transfer. Tether (USDT) is ETC’s largest trading pair, as the stablecoin captures 59.17% of all trades today. Following USDT is the Korean won with 20.82% of all ETC trades, and the U.S. dollar is ETC’s third-largest trading pair as it commands 7.84%.

11.53% of the volume on the South Korean exchange Bithumb stems from ETC swaps and 22.96% of Upbit’s volume derives from ETC trades against the Korean won (KRW) as well. In terms of decentralized finance (defi), the Ethereum Classic network is way behind the eightball when it comes to defi development.

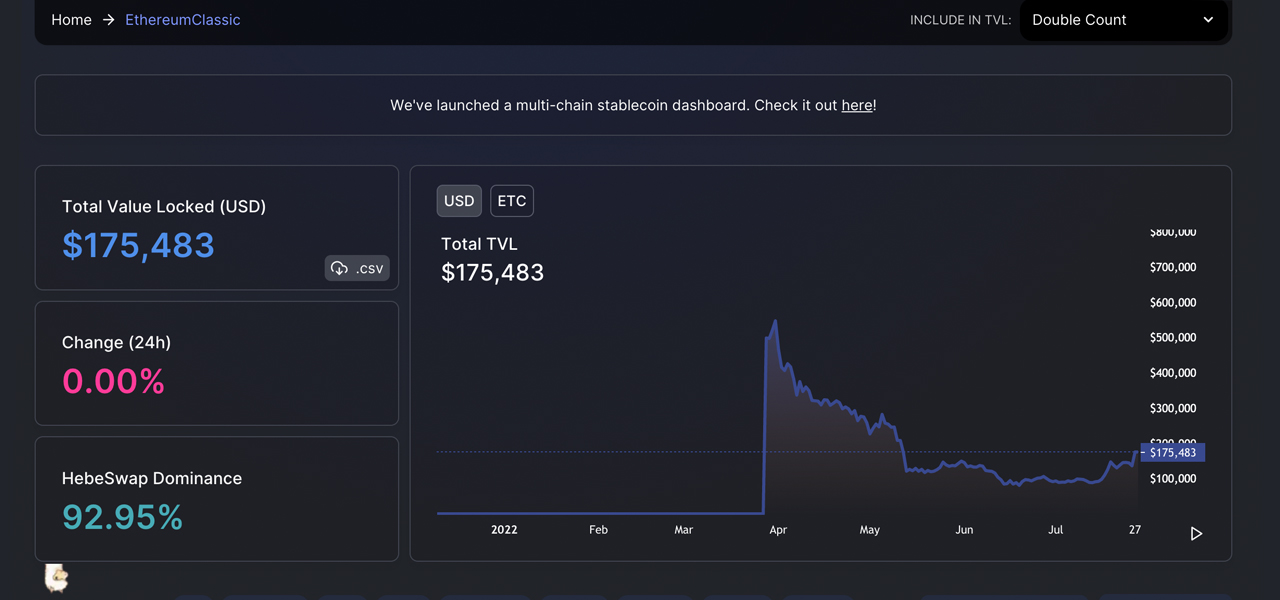

Ethereum (ETH) has the largest value locked out of all the blockchains today with $56.62 billion total value locked (TVL). That’s more than 65% of the $87.56 billion locked across the myriad of blockchains that support defi protocols. Meanwhile, Ethereum Classic’s has a very small TVL, with only $175,483 on July 27, according to defillama.com statistics.

There’s a total of three ETC defi applications compared to Ethereum’s 523 protocols. Over 92% of the value locked in ETC defi applications is held on the Hebeswap, an automated token exchange. The rest of ETC’s defi TVL or a mere $12,366 is held on Etcswap and Swap Cat.

If miners continue to find value in ETC’s PoW security, it is possible that ETC-based defi protocols and smart contract applications could see more development. ETC also has a supply cap set at 210,700,000 while Ethereum’s supply is infinite. Today, 136,026,596 ETC is currently in circulation which means there’s only 74,673,404 ETC left to mine.

Ethereum (ETH) network and community is much larger than Ethereum Classic (ETC) ecosystem in a variety of ways, and in terms of market capitalization, ETH is a behemoth in comparison to ETC. ETH, the second-largest crypto asset by market cap represents 17.7% of the $1 trillion crypto economy with $193.36 billion. ETC, on the other hand, represents 0.402% of the crypto economy’s value with $4.39 billion today.

What do you think about ETC’s recent price spike and the hashrate climbing higher? Do you expect ether miners to transition over to the Ethereum Classic chain? Let us know what you think about this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.